But central bank not ready to declare battle against inflation won

Article content

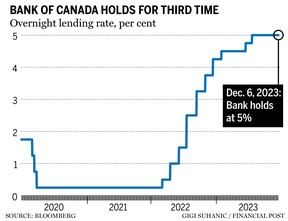

The Bank of Canada held its key overnight interest rate at five per cent as widely expected by economists and markets in light of recent signs the domestic economy is slowing and unemployment is ticking up.

“With further signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate,” the central bank said in a Dec. 6 statement.

Advertisement 2

Article content

Article content

However, the Bank of Canada cautioned that inflation concerns remain and it is prepared to raise rates further “if needed.”

Further hikes won’t happen if there is sustained easing in core inflation, with the central bank keeping an eye on other trends including wage growth and corporate pricing behaviour.

“The Bank remains resolute in its commitment to restoring price stability for Canadians,” the statement read.

Jules Boudreau, senior economist at Mackenzie Investments, noted that the Bank of Canada did not drop its cautionary statement about the possibility of hiking rates further even though in his view that’s extremely unlikely to happen.

“It’s clear that the Governing Council won’t risk removing that statement before it is ready to begin cutting,” the economist said, adding that “tame rhetoric” in early 2023 was misinterpreted, a scenario central bankers will not want to risk repeating.

“At the start of 2023, markets, consumers, and businesses saw the bank’s tame rhetoric around rates as an indication that it was done hiking,” Boudreau said, adding that this provoked a rebound in growth, inflation and the housing market. In June and July, after two consecutive pauses, the Bank of Canada raised the key overnight rate by a total of 50 basis points to five per cent.

Article content

Advertisement 3

Article content

Economists were expecting the hold, and many anticipate that if economic trends continue, the Bank of Canada will begin lowering interest rates by next spring after scorchingly swift and steep increases over the past year and a half or so.

James Orlando, a senior economist at Toronto-Dominion Bank, said an interest rate cut is likely, but not until April.

“With inflation still above three per cent, we get why the BoC (Bank of Canada) isn’t ready to declare victory,” he wrote in a Dec. 6 note.

“Instead, the BoC seems like it is preparing to sit on the sidelines for the next couple of months while maintaining its cautious rhetoric.”

Andrew DiCapua, senior economist at the Canadian Chamber of Commerce, said businesses would take some comfort from the latest rate decisions, but he cautioned against optimism about rate cuts, particularly if they are expected before the second quarter.

“Many factors can complicate the timing of cuts, including the persistence of core inflation, the strength of the housing market, and whether first-quarter GDP continues negative growth,” DiCapua said.

Advertisement 4

Article content

Even if rates do decline, he said many businesses will be faced with refinancing debt at rates well above multi-decade lows.

“What’s even more concerning is that households are being squeezed by significant increases in mortgage interest payments, with nearly $190 billion in renewals expected next year,” said DiCapua.

“Payments could increase anywhere from 20 to 50 per cent, depending on the type of mortgage, putting Canadian families under unprecedented pressure, and further restraining spending in the economy.”

Canada’s economic growth stalled through the middle quarters of 2023, with real GDP contracting at a rate of 1.1 per cent in the third quarter following growth of 1.4 per cent in the second quarter.

“Higher interest rates are clearly restraining spending,” the Bank of Canada said, noting that consumption growth in the last two quarters was close to zero and business investment has been volatile but essentially flat over the past year.

While government spending and new home construction provided a boost, the labour market continued to ease, with job creation slower than labour force growth and the unemployment rate rising modestly.

Advertisement 5

Article content

The Bank of Canada appeared less concerned than in the past about wage growth in its latest statement, though wages are still rising by four to five per cent.

“Overall, these data and indicators for the fourth quarter suggest the economy is no longer in excess demand,” the central bank said.

The slowdown in the economy is reducing inflationary pressures in a growing range of goods and services, which, combined with the drop in gas prices, contributed to the easing of CPI inflation to 3.1 per cent in October.

The central bank noted that shelter price inflation is an outlier, and actually picked up as a result of faster growth in rent and other housing costs alongside continued elevated mortgage interest costs.

Related Stories

Core inflation, the central bank’s preferred measure, has been around 3.5 to four per cent in recent months, with the October data coming in towards the lower end of this range.

Advertisement 6

Article content

Other trends cited in the report include continued slowing in the global economy and further easing of inflation. While growth in the United States has been stronger than expected, led by consumer spending, the Bank of Canada anticipates that things will cool in the U.S. in the months ahead as past policy rate increases work their way through the economy.

Growth in the euro area has already weakened and, combined with lower energy prices, this has reduced inflationary pressures.

The Bank of Canada will make its next key interest rate announcement on Jan. 24, 2024, along with its full outlook for the economy and inflation.

• Email: bshecter@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Bank of Canada holds interest rate at 5% as economy stalls - Financial Post

Read More

Comments