The deadline for reaching a deal on the US debt ceiling is just days away, and Capitol Hill is deadlocked. On or around 1 June, the federal government will no longer have the money to continue paying its bills, potentially resulting in an unprecedented default that would send catastrophic shockwaves across the world economy.

That such a dangerous game of chicken is being allowed to reach this point is further evidence of the severe crisis of US capitalism, whose standing has already been damaged as a result.

Playing dice with the debt ceiling

Debt ceiling debates typically go down to the wire, as the Democrats and Republicans attempt to wring concessions out of one another. But the situation for US capitalism today is particularly precarious.

The US ruling class was forced to spend huge sums of money in the recent period, particularly during the COVID-19 pandemic, where the iron lung of state support was the only thing keeping the economy alive. As a consequence, debt has ballooned both in absolute and relative terms.

According to the US Department of the Treasury, total public debt stands at $31.42 trillion, with the new, $31.4 trillion limit agreed by lawmakers last December having been passed in January. Debt now exceeds 100 percent of the country’s yearly GDP, something not seen since the end of World War II.

Meanwhile, the inflation crisis provoked by all this spending, and exacerbated by fallout from the Ukraine War, has forced the Federal Reserve to raise interest rates in an attempt to cool down the economy. This contributed to the demise of two mid-sized banks (SVB and Signature) earlier this year.

The Fed has already undermined confidence in itself by declaring inflation to be “transitory” in 2021, only to unleash subsequently a string of 10 consecutive rate hikes, and refusing to rule out another in June. It then had to intervene to stem the contagion of the SVB and Signature collapse, which was merely a tremor compared to the almighty earthquake a default would unleash.

The ruling class is thus caught between the rock and hard place of needing to spend more (and cover its existing spending), but also limit spending to bring down inflation.

In the meantime, the Fed is weighing up a number of unpalatable options, such as buying Treasury bonds (an emergency method recently employed by the Bank of England) or allowing banks to pledge defaulted securities as collateral against new loans.

In other words, this debt-ceiling deadlock could hardly have come at a worse time. As Chicago Fed President Austan Goolsbee said in a speech last month:

“Moments of financial stress are a particularly bad time to punch yourself in the face by taking actions that could ignite a financial crisis on their own like, say, defaulting on U.S. Treasuries [bonds] in a fight about the debt limit.”

Deadlock

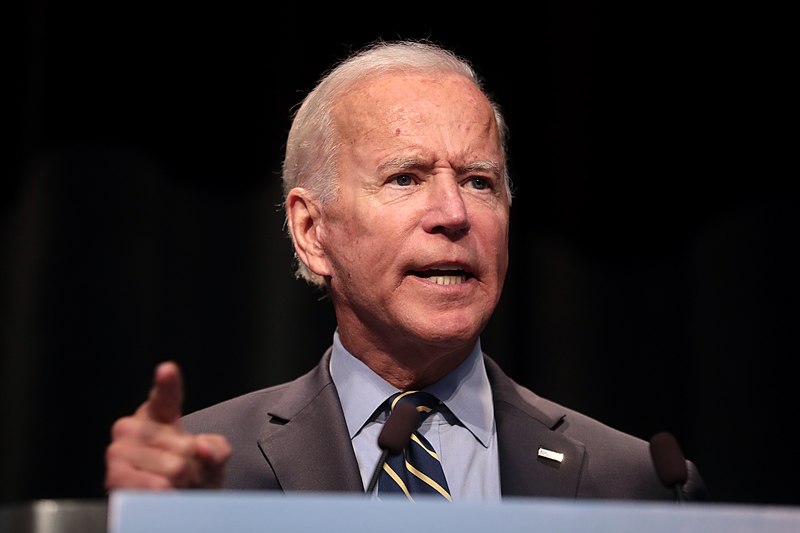

Representatives of the two main bourgeois parties remain at loggerheads. President Joe Biden (whose approval rating is hovering around 40 percent) has stated he will not accept a debt ceiling raise that comes with conditions.

Meanwhile, Speaker Kevin McCarthy is demanding that Biden institute deep spending cuts, and scrap new taxes on corporations and high-earners to raise money for the 2024 budget, in exchange for Republican votes.

In response, Biden has threatened to invoke the 14th Amendment of the US Constitution, allowing him to effectively ignore the debt ceiling altogether if the Republicans don’t give ground, though the legal and constitutional implications of this move make it a nuclear option.

We have seen such charades before. Although the leaders of both parties are happy to exploit the theatrics of the debt-ceiling debate, ultimately, the US capitalist class as a whole has no interest in the federal government defaulting on its debts.

By extension, neither do the Democrats or Republicans in Washington. Hence, they have always come to a compromise, at the expense of working people. Indeed, part of the purpose of these debates is to force through such unpopular cuts.

However, these periodic fracases over the debt-ceiling are becoming more and more acrimonious, creeping closer and closer to the brink, reflecting the deepening splits within the US ruling class.

Already, there have been consequences for the reputation of US capitalism, which in turn has big implications for the entire global economy. The dollar is the world’s de facto reserve currency, and US Treasury bonds are a key asset for investors, fund managers, and ordinary savers in America and internationally. A threat to either haunts the worst nightmares of the world markets.

What would a default mean?

In any game of chicken, the risk of collision is always implicit, increased in this case by the myopic senility of US capitalism and its political representatives. The New York Times’ Robert Hockett describes the incalculable impact of crossing the x-date threshold without a resolution:

“[It] would undo what Hamilton and his successors sought to ensure: a national credit rating beyond cavil or reproach. We would see a great tottering — if not worse — of U.S. banking, U.S. financial markets and the world’s capital markets.”

The exact effects of a default are hard to measure, but some things can be reliably predicted.

The dollar would plunge, and borrowing costs would rocket. State-sponsored medical care and pension funds would hang in the balance. Social security payments would be delayed. Import costs would surge and the accompanying inflation would make the current post-pandemic rise in prices seem like child’s play. According to Hockett, it “could look more like that of Argentina or Russia 20 years ago than that of the present or even the 1970s.”

There would also be a wave of bankruptcies and business closures, while debt-servicing costs would rise, increasing the state deficit even further. In all, Moody’s Analytics estimates there would be 7.8 million lost jobs and a $10 trillion loss in household wealth in the event of a default.

Furthermore, the US would be faced with an “incapacity to maintain… military bases and other assets abroad” (per Hockett), hobbling the reach of the main imperialist world power.

Especially given the parlous state of US economic growth, as former Treasury Secretary Jacob Lew said last month in a Council on Foreign Relations meeting: “if we were to default, it makes the odds of a recession almost certain.”

And as we saw in 2007–8, a recession for the biggest capitalist economy would be replicated worldwide. While the majority of US debt is held domestically, 24 percent, or around $7.4 trillion, is owned by foreign countries. Huge swathes of the world economy depend on these investments, which are supposed to be ‘as good as gold’.

A default would turn these bonds into an immediate vector for global recession, which would further undermine the dollar’s role as a reliable lubricant for world trade.

In all, to quote US treasury secretary Janet Yellen: “Failure to meet the government’s obligation would cause irreparable harm to the US economy, the livelihoods of all Americans and global financial stability.”

The mere threat of such a scenario is unthinkable. And even if a deal is reached in the coming days, serious damage has already been done to the prestige of the world’s foremost imperialist power, whose reckless representatives are effectively gambling with the future of the entire capitalist system.

In the 2011 debt ceiling showdown, the US saw its credit rating downgraded by S&P from AAA to AA+, despite actually passing a debt ceiling increase in the final moments before the deadline, as the whole symbolic affair meant US Treasury bonds were seen as a riskier investment. This immediately sent global stock markets into convulsions.

The general economic picture is a lot more unstable today than in 2011, with inflation raging, debts precariously piled up, and protectionism on the rise. Thus, even if a deal is reached at the eleventh hour, another serious downgrade could detonate a bomb within capitalism’s fragile fiscal foundations.

Not our debt! Make the bosses pay!

The existential danger of a default makes this scenario very unlikely. In recent days, Biden and McCarthy have apparently held “productive” conversations – while ramping up the rhetoric and stressing that a deal has not been reached.

Nevertheless, the main effect of this whole episode is to further erode confidence in the US economy, at home and abroad, which is supposed to be the lynchpin of the global capitalist system. This, at a time when the world is already beset with profound instability and uncertainty.

The political representatives of US capitalism, for their part, are tobogganing towards the edge of a cliff with their eyes wide open! It is testament to the relative decline of US imperialism as the main world power, and the increasing irrationality of capitalism as a whole, that this periodic dance with disaster is allowed to reach such a juncture.

These are all symptoms of an economic and social system that has been allowed to survive well past its natural life. It must be put out of its misery and replaced with a new, rational economic model, based on socialist planning and democratic workers’ control.

For starters, the International Marxist Tendency demands that all national debts be cancelled, with the billionaires’ enormous wealth expropriated to protect the pensions and savings of the working class and the poor. We should not be forced to pay the bosses’ debts, which have been accrued by financing war, subsidising big business, and keeping capitalism on life support.

A workers’ government would place the commanding heights of the economy, i.e., the big banks and large corporations, under democratic workers’ control, as part of a rational, socialist plan of production.

On this basis, we could end the crises of capitalism that cause devastation across society, and end the insanity of constant debates about “balanced budgets” and “debt ceilings”, while providing free and high quality housing, healthcare and education to all.

The resources exist to accomplish this. But in order to realise these goals, we require a workers’ party in the US that is willing to fight on a socialist programme. If you want to fight for such a party and a socialist future in our lifetime, join the IMT!

US economy on collision course with debt ceiling - In Defence of Marxism

Read More

No comments:

Post a Comment