Article content

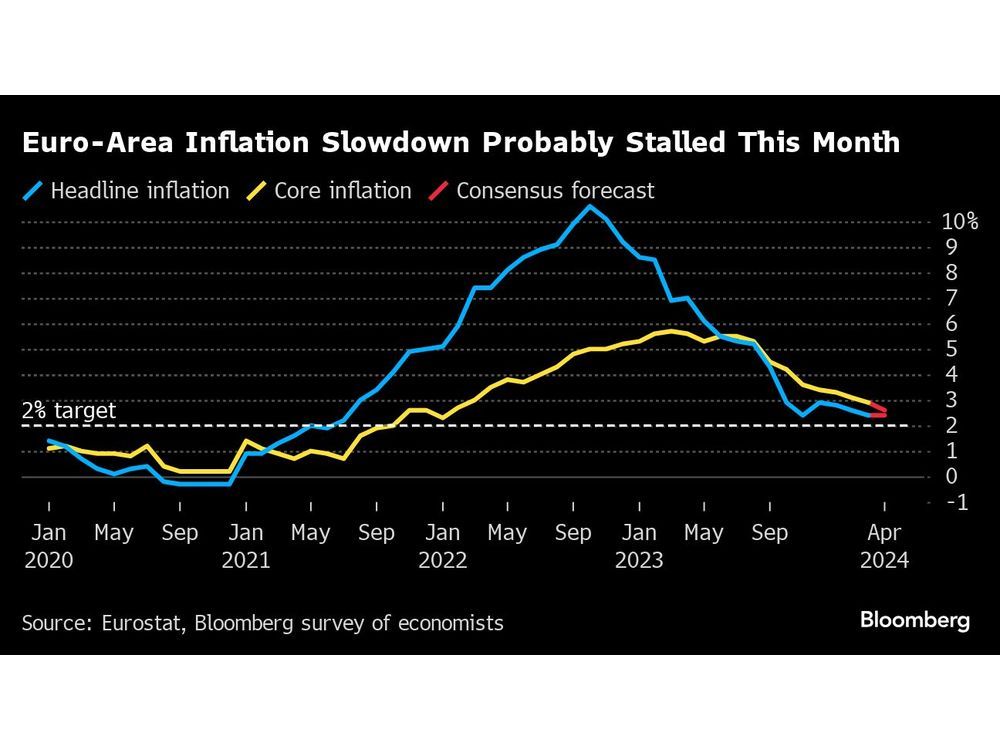

(Bloomberg) — The slowdown in euro-zone inflation may have stalled in April for the first time this year, just after a quarter when the economy shook off the shallow recession it suffered in late 2023.

Consumer prices probably rose 2.4% from a year earlier, matching the outcome for March, according to the median forecast of economists surveyed by Bloomberg. They anticipated gross domestic product to have risen 0.1% in the first quarter.

Article content

Those reports on Tuesday may chime with the European Central Bank’s view at its decision earlier this month, when President Christine Lagarde described the economy as weak, and predicted “bumps on the road” for the path of inflation.

With that outlook in mind, policymakers are gearing up to cut interest rates at their June 6 meeting, dialing down constriction on the euro zone after an unprecedented cycle of tightening.

While the overall inflation number may stay unchanged after Middle East tensions caused a surge in energy costs, the underlying measure that strips out such volatile items may provide reassurance to officials that the direction of travel is still downwards.

That gauge is expected by economists to have slowed to 2.6% in April, marking further progress toward the 2% goal. Policymakers reckon that inflation will reach that target in the middle of next year.

What Bloomberg Economics Says…

“Euro-area headline inflation is likely to be broadly steady in April, held up by higher energy costs. We see core inflation dropping materially. The disinflation process is well advanced, price gains are likely to dip below 2% in the summer and a June rate cut looks like a done deal.”

Article content

—Jamie Rush, chief European economist. For full preview, click here

This week’s national reports may further validate Lagarde’s outlook of volatility in the data. Inflation measures in Germany and Spain, both due on Monday, are expected to show an uptick, offset by weakening from those in France and Italy published the next day.

The small pickup in economic growth meanwhile could partly reflect what both Lagarde and economists increasingly identify as a turning point for the German economy, which may be recovering after a period when its weakness weighed on the rest of the region.

But just like with inflation, the GDP numbers on Tuesday may also mask uneven outcomes from across the currency zone.

For a taste of that, investors are likely to watch Ireland’s growth data closely when they get published on Monday, even before national numbers for the euro area’s four biggest members get released the following day.

Despite being one of the euro area’s smaller economies, its role as a tax base for US multinationals leads to huge swings between growth or contraction that can sometimes overshadow the overall result for the region, at a time when expansion across Europe has been essentially flat-lining.

—With assistance from Giovanni Salzano.

Share this article in your social network

Euro-Zone Inflation Set to Hit First Bump in ECB's Road to 2% - Financial Post

Read More

No comments:

Post a Comment