The Canadian economy still has some gas left in the tank, with robust gains in the first two months of this year, bolstering the Bank of Canada’s case for a patient stance on interest rate cuts.

Preliminary data suggest gross domestic product rose 0.4 per cent in February, with broad-based increases led by oil and gas, manufacturing and finance, Statistics Canada reported Thursday in Ottawa.

That followed a 0.6 per cent expansion the previous month, beating expectations for a 0.4 per cent increase in a Bloomberg survey of economists. January’s gain was led by a rebound in education after strikes in Quebec ended. December’s GDP was downwardly revised to a 0.1 per cent contraction.

Combined, the gains in January and the February flash estimate point to the strongest growth since early 2022, when the economy was rebounding from the pandemic.

The data were released at the same time as GDP figures in the U.S., where the two main measures of economic activity posted strong advances at the end of last year.

After the releases, traders shifted bets on a Bank of Canada rate cut in June to about two-thirds, from a three-quarters chance previously. Canadian government bond yields rose and the loonie strengthened.

Overall, the industry-based numbers are tracking an increase of 3.5 per cent annualized in the first quarter of 2024, assuming March output is flat, versus 1 per cent growth between October and December. That’s much faster than the 1 per cent consensus estimate in a Bloomberg survey and the Bank of Canada’s forecast of 0.5 per cent.

Thursday’s report shows economic momentum that will buy the Bank of Canada time before it starts easing policy rates. Policymakers are waiting for more data to convince them that the downward path to the 2 per cent inflation target can be sustained before reducing borrowing costs.

Governor Tiff Macklem and his officials held rates steady at their last meeting earlier this month, and the data released since then have signaled easing price pressures. Inflation has been within the bank’s control range since the start of this year, and core inflation cooled further last month. Population gains continue to outpace employment growth and wage growth is softening.

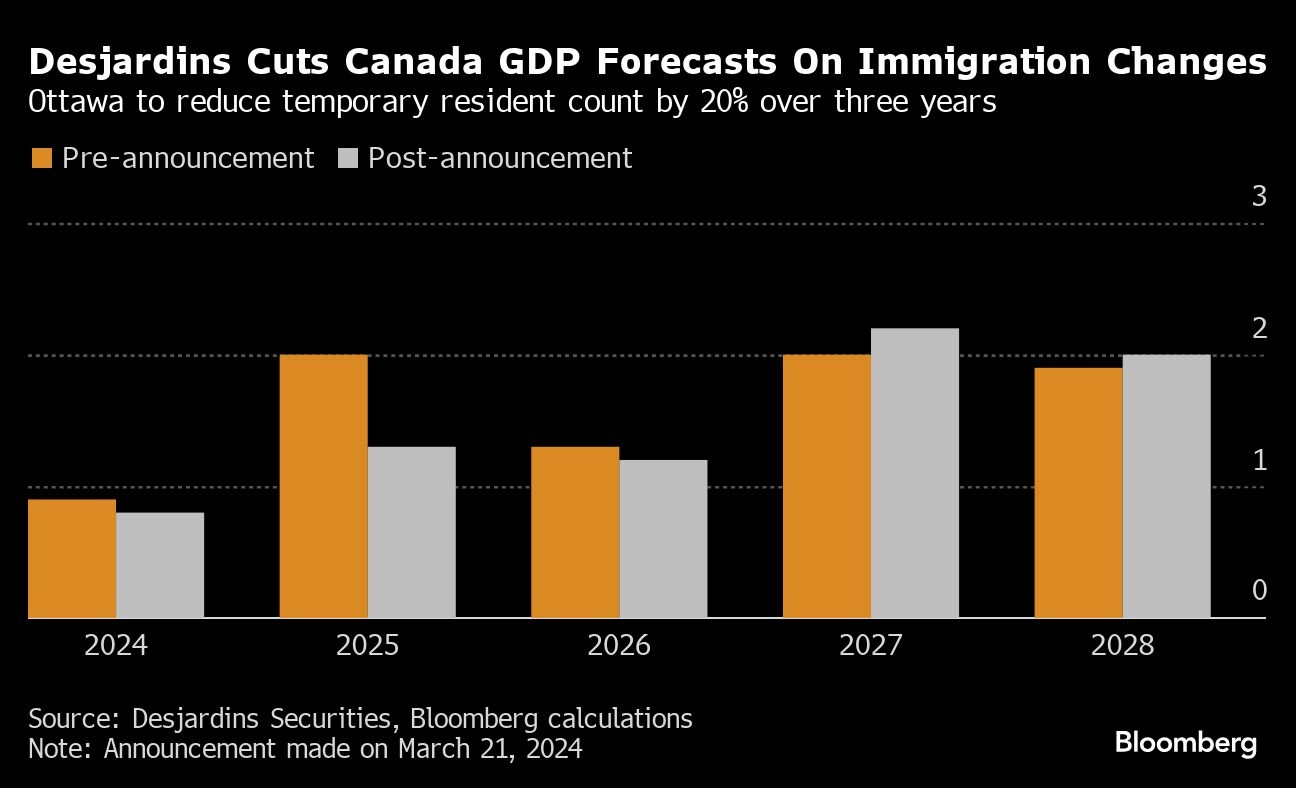

Prime Minister Justin Trudeau’s government last week announced plans to reduce the temporary resident population, which is expected to weigh on economic growth over the next three years and help slow shelter price gains.

The data clearly suggest there is no urgency for an immediate reduction in interest rates, Andrew Grantham, an economist with Canadian Imperial Bank of Commerce, wrote in a report for investors.

“However, with inflation also undershooting the bank’s prior expectations at the same time, it appears that much of the growth we are seeing is coming from an easing of supply constraints rather than necessarily a pick-up in underlying demand, and as a result we still see scope for a gradual reduction in interest rates starting in June,” he wrote.

In a separate release on Thursday, Canadian non-farm payrolls rose 39,800 in January and average weekly earnings were up 3.9 per cent from a year ago.

The central bank’s next rate decision is on April 10, when officials will also update their economic projections. Economists widely expect the bank to hold policy rates at 5 per cent again for a sixth straight meeting.

At face value, the resilience in economic activity could be interpreted as offering the Bank of Canada a motive to delay rate cuts, Jimmy Jean, chief economist at Desjardins Securities, wrote in a report to investors.

“However, demographics continue to flatter these numbers,” he wrote, pointing out that population data released Wednesday set a fresh record for growth in Canada.

When controlling for demographics, the cumulative weakness in per-capita GDP since mid-2022 is similar to what was experienced in the 2008-2009 recession, Jean said.

Marc Ercolao, an economist at Toronto Dominion Bank, said the data present a more difficult challenge for the central bank.

“Make no mistake, these growth figures are robust,” he wrote in a report to investors. “Over the past two months, the bank has received solid evidence that inflation is cooperating, but strong GDP data prints like today’s will keep them on their toes.”

In January, there was broad-based growth with 18 of 20 sectors increasing. Services-producing industries rose 0.7 per cent, led by a rebound in educational services after public-sector strikes in Quebec ended. Goods-producing sectors were up 0.2 per cent with utilities and manufacturing rebounding from declines in the previous month.

The education sector grew 6 per cent and was the largest contributor to growth. The health care and social assistance sector, which was also affected by the strikes in Quebec, rose 0.8 per cent, the largest growth rate since October 2020.

The manufacturing sector fully recouped December’s decline with a 0.9 per cent increase. Utilities posted its largest growth rate since January 2022 with a 3.2 per cent gain, partly due to a sudden drop in temperatures mid-January in parts of the country.

Real estate grew 0.4 per cent, the third straight monthly increase, with higher activity in the Greater Toronto Area, Hamilton-Burlington and most markets in Ontario’s Greater Golden Horseshoe contributing to the growth.

Oil and gas extraction dropped 4.4 per cent, and oilsands extraction fell 5.2 per cent.

Canada economy on track to beat first-quarter forecasts - BNN Bloomberg

Read More

No comments:

Post a Comment