Inflation in Europe accelerated by more than forecast in May, but the European Central Bank is still expected to start cutting interest rates next week.

Article content

(Bloomberg) — Inflation in Europe accelerated by more than forecast in May, but the European Central Bank is still expected to start cutting interest rates next week.

Consumer prices rose 2.6% from a year ago, up from 2.4% in April, according to Eurostat. A measure stripping out volatile components like food and energy also surpassed expectations. While money markets still see a quarter-point cut at the June 6 ECB meeting, they pared wagers on reductions beyond that.

Advertisement 2

Article content

In the US, the Federal Reserve’s preferred measure of underlying inflation moderated in April and consumers dialed back their spending, supporting plans for an eventual reduction in interest rates. Swaps traders still expect the Fed to cut rates at least once this year.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Europe

Euro-area inflation accelerated more than anticipated, further clouding the outlook for ECB interest rates after next week’s planned cut. They’re nevertheless set to reduce the deposit rate from its current record high of 4% on June 6 — moving before either the Fed or the Bank of England.

Sweden’s economy exceeded forecasts in the first quarter by expanding at the fastest clip in almost two years — helped mainly by higher inventories — as the Nordic country’s prospects are brightening with its central bank having started interest-rate cuts. Output for the three previous quarters was also revised higher, meaning there was no technical recession — as defined by two consecutive quarters of falling output — in the past two years.

Article content

Advertisement 3

Article content

Britain’s richest households are experiencing higher rates of inflation than poorer segments of society because of high mortgage costs and rapid price increases in restaurants and hotels. The figures show how the sharp cooling in energy and food inflation has alleviated the pressure on the finances of the worst off in Britain.

US

The so-called core personal consumption expenditures price index, which strips out the volatile food and energy components, increased 0.2% from the prior month. That marked the smallest advance of the year, according to Bureau of Economic Analysis.

Asia

The International Monetary Fund now expects China’s economy to grow 5% this year, raising its forecast from 4.6% a few weeks ago to reflect a strong expansion at the start of 2024 and additional support from the government. The IMF has called on Beijing to provide more monetary and fiscal support, including further steps to resolve the housing crisis, which has persisted despite repeated efforts by authorities to put a floor under prices and boost demand.

There’s little argument that Japan needs a new way to power its $4.1 trillion economy. Russia’s invasion of Ukraine and conflicts in the Middle East have underscored the risks of depending on imported energy, which Japan relies on for 70% of its electricity generation. Meanwhile, 21 nuclear reactors around the country sit unused.

Advertisement 4

Article content

Emerging Markets

Brazil’s annual inflation eased more than expected in early May, adding to economists’ expectations that policymakers have enough wiggle room to cut borrowing costs again in June before pausing their easing cycle.

The insistence that Israel should never again be caught flat-footed led to a huge ramp-up in defense spending, which averaged almost 29% of gross domestic product in 1973-1975 — a period known in economic circles as “the lost decade.” Israel is a very different country today, but the parallels are haunting.

Argentina’s Mendoza province, known for Malbec vineyards that draw tourists from across the world, is moving to spur exploration of its copper deposits long shunned by prospectors due to restrictions and red tape. Its officials are eying the wiring metal after finding new investors for a potash project abandoned a decade ago and as Argentina’s new President Javier Milei tries to deregulate his nation’s economy to drive growth.

World

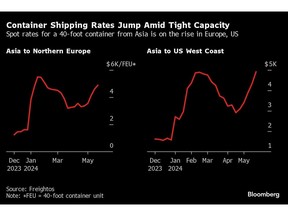

Companies transporting goods from Asia face costs of as much $10,000 for an urgent full-size shipping container over the next month — about double current spot rates, according to prices circulating between carriers and importers. With capacity stretched by more than five months of attacks on vessels in the Red Sea, the container shipping industry is scrambling to meet demand that’s picking up in the US and Europe.

—With assistance from Galit Altstein, James Attwood, Ethan Bronner, Jonathan Gilbert, James Mayger, Brendan Murray, Shoko Oda, Tom Rees, Niclas Rolander, Andrew Rosati, Augusta Saraiva and Alexander Weber.

Article content

Charting the Global Economy: Europe Inflation Picks Up Before ECB Meeting - Financial Post

Read More

Comments