Article content

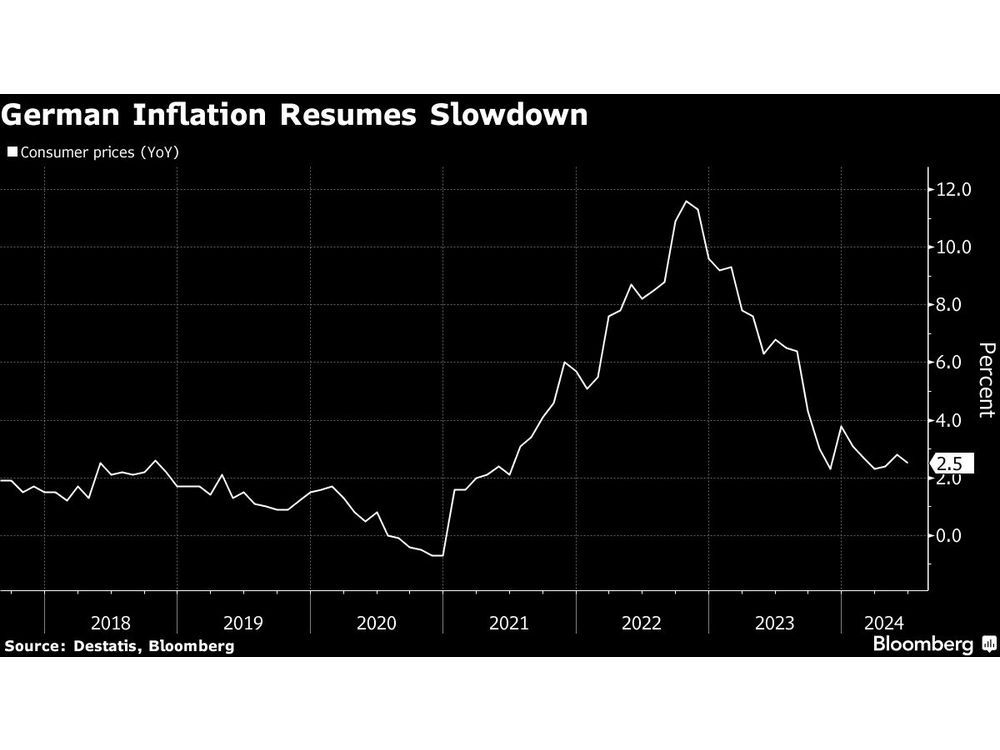

(Bloomberg) — German inflation slowed after two months of accelerating as the country’s economic recovery showed signs of stalling.

Consumer prices rose 2.5% from a year earlier in June — down from 2.8% in May and in line with a Bloomberg survey of analysts. Energy costs continued to decline, while goods eased and services, under particular scrutiny now, were unchanged at 3.9%.

Article content

Separate reports Friday showed inflation also moderated last month in France and Spain. While picking up a touch in Italy, it remained below 1%. A gauge for the 20-nation euro zone will come on Tuesday, with analysts and a Bloomberg Economic Nowcast both predicting a slowdown to 2.5% from 2.6%.

The scale of the retreat toward the 2% target will determine how quickly the European Central Bank can lower interest rates following an initial move last month. Other factors weighing on the minds of policymakers include the political turmoil in France and the actions of other major central banks like the Federal Reserve.

Monday’s data “leave the door open to another rate cut in September, even though wage developments could still motivate some officials to postpone the next rate cut to the winter,” said Carsten Brzeski, ING’s head of macro.

In Germany, faltering sentiment may have damped price pressures. Consumers and firms weren’t as optimistic as anticipated on Europe’s biggest economy lately. Private-sector business activity has also been softer than estimated.

Article content

Data remain tricky to interpret, however, as the impact of volatile energy costs a year ago washes out of the statistics. The Bundesbank expects inflation to ease slightly until September before picking up again by year-end. While the economy “continues to face headwinds, there are increasing bright spots,” it said last month.

Wage growth poses an upside risk to prices. Negotiated pay increased 6.2% in the first quarter, and demands by Germany’s largest union for a 7% boost for almost 4 million workers in the metal and electric-parts industries suggest pressure will persist.

While the ECB sees inflation in the 20-nation euro zone back at 2% toward the end of 2025, the Bundesbank predicts an average of 2.2% next year for Germany.

Joachim Nagel, who heads the country’s central bank, has warned against complacency — pointing to “still very sticky” underlying prices. He’s stressed that the ECB won’t now automatically lower rates, having made an initial reduction.

In a speech at a Frankfurt conference, he highlighted his nation’s muted economic prospects and appealed to politicians to lay foundations for stronger momentum.

“Although there are some rays of hope and the German economy is slowly regaining its footing, in many international comparisons Germany is lagging far behind in terms of growth — and in some cases is even at the bottom of the league,” he said.

Above all, he added, more investment is needed to master the green transition and capitalize on digital technologies, though there’s been no sign of a spending boom to date.

—With assistance from Kristian Siedenburg and Joel Rinneby.

(Updates with Nowcast, analyst comment starting in third paragraph.)

Share this article in your social network

German Inflation Slows as Optimism in Economic Rebound Wanes - Financial Post

Read More

No comments:

Post a Comment