Markets now see 40% chance of a hike next week, 100% chance of another hike by September

Article content

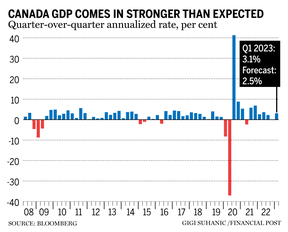

Stronger-than-expected economic growth in the first quarter could force the Bank of Canada to end its pause and hike interest rates again during one of its meetings over the summer, economists are predicting.

Advertisement 2

Article content

Gross domestic product, the country’s main gauge on the amount of goods and services changing hands, expanded at a 3.1 per cent annualized pace over the first three months of the year. It’s a figure that blew past Bay Street’s expectations of 2.5 per cent growth and the Bank of Canada’s own 2.3 per cent projection.

Article content

Economists have been putting more stock into the potential for a rate hike at some point over the next few months, with some predicting a bump as early as next week in its June 7 meeting.

Markets are now pricing in a 40 per cent chance of a hike next week, up from 28 per cent before the data, Reuters reports, and they now expect an increase of 25 basis points by September.

“It seems likely the Bank of Canada will be seriously considering raising rates next week,” said Royce Mendes, Desjardins head of macro strategy, in a May 31 note. “While they might pass on changing course just yet, the belief that the central bank will further tighten policy this summer is justifiably gaining traction.”

Article content

Advertisement 3

Article content

The central bank has said it would only maintain a pause on rate hikes if the economy cooled off in line with its expectations, but the latest reading points to continued strength.

The economics team at the Canadian Imperial Bank of Commerce also said the stronger GDP raises the odds of a hike, but say it’s not a done deal. CIBC senior economist Andrew Grantham said he expects policymakers will prefer to wait and see more data and revise forecasts rather than raising rates next week.

Bank of Montreal chief economist Doug Porter said that patience could be key, given the current economic outlook.

“However, given the uncertain backdrop and the possibility that inflation took a big step down in May, the (Bank of Canada) could opt to remain patient for a bit longer and signal that it’s open to hiking in July if the strength persists,” Porter said in a May 31 note.

Advertisement 4

Article content

The latest data on the economy bolsters Monex Canada foreign exchange analyst Jay Zhao-Murray’s argument that the central bank would have to hike in June.

“A few days after we made that call, Governor Macklem tried to downplay the uncomfortably strong inflation data when asked by a journalist, buying himself a bit of time by suggesting that he would wait for today’s GDP report and then take all of the information together before making a decision,” Zhao-Murray wrote.

“With the final piece of the puzzle also suggesting that the economy has more excess demand than the Bank of Canada thought, the stars are aligned for a resumption in the hiking cycle.”

“We are now at a stage where, should the Bank lack the conviction to act in June, the history books likely won’t look kindly upon the decision,” he added.

• Email: shughes@postmedia.com | Twitter:

Odds of Bank of Canada rate hike just went up as economy beats expectations - Financial Post

Read More

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation