- Commodities

- Cryptocurrencies

- Mining

- Economy

- Conferences

- Opinion

Powell says inflation ‘higher than anybody expected’ and his confidence ‘not as high as it was’

Kitco News

The Leading News Source in Precious Metals

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

(Kitco News) - Federal Reserve Chair Jerome Powell attended a Foreign Bankers’ Association event in Amsterdam on Tuesday, which offered him the opportunity to comment on the U.S. economy in general, and inflation in particular, after PPI came in well above expectations in the morning.

While Powell pointed to the progress that was made on inflation in 2023, he acknowledged that this year has not continued the positive trend.

“The first quarter in the United States was notable for its lack of further progress on inflation,” he said. “We had higher readings in the first quarter, higher than we expected. We did not expect this to be a smooth road, but these were higher than anybody expected. What that has told us is that we will need to be patient and let restrictive policy do its work.”

Turning to the outlook, Powell said he still expects the data to get back on track. “We expect continued growth, 2% or better, we expect the labor market to continue to be strong but to move further and further into balance, and I expect that inflation will move back down on a monthly basis to levels that were more like the lower readings we were having last year,” he said. “I would say my confidence in that is not as high as it was, having seen these readings in the first 3 months of the year, so we're just going to have to see where the inflation data fall out.”

Powell was asked specifically about the high producer price index reading from this morning, and whether he sees risks that inflation could become a bigger problem in the United States than it is elsewhere.

“I would say it's actually quite mixed,” he said. “The headline numbers were higher, but there were backward revisions, and we are of course taking it apart and looking at it. I think markets and analysts are looking at it as, I wouldn't call it hot, I would call it sort of mixed.”

Powell said that last year’s “historically fast disinflation,” when inflation dropped by two full percentage points, was driven by two forces working together. “One of them is the reversal, the unwinding of the pandemic-related supply and demand shocks,” he said. “The second thing is restrictive monetary policy, and restrictive monetary policy cools the economy and makes room for the supply side to heal, but also lowers demand and ultimately lowers inflation.”

“Is inflation going to be more persistent going forward?” he asked. “That would essentially mean that we'd gotten the supply side gains that we are going to get, and now it's down to lower demand, which would take longer, and potentially be more painful. I don't think we know that yet. I think we need more than a quarter's worth of data to really make a judgment on that. I don't want to give up on it yet at this point.”

The Fed chair was then challenged on whether the recent lack of progress means the Fed funds rate may not be high enough, and a hike may be necessary to bring inflation back down to the 2% target.

“I do think it's really a question of keeping policy at the current rate for longer than had been thought,” Powell said. “I think by many, many measures, the policy rate is restrictive. The question is, is it efficiently restrictive, and that's going to be a question that time will have to tell.”

“I don't think that it's likely, based on the data that we have, that the next move that we make would be a rate hike,” he emphasized. “I think it's more likely that we'll be at a place where we hold the policy rate where it is.”

Still, Powell said that despite the worst-case scenarios not materializing, he recognizes that persistent inflation is hurting many people who don’t see the progress in their everyday lives.

“You tell people inflation is coming down, and they think ‘I don't understand, the price of all the things I buy hasn't come down,’ and they’re not wrong,” he said. “They're suffering, particularly people at the lower end of the income spectrum were very hard-hit by inflation at the start, which is why we're so strongly committed to restoring place stability and keeping it in place as long as possible.”

Powell also fielded a question about the large U.S. budget deficits and the growing national debt.

“I think it's utterly non-controversial to say that U.S. fiscal policy is on an unsustainable path,” he answered. “Not that our fiscal position itself is unsustainable, but the path is unsustainable, meaning that we have full employment and we are running big structural deficits.”

“We are going to have to deal with this sooner or later, and sooner is a lot more attractive than later.”

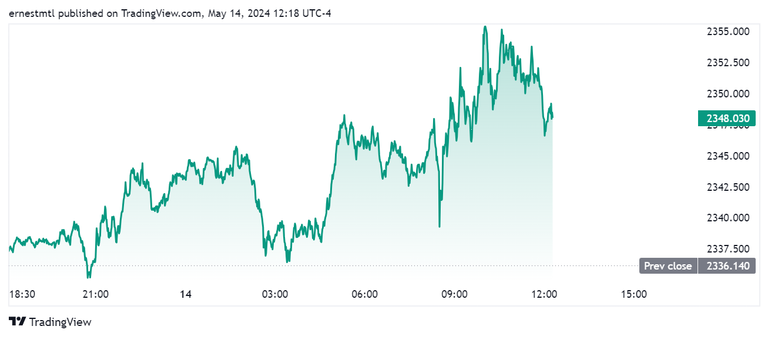

Spot gold hit its intraday high of $2,357.14 just as the event was getting underway, and it oscillated within an elevated range as Powell delivered his comments.

Spot gold last traded at $2,348.02 at the time of writing, and is up 0.51% on the session.

Ernest Hoffman

Ernest Hoffman is a Crypto and Market Reporter for Kitco News. He has over 15 years of experience as a writer, editor, broadcaster and producer for media, educational and cultural organizations. Ernest began working in market news in 2007, establishing the broadcast division of CEP News in Montreal, Canada, where he developed the fastest web-based audio news service in the world and produced economic news videos in partnership with MSN and the TMX. He has a Bachelor's degree Specialization in Journalism from Concordia University. You can reach Ernest at 1-514-670-1339.

Tags:

Powell says inflation 'higher than anybody expected' and his confidence 'not as high as it was' - Kitco NEWS

Read More

No comments:

Post a Comment