'Recession risks are higher north of the border, with a bumpier landing in store'

Article content

Article content

With all this talk of Goldilocks lately, you might think the economy is out of the woods.

Not quite yet.

The world’s central banks appear to be ending their particularly aggressive interest-rate hiking cycle and there’s a new optimism in the air. The global economy, especially the United States, stormed past expectations this year, with U.S. growth hitting 2.4 per cent, up from 1.9 per cent last year.

Advertisement 2

Article content

But until those central banks actually start cutting, higher interest rates are still around and promise more pain to come — especially for Canada, say economists.

While the U.S. might get off with a soft landing, Canada, with its high household debt and dependence on the housing market, likely won’t be so lucky.

“Recession risks are higher north of the border, with a bumpier landing in store,” said Toronto Dominion economists led by Beata Caranci.

Canada’s growth will hit a low point in the first half of next year as the drag of higher borrowing costs continue to pull on the economy.

“Cushy soft is not how we would describe Canada’s outlook, which is clearly bumpier due to a more exposed consumer,” said Bank of Montreal’s chief economist Douglas Porter.

“Famously strong population growth of now nearly 3 per cent is papering over an even rockier performance on the ground, while also pressuring shelter costs and pushing up the jobless rate.”

Consumer belt tightening is expected to reach a peak in the first half of the new year, slowing spending to below 1 per cent, said TD.

Article content

Advertisement 3

Article content

With businesses also pulling back, it expects growth to slow to 1.1 per cent this year from 3.8 per cent in 2022, and then hit its trough at 0.5 per cent in 2024.

“This leaves a very narrow margin for error and recession risks are elevated,” said TD.

Other economists think the Canadian economy is unlikely to grow at all. Capital Economics has lowered its growth forecast for 2024 from 0.5 per cent to zero. It expects GDP will contract by 0.2 per cent in the fourth quarter and 1 per cent in the first quarter of 2024.

The Achilles heal of Canada’s economy, the housing market, has weakened more than economists expected, and Capital predicts prices will fall 7 per cent from their August peak.

“With affordability so stretched, there is a clear risk of an even larger fall,” said Capital Economic’s Stephen Brown.

“In that scenario, the modest recession that we forecast could morph into a deeper downturn.”

Economists at Desjardins expect a “short and shallow” recession in the first half of 2024 with consumption, business and housing investment all contracting, pushing the unemployment rate higher.

Advertisement 4

Article content

Bank of Montreal sees GDP gains slowing to 0.5 per cent in 2024, “with the economy dancing around the edge of recession in the first half of the year.”

The upside of stalling growth is that it will (eventually) trigger Bank of Canada interest rate cuts.

Most economists see this happening in the spring, but the month and the amount varies.

Predictions on the starting date range from as early as March to June or later and forecasts on where the Bank’s rate will be by the end of 2024 range from 3 per cent to 4.25 per cent.

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

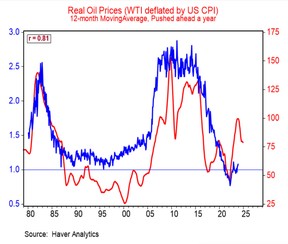

Lots going on in this chart from BMO chief economist Douglas Porter. Looking at the ratio of home prices in Calgary versus Windsor gives a read on the resource sector versus manufacturing.

The red line tracks oil prices which in the past have been a good indicator of the fate of the two housing markets, he said.

It also shows the western city’s recent country-beating strength in real estate.

Advertisement 5

Article content

While housing markets across Canada are soft, Calgary is up more than 10 per cent year over year, said Porter. Calgary dipped below Windsor prices at the peak of the pandemic housing boom, but has since regained ground. Even with the recent slump in oil prices “the balance still favours Calgary,” he said.

- This week marks the last full week of trading for 2023 on the Toronto Stock Exchange. It’s been a volatile year but a rally that began at the end of October has TSX on track to eke out a gain for the year.

- Today’s Data: Canada’s new housing price index for November, construction investment for October

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

Calculating the combined federal/provincial tax rate is not as simple as adding up their respective rates, which can cause confusion when financial planning. Certified financial planner Andrew Dobson says we should not confuse marginal tax rates with our average tax rate. Get the answer at FP Investing

Related Stories

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Canadian economy outlook: worst is yet to come - Financial Post

Read More

Comments