Article content

(Bloomberg) — Federal Reserve Bank of Richmond President Thomas Barkin said the central bank might need to tighten monetary policy further to reduce inflation and slow a resilient US economy and labor market.

Article content

“I want to reiterate that 2% inflation is our target, and that I am still looking to be convinced of the plausible story that slowing demand returns inflation relatively quickly to that target,” Barkin said in prepared remarks for a speech in Ocean City, Maryland. “If coming data doesn’t support that story, I’m comfortable doing more.”

Article content

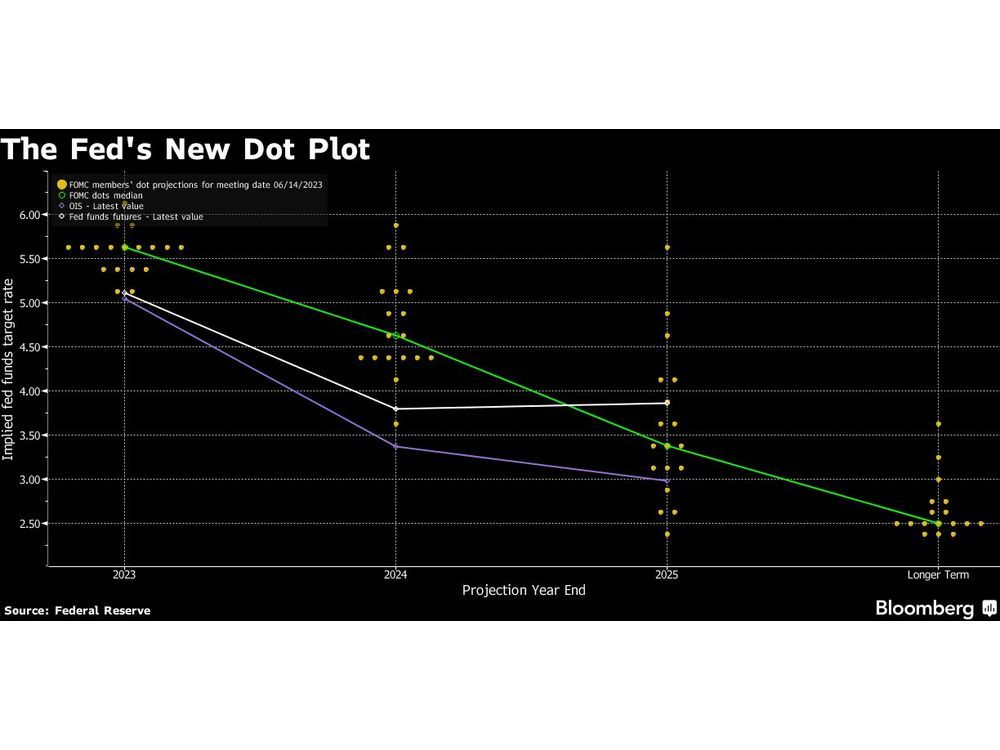

The Federal Open Market Committee paused its series of interest-rate hikes Wednesday, but policymakers projected rates would move higher than previously expected in response to surprisingly persistent price pressures and labor-market strength.

Speaking to the Maryland Government Finance Officer Association, Barkin — who does not vote on policy decisions this year — warned that prematurely loosening policy would be a costly mistake.

Article content

“I recognize that creates the risk of a more significant slowdown, but the experience of the ’70s provides a clear lesson: If you back off inflation too soon, inflation comes back stronger, requiring the Fed to do even more, with even more damage,” he said. “That’s not a risk I want to take.”

Moderating Pace

Barkin’s comments echoed those of Fed Chair Jerome Powell, who Wednesday said the committee felt it was appropriate to moderate the pace of rate increases following the most aggressive hiking cycle in four decades, as well as recent bank failures that might tighten credit conditions. At the same time, he said that the vast majority of the committee projected more hikes will be needed to tame inflation.

“With forward-looking real rates now positive across the curve, we have been moderating the pace of those increases,” Barkin said. “Think of it as slowing your boat as you approach the dock. That gives us time to assess the data on demand and inflation and determine what more we might need to do.”

The Richmond Fed leader called inflation “too high” and “stubbornly persistent.”

Demand has been “elevated,” he said, supported by ongoing fiscal spending, almost $1 trillion in excess savings and robust household wealth gains from stocks and housing equity.

The consumer price index this week showed headline inflation slowed but core prices excluding food and energy continued to rise at a pace that’s concerning for Fed officials.

Fed's Barkin Comfortable Doing More to Slow Resilient US Economy - Financial Post

Read More

No comments:

Post a Comment