[unable to retrieve full-text content]

Services Sector Shields Indian Economy From Still-High Rates BloombergServices Sector Shields Indian Economy From Still-High Rates - Bloomberg

Read More

[unable to retrieve full-text content]

Services Sector Shields Indian Economy From Still-High Rates Bloomberg[unable to retrieve full-text content]

China Considers Tax Breaks for Manufacturers as Economy Cools Bloomberg

(Bloomberg) -- A peek at five often overlooked raw materials markets shows how China’s stuttering recovery extends to almost every nook and cranny of its economy.

Most Read from Bloomberg

Commodities like crude oil or copper usually take the headlines for investors parsing the state of Chinese demand. But the world’s second-biggest economy also hosts an array of markets that trade less familiar products. While they may not attract Wall Street analysis, they’re still recognizable as important building blocks of an economy.

Futures markets for items as diverse as glass, styrene and corn starch are piling on the evidence that China isn’t recovering as fast as many people had hoped, after Beijing abandoned the pandemic restrictions late last year that were crushing its economy.

Glass

China accounts for more than half of the world’s plate glass production thanks to the rapid growth of high-rise buildings and vehicle sales in recent decades. Similar to other industries, low margins and supply gluts have troubled producers for years, forcing them to cut output in recent months.

The situation this year looks even more challenging. Glass futures on the Zhengzhou Commodity Exchange have plunged nearly 20% in the past month, a period when demand usually picks up. The reasons include China’s teetering property market and weaker-than-expected vehicle output in April.

Trucked LNG

China has a vast requirement for natural gas, carried by sea from mega-projects in far-flung places like Qatar and Australia, or over pipelines that stretch across continental Asia. But the last few miles to consumers is often via trucks that criss-cross China’s cities, a barometer of the immediate needs of industries from glass-makers to ceramic factories.

That price has fallen to its lowest level in almost two years. Demand is so weak that the nation’s top importers of seaborne liquefied natural gas are even offering to resell their shipments abroad.

Styrene

Fewer home buyers also means less demand for the purchases that often accompany a new place to live. The price of styrene monomer, a material used for the plastics and rubber that go into appliances like fridges, has declined. China has been the world’s fastest growing market in the past decade with capacity climbing to over 40% of the global total.

Dalian futures fell last week to their lowest since February 2021, after a near-5% drop in home appliance sales in the first quarter, according to the National Appliance Information Center. The problems are slower growth in personal incomes and a “low-frequency sales cycle” for white goods, according to Wu Haitao, a director at the center.

Corn Starch

Corn starch has a wide variety of uses, in soft drinks, as a thickening agent for sauces and in the paper and textiles industries. China produces almost 50 million tons a year.

Although retail sales have outperformed other economic measurements in the months since China’s Covid Zero restrictions were lifted, they grew at a slower pace than expected in April. China’s falling population is another headwind: corn starch is a key ingredient in baby formula.

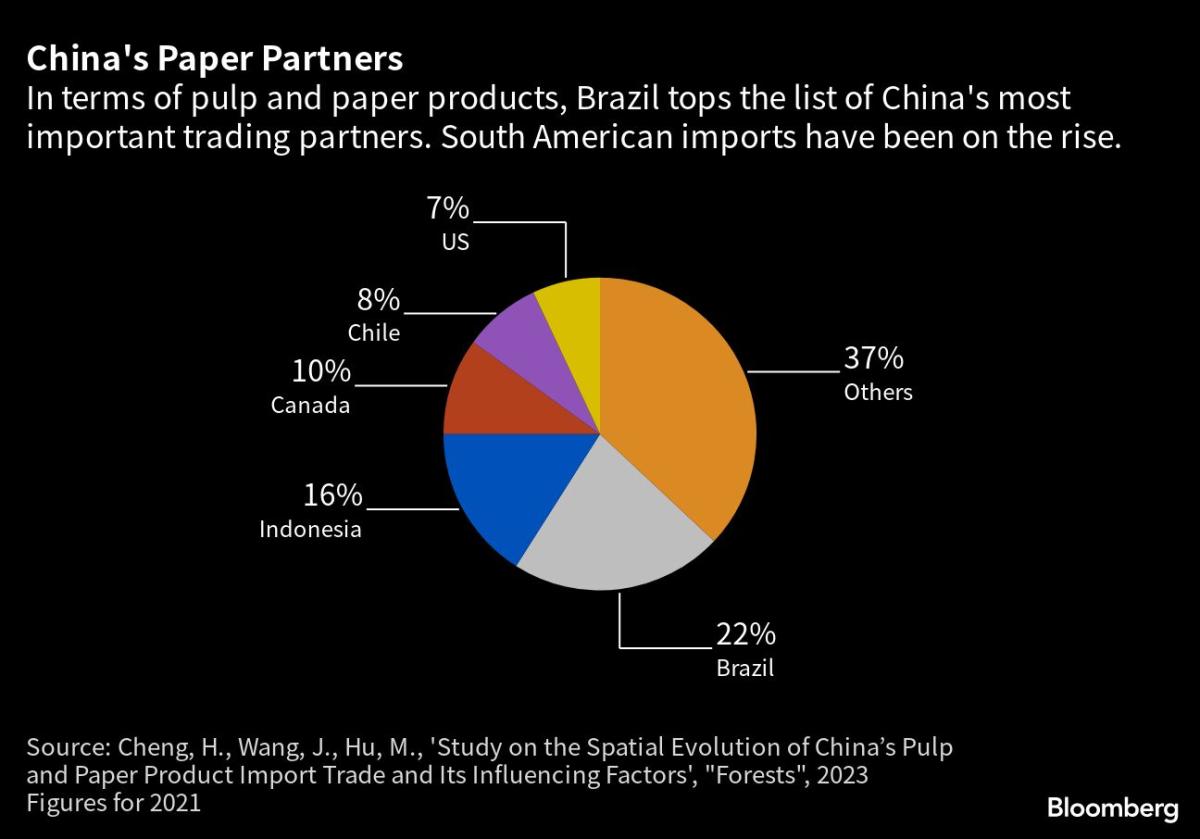

Paper Pulp

Shanghai pulp futures went into free-fall in February after a sudden recovery in production at paper mills after the Lunar New Year holiday was augmented by resurgent imports. Domestic demand, which was also supposed to rise after China’s reopening, couldn’t keep up.

As with many commodities, China is the biggest producer and consumer of pulp, used for packaging, publishing and household goods. But the market is so vast that a lot of pulp and paper also needs to be sourced from abroad.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Tuesday, May 30

Wednesday, May 31

China official PMIs for May, 09:30

CCTD’s weekly online briefing on Chinese coal, 15:00

SMM Indonesia Nickel and Cobalt Industry Chain Conference in Jakarta, day 2

Thursday, June 1

Friday, June 2

China weekly iron ore port stockpiles

Shanghai exchange weekly commodities inventory, ~15:30

--With assistance from Hallie Gu, Stephen Stapczynski, Kathy Chen and Dan Murtaugh.

(Updates with diary items in final section)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Yahoo Finance Live's Rachelle Akuffo discusses China's economy amid the country's COVID recovery, as well as Elon Musk and Jamie Dimon visiting China this week.

RACHELLE AKUFFO: But while Asia's indexes are trading slightly higher this morning, China's economy appears to be stalling as investors concerns mount over the country's coronavirus recovery.

Chinese stocks and Hong Kong are flirting in bear market territory on Tuesday. The weakening Yuan and growing geopolitical tensions are keeping investors away from trading overseas. The Hang Seng China enterprises index, one of the most followed Asian indexes, is more than 6% this year. Industrials production and property sales also contributing to the country's slowing growth as well.

But despite China's weakening recovery and rising geopolitical tensions, business elites are flocking to the world's second biggest economy. Elon Musk arrived in China Tuesday morning to visit Tesla's Shanghai plant and meet with government officials on the country's electric vehicle industry.

And Jamie Dimon is set to arrive in China on Wednesday for JP Morgan's China summit. Now, where the CEO will weigh in on the bank's business outlook. So lots to watch there as well.

[unable to retrieve full-text content]

China Considers Tax Breaks for Manufacturers as Economy Cools Bloomberg:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/7VJ2DGWRIZLJ7JUGMPAZH5LFDY.jpg)

A new solar panel array is installed in Scugog, Ont. on April 27, 2016.Frank Gunn/The Canadian Press

Executives from an array of low-carbon industries are attempting a show of strength on Parliament Hill this week, at a precarious point in Canada’s efforts to keep pace with the United States and other countries prioritizing low-carbon economic growth.

Although representatives of specific sectors frequently show up in Ottawa to press members of Parliament for support, the gathering on Tuesday and Wednesday – featuring approximately 45 leaders of companies, industry associations, organized labour and Indigenous business groups – is aiming for something wider and more symbolic.

Based on interviews with some of those representatives and with the climate-focused Ivey Foundation – which along with the non-governmental organizations Clean Energy Canada and the Transition Accelerator is co-ordinating the effort – the idea is to have different corners of the clean-economy transition form a united front in a way they have not previously.

Branded New Economy Canada, it’s something of an experiment in whether co-ordination can build a degree of cross-partisan consensus about the need to implement regulatory reforms, industrial subsidies and financing mechanisms, and other measures to expedite that transition.

The list of participants has clearly been curated to showcase the range of economic activity that organizers hope will prove irresistible, even to politicians for whom Canada’s emissions-reduction commitments may not be a priority.

It spans from renewable electricity producers such as Northland Power Inc. and energy storage players such as Hydrostor Inc., to mining giants including Teck Resources Ltd. TECK-B-T and the more junior E3 Lithium Inc. ETL-X, to environmental, social and governance-focused asset managers such as Addenda Capital Inc. And it runs the gamut from Canadian startups to domestic wings of multinationals, such as GE Canada.

Canada’s financial support for clean energy transition is competitive with U.S., report says

Is Canada keeping its promises on climate change? The Globe tracks its progress

Participating industry organizations represent both relatively new segments of the economy (the Battery Metals Association of Canada) and established sectors with decarbonization ambitions (the Cement Association of Canada). Others range from the First Nations Major Project Coalition to the International Brotherhood of Electrical Workers.

The plan for them in Ottawa is to break off into small groups, each featuring a cross-section of sectors, which will sit down with MPs and political staff to press their case. Organizers said they have secured meetings with members of each federal party.

That in itself may be a small victory. Part of the impetus behind the event is to light a fire under the governing Liberals to swiftly follow up on commitments in this spring’s budget to stay competitive with the United States as it rolls out hundreds of billions of dollars in clean-economy spending through its Inflation Reduction Act. But there is also a perceived need to engage with the opposition Conservatives, who under Pierre Poilievre’s leadership have thus far displayed little interest in climate-related policies, to try to ensure they maintain such efforts if they win government in the coming years.

“When I look at what we build, these are multidecade projects that involve hundreds of millions of dollars,” said Colleen Giroux-Schmidt, a vice-president with another participant, Quebec-based Innergex Renewable Energy Inc. That points, she suggested, to the need for investors to have confidence that policies will be durable through changes in government.

The program for a New Economy Canada reception being held on Tuesday evening also seems intended to catch the Tories’ attention. One of its featured speakers is former Conservative MP Joe Preston, who now serves as mayor of St. Thomas, Ont. – home to the massive new Volkswagen electric-vehicle battery plant that Ottawa will heavily subsidize.

Somewhat less clear is the precise message that companies will be delivering to MPs during all their meetings – or how New Economy Canada might evolve after this week’s initial event.

It is, by the acknowledgment of those involved, a fairly ad hoc undertaking. And there is recognition that messages must be kept fairly broad, given differing policy needs of the sectors involved, and limited work put in thus far to determine where they intersect.

Some of the companies are nevertheless eager to seize the chance to convey to policy makers their own key messages, applicable to the fields they’re in, if not the entire sweep of low-carbon industries.

Nouveau Monde Graphite Inc. vice-president Julie Paquet – whose company touts its sustainable mining practices but whose first major project, in Quebec, has attracted local concern about environmental effects – expressed hope about being able to “deconstruct some of the myths that might be plaguing some of our companies.” That includes, she said, trying to persuade left-of-centre MPs to set aside pre-existing impressions of how the mining sector operates.

Addenda Capital, meanwhile, sees some opportunity to push for policies that provide greater accountability and transparency to guide investors through myriad net-zero and ESG commitments currently being made. One example, cited by senior director Andrea Moffat, is trying to get the government to act on the framework for a green taxonomy – a rulebook for what qualifies as a sustainable investment – that was developed last year by a government-appointed expert panel.

Then there is Alberta’s Kiwetinohk Energy Corp. KEC-T, which occupies a unique place as a self-described energy transition company that produces oil and gas, but is also developing renewables and wants to primarily become a supplier of low-emissions electricity. “I honestly don’t know why we were invited to this particular event,” chief executive Pat Carlson said, but he’s going because he sees it as an opportunity to educate politicians about his company’s unusual story and ambitions.

Whether it coalesces into a coherent case – or offers lessons about what works and doesn’t, in terms of enlightening politicians about the path to clean-economy competitiveness – will seemingly determine if the effort proves a one-off or develops into something more structured.

“I don’t think two days in Ottawa will be enough education,” said Ivey Foundation senior adviser Merran Smith. “But we’ll see how it goes and determine next steps.”

For now, there is a feeling among the businesses that at least trying to capture politicians’ attention with a shared vision, rather than advancing interests as smaller emerging sectors that don’t all yet have as much clout on their own, is overdue.

“We tend to be siloed into our different segments of the economy,” said Ms. Giroux-Schmidt, of Innergex. “We’ve been looking for a unified voice like this for quite a while.”

[unable to retrieve full-text content]

Debt Deal Adds Brake on US Economy Already at Risk of Recession Bloomberg

Two weeks of negotiations between the federal and provincial governments and Stellantis have failed to produce a new deal for the NextStar EV battery plant in Windsor, Ont. Ian Lee, an associate professor at Carleton University's Sprott School of Business, says the economic might of the U.S., coupled with the incentives offered in recent legislation, make it extremely challenging for Canada to compete.

[unable to retrieve full-text content]

Debt Deal Adds Brake on US Economy Already at Risk of Recession Bloomberg(Bloomberg) -- Mexico’s economy expanded at a slightly slower pace than the preliminary estimate in the first quarter, while still benefiting from strong remittance flows and record exports to the US.

Gross domestic product expanded 1% in the first quarter from the previous three months, according to the revised figure released by Mexico’s national statistics institute on Friday. That compares with the 1.0% estimate from economists surveyed by Bloomberg and the 1.1% preliminary reading reported last month.

From the same period a year ago, GDP rose 3.7%, below the 3.9% first reading, as sustained domestic consumption and foreign demand continue to boost growth.

In the near-term, Latin America’s second-biggest economy may soon have to contend with an economic slowdown in the US — the No. 1 buyer of Mexico’s goods — which would weigh on exports, cash flows sent home from abroad and tourism.

“Mexico’s economic activity in 1Q was strong, but it shows an important deceleration at the margin,” said Carlos Capistran, chief Mexico and Canada economist for BofA Securities Inc, adding that he sees a GDP contraction as soon as the third quarter. “Going forward we continue to expect the economy to decelerate, specially as exports and remittances slow down with US activity.”

Quarterly Details

In the first quarter, in comparison to the same period the prior year, the agriculture sector grew 2.3%, the manufacturing sector 2.5% and the services sector 4.3%. On a quarterly basis, with seasonal adjustment, agriculture shrank 2.8%, manufacturing grew 0.6%, and services expanded 1.5%.

Businesses’ investment in machinery, a recovery of the services sector after it plunged earlier during the pandemic and firm consumption despite high borrowing costs point to the economy’s strength.

The economy has now posted six straight quarters of growth, the longest run under President Andres Manuel Lopez Obrador, underscoring its resilience and the sustained demand for goods produced in Mexico’s manufacturing centers.

While a so-called soft landing for the US can’t be fully discounted, most analysts anticipate at least a mild contraction in the wake of the US Federal Reserve’s sharpest interest rate tightening campaign in decades. Any significant spending cuts stemming from a US debt limit deal adds downside risk to growth for the US and, by extension, Mexico.

US demand was responsible for almost 80% of Mexico’s $53.6 billion worth of exports in March — the highest monthly total in the series that goes back to 1985 — though data came in below expectations in April. The weakness in manufacturing exports, especially of autos, was responsible for the sub-par reading, according to Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc.

In Mexico itself, ever-rising flows of cash sent home by citizens working abroad has become a key support for the economy. Full-year remittances hit a record $58.5 billion in 2022, of which almost $56 billion came from the US, and in the 12 months through March they reached $59.9 billion.

Rate Cuts

Looking forward, slowing inflation and the end of the central bank’s record tightening cycle will be supportive to domestic demand. Earlier this month, the central bank, known as Banxico, held its key rate at an all-time high of 11.25% after hiking 725 basis points over two years.

In the statement accompanying that decision, the board said it would maintain the rate for a “prolonged period.” Economists are divided about whether the bank will cut borrowing costs this year or wait until 2024.

Economists in a Citibanamex survey published this week held their 2023 growth forecast at 1.90%, up from 1% in early February. They also forecast that the central bank’s key rate would be 11.25% at year-end.

--With assistance from Rafael Gayol.

(Update with economist comments, analysis and sector growth starting in fifth paragraph.)

©2023 Bloomberg L.P.

(Bloomberg) — Germany suffered its first recession since the start of pandemic, extinguishing hopes that Europe’s top economy could escape such a fate after the war in Ukraine sent energy prices soaring.

Those troubles risk spilling over to the rest of the continent, which for decades has relied on Germany to power growth. The country’s companies are also pessimistic, maintaining a prediction for no growth in 2023.

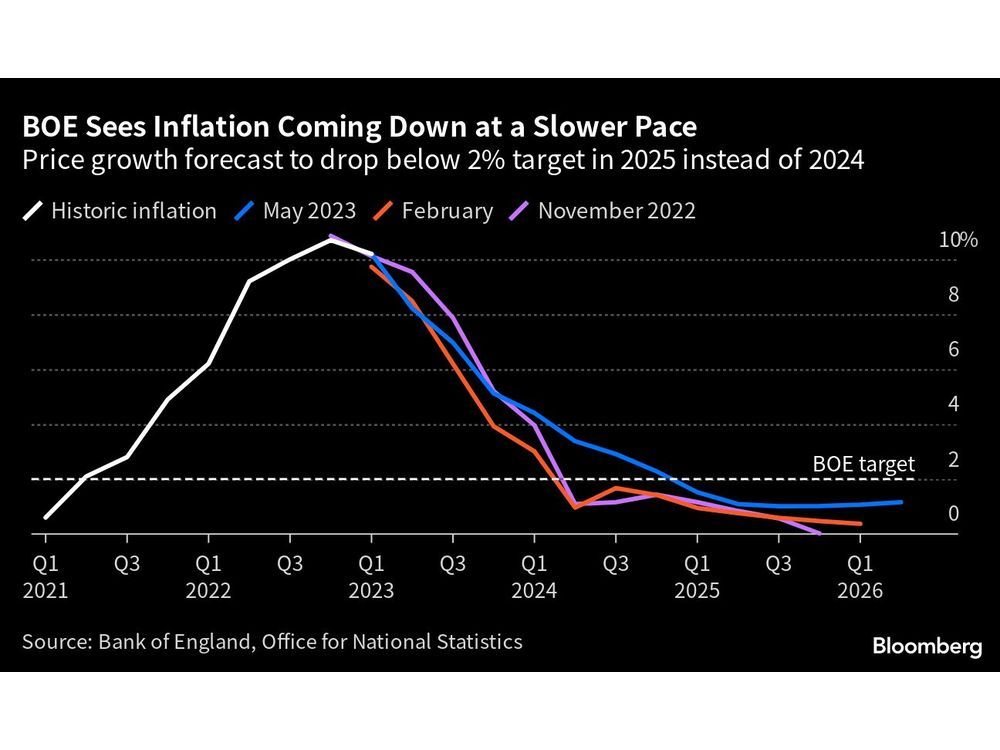

Inflation in the US and UK were both stronger than forecast in April, fueling bets in both regions that their central banks will keep raising interest rates.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Europe

Germany has been Europe’s economic engine for decades, pulling the region through one crisis after another. But that resilience is breaking down, and it spells danger for the whole continent.

German companies aren’t seeing any evidence of a pickup taking hold in Europe’s biggest economy, according to a survey conducted by the DIHK business lobby. The group maintained a prediction for zero growth in 2023, an outlook that’s more pessimistic than the 0.2% expansion forecast by the European Commission.

Britain’s inflation rate remained much stronger than expected, with the fastest increase in services and core prices in more than three decades fueling a flurry of bets on more Bank of England interest rate rises.

US

Inflation and consumer spending accelerated last month, highlighting steady price pressures and demand that will keep Federal Reserve policy makers tilted toward raising interest rates further. Combined with other Friday reports showing a surge in business equipment orders and a pickup in merchandise imports, the data indicate demand continues to power ahead.

On Friday, June 2, millions of Americans are due a total of $25 billion worth of Social Security payments. And more than anything else, that may prove a decisive element in forcing an end to the partisan standoff over raising the federal debt limit.

Asia

In 2021, a remote coal town in northeastern China was forced to undergo an unprecedented financial restructuring. Its struggles since are an ominous sign for President Xi Jinping as other heavily indebted municipalities look set to follow suit.

Singapore is confident that a rebound in travel that’s boosting the services sector will help the island’s economy avoid a recession this year despite a darkening global outlook.

Emerging Markets

Brazil’s central bank may have pushed up interest rates earlier and higher than others, but almost all of them — from the Federal Reserve to the Bank of England — have hiked to levels that are uncomfortably high for politicians. Calls for an end to rate hikes are mounting in capitols from Nairobi to Bogotá to New Delhi, threatening to undermine the autonomy that’s so critical to central banks’ fight against inflation.

Mexico’s economy expanded at a slightly slower pace in the first quarter than previously estimated, while still benefiting from strong remittance flows and record exports to the US. The economy has now posted six straight quarters of growth.

World

Israel delivered an unprecedented 10th consecutive interest-rate increase, New Zealand signaled this hike would likely be its last of the cycle, while Iceland and South Africa also tightened. Hungary cut the EU’s highest interest rate, while Vietnam and Belarus also eased. Ghana, Korea and Turkey stood pat.

Argentina’s government is asking China for an expansion of its bilateral currency swap in yuan as it seeks to build up central bank reserves in a bid to contain another peso selloff with inflation already running above 100%, according to two people with direct knowledge. For China, it’s another opportunity — albeit risky lending more to a serial defaulter in Argentina — to expand the yuan’s global use in a bid to diminish dependence on the US dollar.

—With assistance from Andrew Atkinson, Maya Averbuch, Martha Beck, Maria Eloisa Capurro, Laura Litvan, Yujing Liu, Colum Murphy, Ignacio Olivera Doll, Jana Randow, Tom Rees, Felipe Saturnino, Zoe Schneeweiss, Craig Stirling, Karthikeyan Sundaram, Alexander Weber, William Wilkes and Xiao Zibang.

Video Duration 25 minutes 30 seconds 25:30

The economy is recovering after a decade-long debt crisis, but are Greeks feeling the benefits?

Nearly a decade ago, Greece was bankrupt. Today, its economy is recovering.

But after years of austerity measures, Greeks’ incomes are being hit by the cost of living crisis.

Meanwhile, wealthy nations promised $13 trillion in aid to poor countries, so why hasn’t it been paid?

And we also speak to Iraq’s deputy prime minister and oil minister.

(Bloomberg) -- Mexico’s economy expanded at a slightly slower pace than the preliminary estimate in the first quarter, while still benefiting from strong remittance flows and record exports to the US.

Gross domestic product expanded 1% in the first quarter from the previous three months, according to the revised figure released by Mexico’s national statistics institute on Friday. That compares with the 1.0% estimate from economists surveyed by Bloomberg and the 1.1% preliminary reading reported last month.

From the same period a year ago, GDP rose 3.7%, below the 3.9% first reading, as sustained domestic consumption and foreign demand continue to boost growth.

In the near-term, Latin America’s second-biggest economy may soon have to contend with an economic slowdown in the US — the No. 1 buyer of Mexico’s goods — which would weigh on exports, cash flows sent home from abroad and tourism.

“Mexico’s economic activity in 1Q was strong, but it shows an important deceleration at the margin,” said Carlos Capistran, chief Mexico and Canada economist for BofA Securities Inc, adding that he sees a GDP contraction as soon as the third quarter. “Going forward we continue to expect the economy to decelerate, specially as exports and remittances slow down with US activity.”

Quarterly Details

In the first quarter, in comparison to the same period the prior year, the agriculture sector grew 2.3%, the manufacturing sector 2.5% and the services sector 4.3%. On a quarterly basis, with seasonal adjustment, agriculture shrank 2.8%, manufacturing grew 0.6%, and services expanded 1.5%.

Businesses’ investment in machinery, a recovery of the services sector after it plunged earlier during the pandemic and firm consumption despite high borrowing costs point to the economy’s strength.

The economy has now posted six straight quarters of growth, the longest run under President Andres Manuel Lopez Obrador, underscoring its resilience and the sustained demand for goods produced in Mexico’s manufacturing centers.

While a so-called soft landing for the US can’t be fully discounted, most analysts anticipate at least a mild contraction in the wake of the US Federal Reserve’s sharpest interest rate tightening campaign in decades. Any significant spending cuts stemming from a US debt limit deal adds downside risk to growth for the US and, by extension, Mexico.

US demand was responsible for almost 80% of Mexico’s $53.6 billion worth of exports in March — the highest monthly total in the series that goes back to 1985 — though data came in below expectations in April. The weakness in manufacturing exports, especially of autos, was responsible for the sub-par reading, according to Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc.

In Mexico itself, ever-rising flows of cash sent home by citizens working abroad has become a key support for the economy. Full-year remittances hit a record $58.5 billion in 2022, of which almost $56 billion came from the US, and in the 12 months through March they reached $59.9 billion.

Rate Cuts

Looking forward, slowing inflation and the end of the central bank’s record tightening cycle will be supportive to domestic demand. Earlier this month, the central bank, known as Banxico, held its key rate at an all-time high of 11.25% after hiking 725 basis points over two years.

In the statement accompanying that decision, the board said it would maintain the rate for a “prolonged period.” Economists are divided about whether the bank will cut borrowing costs this year or wait until 2024.

Economists in a Citibanamex survey published this week held their 2023 growth forecast at 1.90%, up from 1% in early February. They also forecast that the central bank’s key rate would be 11.25% at year-end.

--With assistance from Rafael Gayol.

(Update with economist comments, analysis and sector growth starting in fifth paragraph.)

©2023 Bloomberg L.P.

BERLIN — The German economy was in recession in early 2023 after household spending in Europe’s economic engine finally succumbed to the pressure of high inflation.

Gross domestic product fell by 0.3% in the first quarter of the year when adjusted for price and calendar effects, a second estimate from the statistics office showed on Thursday. This follows a decline of 0.5% in the fourth quarter of 2022. A recession is commonly defined as two successive quarters of contraction.

German GDP data showed “surprisingly negative signals,” Finance Minister Christian Lindner said on Thursday. He added that comparing Germany with other highly developed economies, the economy was losing potential for growth.

“I don’t want Germany to play in a league in which we have to relegate ourselves to the last positions,” he said, referring to the forecasts of the International Monetary Fund, which predicted a recession in 2023 only in Germany and Britain among European countries.

Robert Habeck, Germany’s economy minister, said his nation’s previous high dependency on Russia for energy supply led to the recession but the growth forecasts were much bleaker.

“We’re fighting our way out of this crisis,” Habeck said at an event in Berlin on Thursday.

“Under the weight of immense inflation, the German consumer has fallen to his knees, dragging the entire economy down with him,” said Andreas Scheuerle, an analyst at DekaBank.

Household consumption was down 1.2% quarter on quarter after price, seasonal and calendar adjustments. Government spending also decreased significantly, by 4.9%, on the quarter.

“The warm winter weather, a rebound in industrial activity, helped by the Chinese reopening, and an easing of supply chain frictions were not enough to get the economy out of the recessionary danger zone,” ING global head of macro Carsten Brzeski said.

By contrast, investment was up in the first three months of the year, following a weak second half of 2022. Investment in machinery and equipment increased by 3.2% compared with the previous quarter, while investment in construction went up 3.9% on quarter.

There were also positive contributions from trade. Exports rose 0.4%, while imports fell 0.9%.

“The massive rise in energy prices took its toll in the winter half-year,” Commerzbank chief economist Joerg Kraemer said.

A recession could not be avoided and now the question is whether there will be any recovery in the second half of the year.

“Looking beyond the first quarter, the optimism at the start of the year seems to have given way to more of a sense of reality,” Brzeski said.

A drop in purchasing power, thinned-out industrial order books, aggressive monetary policy tightening and the expected slowdown of the U.S. economy all argue in favor of weak economic activity.

Following Wednesday’s decline in the Ifo business climate, all key leading indicators in the manufacturing sector are now falling, Kraemer said.

The German Bundesbank, however, expects the economy to grow modestly in the second quarter as a rebound in industry more than offsets stagnating household consumption and a slump in construction, according to a monthly economy report published on Wednesday. (Reporting by Maria Martinez, Additional reporting by Christian Kraemer, Editing by Friederike Heine, Simon Cameron-Moore, Toby Chopra and Mark Porter)

Germany's economy is facing extreme testing times. First, the coronavirus pandemic took a toll, and now the impact of the war in Ukraine is pushing the economy to the brink.

Inflation, rising energy prices and supply bottlenecks all add up to a perfect storm for the economy — which, according to economists' theories, goes up and down in waves. A distinction is usually made between four phases:

A recession marks a downturn when, for example, production capacities are no longer being utilized because exports are falling and demand for goods and services is shrinking at home.

The benchmark here is GDP. This is the value of all services and goods produced in a given period.

If GDP shrinks for two quarters in a row, this is referred to as a "technical recession," which already loomed at the end of 2021 after GDP shrank by 0.3% in the last quarter of the year as a result of the coronavirus pandemic.

In the first three months of 2022, economic output increased by 0.2%. However, the situation now looks much different. Both in the last quarter of 2022 and the first quarter of this year Germany's economy contracted.

If a recession persists over a sustained period, it can turn into a tangible economic crisis. Unemployment and the number of insolvencies rise, goods pile up in warehouses, and financial crises, stock market crashes and bank failures round off a nightmare scenario.

The government's task is therefore to prevent the economy from sliding into depression and thus into the lowest phase of the economic cycle. It will try to counter emerging recessions in advance or to keep them as short as possible.

The tools at its disposal include relief packages for companies and citizens, such as government grants and tax cuts — much like what the German government has introduced to tackle the fallout from the energy crisis.

This article was originally published in German. It has been updated to reflect the latest news about Germany entering a technical recession.

The German economy shrank unexpectedly in the first three months of this year, marking the second quarter of contraction that is one definition of recession.

Data released Thursday by the Federal Statistical Office shows Germany's gross domestic product, or GDP, declined by 0.3% in the period from January to March. This follows a drop of 0.5% in Europe's biggest economy during the last quarter of 2022.

Two consecutive quarters of contraction is a common definition of recession, though economists on the euro area business cycle dating committee use a broader set of data, including employment figures. Germany is one of the 20 countries that use the euro currency.

Employment in the country rose in the first quarter and inflation has eased, but higher interest rates will keeping weighing on spending and investment, said Franziska Palmas, senior Europe economist for Capital Economics.

"Germany has experienced a technical recession and has been by far the worst performer among major eurozone economies over the past two quarters," Palmas said, predicting further weakness ahead.

The figures are a blow to the German government, which last month boldly doubled its growth forecast for this year after a feared winter energy crunch failed to materialize. It said the economy would grow by 0.4% -- up from a 0.2% expansion predicted in late January -- a forecast that may now need to be revised downward.

Economists said high inflation hit consumer spending, with prices in April 7.2% higher than a year ago.

GDP reflects the total value of goods and services produced in a country. Some experts question whether the figure alone is a useful indicator of economic prosperity given that it doesn't distinguish between types of spending.

The eurozone economy scraped out meagre growth of 0.1% in the first quarter, according to initial estimates, with inflation eroding people's willingness to spend as their pay fails to keep pace.

The U.S. also has reported disappointing growth estimates that kept alive fears of a recession in the world's largest economy.

The International Monetary Fund predicted this week that the United Kingdom would avoid falling into recession this year after previously expecting it to be one of the worst performing among the Group of Seven leading industrial nations.

IMF Managing Director Kristalina Georgieva said Tuesday that "we're likely to see the U.K. performing better than Germany, for example."

Persistent inflation has helped push Germany into recession in the first three months of the year, an upgrade to growth data shows.

Europe's largest economy was also badly affected when Russian gas supplies dried up after the invasion of Ukraine, analysts said.

The economy contracted by 0.3% between January and March, the statistics office said.

That followed a 0.5% contraction in the last three months of last year.

A country is deemed to be in recession when its economy shrinks for two consecutive three-month periods, or quarters.

"Under the weight of immense inflation, the German consumer has fallen to his knees, dragging the entire economy down with him," said Andreas Scheuerle, an analyst at DekaBank.

Germany's inflation rate stood at 7.2% in April, above the euro area's average but below the UK's 8.7%.

Higher prices have weighed on household spending on things such as food, clothing and furniture. Industrial orders are also weaker, reflecting the impact of higher energy prices on businesses.

"The persistence of high price increases continued to be a burden on the German economy at the start of the year," the federal statistics agency Destatis said in a statement.

Originally, the agency had estimated zero growth for the first quarter of this year, suggesting Germany would side-step a recession.

However, the revised figures showed household spending was 1.2% lower than in the previous quarter.

Government spending was 4.9% lower, and car sales also fell after government grants for electric and hybrid cars were scaled back.

The recession was less severe than some had predicted, given Germany's heavy reliance on Russian energy. A mild winter and the reopening of China's economy, helped ease the impact of higher energy prices.

Private sector investment and exports rose, but that was not enough to get Germany out of the "danger zone" for recession, analysts said.

"The early indicators suggest that things will continue to be similarly weak in the second quarter [of 2023]," said LBBW bank analyst Jens-Oliver Niklasch.

However, the German central bank, the Bundesbank, expects the economy to grow modestly in the April to June quarter, with a rebound in industry offsetting stagnating consumer spending.

The IMF has predicted that Germany will be the weakest of the world's advanced economies, shrinking 0.1% this year, after it upgraded its forecast for the UK from minus 0.3% to growth of 0.4%.

[unable to retrieve full-text content]

Canadian household debt now worth more than the entire country’s economy CityNews Vancouver

WASHINGTON -- If the debt crisis roiling Washington were eventually to send the United States crashing into recession, America's economy would hardly sink alone.

The repercussions of a first-ever default on the federal debt would quickly reverberate around the world. Orders for Chinese factories that sell electronics to the United States could dry up. Swiss investors who own U.S. Treasurys would suffer losses. Sri Lankan companies could no longer deploy dollars as an alternative to their own dodgy currency.

“No corner of the global economy will be spared’’ if the U.S. government defaulted and the crisis weren't resolved quickly, said Mark Zandi, chief economist at Moody’s Analytics.

Zandi and two colleagues at Moody’s have concluded that even if the debt limit were breached for no more than week, the U.S. economy would weaken so much, so fast, as to wipe out roughly1.5 million jobs.

And if a government default were to last much longer — well into the summer — the consequences would be far more dire, Zandi and his colleagues found in their analysis: U.S. economic growth would sink, 7.8 million American jobs would vanish, borrowing rates would jump, the unemployment rate would soar from the current 3.4% to 8% and a stock-market plunge would erase $10 trillion in household wealth.

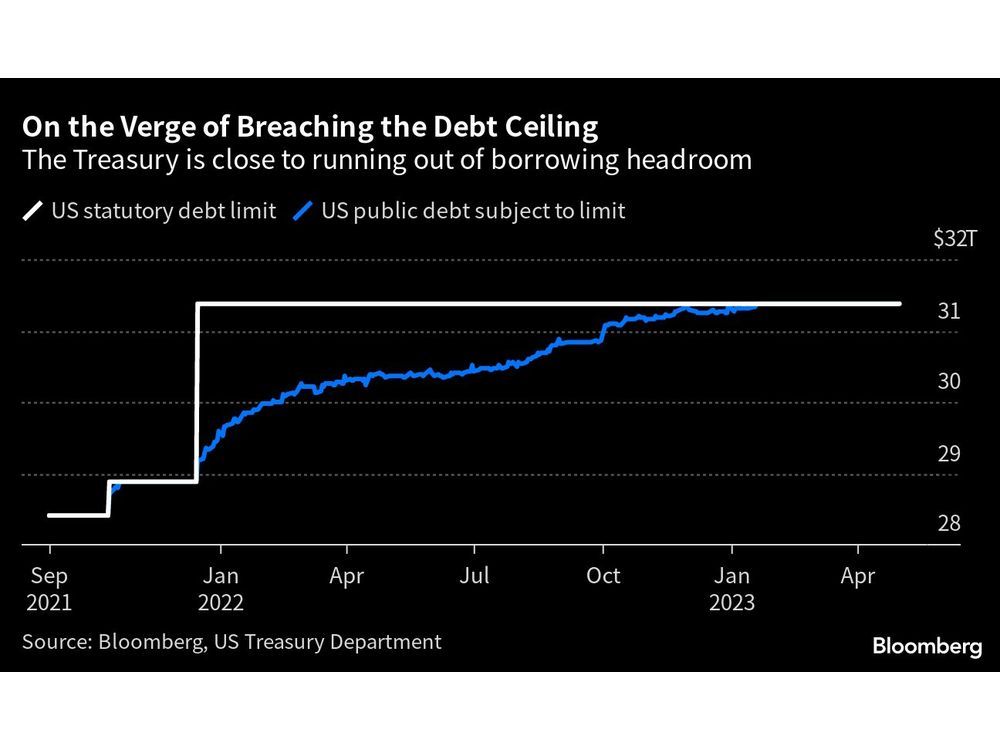

Of course, it might not come to that. The White House and House Republicans, seeking a breakthrough, concluded a round of debt-limit negotiations Sunday, with plans to resume talks Monday. The Republicans have threatened to let the government default on its debts by refusing to raise the statutory limit on what it can borrow unless President Joe Biden and the Democrats accept sharp spending cuts and other concessions.

US DEBT, LONG VIEWED AS ULTRA-SAFE

Feeding the anxiety is the fact that so much financial activity hinges on confidence that America will always pay its financial obligations. Its debt, long viewed as an ultra-safe asset, is a foundation of global commerce, built on decades of trust in the United States. A default could shatter the $24 trillion market for Treasury debt, cause financial markets to freeze up and ignite an international crisis.

“A debt default would be a cataclysmic event, with an unpredictable but probably dramatic fallout on U.S. and global financial markets,’’ said Eswar Prasad, professor of trade policy at Cornell University and senior fellow at the Brookings Institution.

The threat has emerged just as the world economy is contending with a panoply of threats — from surging inflation and interest rates to the ongoing repercussions of Russia's invasion of Ukraine to the tightening grip of authoritarian regimes. On top of all that, many countries have grown skeptical of America’s outsize role in global finance.

In the past, American political leaders generally managed to step away from the brink and raise the debt limit before it was too late. Congress has raised, revised or extended the borrowing cap 78 times since 1960, most recently in 2021.

Yet the problem has worsened. Partisan divisions in Congress have widened while the debt has grown after years of rising spending and deep tax cuts. Treasury Secretary Janet Yellen has warned that the government could default as soon as June 1 if lawmakers don't raise or suspend the ceiling.

‘SHOCKWAVES THROUGH THE SYSTEM’

“If the trustworthiness of (Treasurys) would become impaired for any reason, it would send shockwaves through the system ... and have immense consequences for global growth,’’ said Maurice Obstfeld, senior fellow at the Peterson Institute for International Economics and former chief economist at the International Monetary Fund.

Treasurys are widely used as collateral for loans, as a buffer against bank losses, as a haven in times of high uncertainty and as a place for central banks to park foreign exchange reserves.

Given their perceived safety, the U.S. government’s debts — Treasury bills, bonds and notes — carry a risk weighting of zero in international bank regulations. Foreign governments and private investors hold nearly $7.6 trillion of the debt — roughly 31% of the Treasurys in financial markets.

Because the dollar's dominance has made it the de facto global currency since World War II, it's relatively easy for the United States to borrow and finance an ever-growing pile of government debt.

But high demand for dollars also tends to make them more valuable than other currencies, and that imposes a cost: A strong dollar makes American goods pricier relative to their foreign rivals, leaving U.S. exporters at a competitive disadvantage. That’s one reason why the United States has run trade deficits every year since 1975.

CENTRAL BANKS' STOCKPILES OF DOLLARS

Of all the foreign exchange reserves held by the world’s central banks, U.S. dollars account for 58%. No. 2 is the euro: 20%. China’s yuan makes up under 3%, according to the IMF.

Researchers at the Federal Reserve have calculated that from 1999 to 2019, 96% of trade in the Americas was invoiced in U.S. dollars. So was 74% of trade in Asia. Elsewhere outside of Europe, where the euro dominates, dollars accounted for 79% of trade.

So reliable is America's currency that merchants in some unstable economies demand payment in dollars, instead of their own country’s currency. Consider Sri Lanka, battered by inflation and a dizzying drop in the local currency. Earlier this year, shippers refused to release 1,000 containers of urgently needed food unless they were paid in dollars. The shipments piled up at the docks in Colombo because the importers weren't able to obtain dollars to pay the suppliers.

“Without (dollars), we can’t do any transaction,” said Nihal Seneviratne, a spokesman for Essential Food Importers and Traders Association. “When we import, we have to use hard currency — mostly the U.S. dollars.’’

Likewise, many shops and restaurants in Lebanon, where inflation has raged and the currency has plunged, are demanding payment in dollars. In 2000, Ecuador responded to an economic crisis by replacing its own currency, the sucre, with dollars — a process called “dollarization’’ — and has stuck with it.

THE GO-TO HAVEN FOR INVESTORS

Even when a crisis originates in the United States, the dollar is invariably the go-to haven for investors. That's what happened in late 2008, when the collapse of the U.S. real estate market toppled hundreds of banks and financial firms, including once-mighty Lehman Brothers: The dollar's value shot up.

“Even though we were the problem — we, the United States — there was still a flight to quality,’’ said Clay Lowery, who oversees research at the Institute of International Finance, a banking trade group. “The dollar is king.’’

If the United States were to pierce the debt limit without resolving the dispute and the Treasury defaulted on its payments, Zandi suggests that the dollar would once again rise, at least initially, “because of the uncertainty and the fear. Global investors just wouldn’t know where to go except to where they always go when there’s a crisis and that’s to the United States.’’

But the Treasury market would likely be paralyzed. Investors might shift money instead into U.S. money market funds or the bonds of top-flight U.S. corporations. Eventually, Zandi says, growing doubts would shrink the dollar's value and keep it down.

GOVERNMENT'S STRATEGY IF DEBT CAP IS BREACHED

In a debt-ceiling crisis, Lowery, who was an assistant Treasury secretary during the 2008 crisis, imagines that the United States would continue to make interest payments to bondholders. And it would try to pay its other obligations — to contractors and retirees, for example — in the order that those bills became due and as money became available.

For bills that were due on June 3, for example, the government might pay on June 5. A bit of relief would come around June 15. That's when government revenue would pour in in as many taxpayers make estimated tax payments for the second quarter.

The government would likely be sued by those who weren’t getting paid — “anybody who lives off veterans’ benefits or Social Security,’’ Lowery said. And ratings agencies would likely downgrade U.S. debt, even if the Treasury continued to pay interest to bondholders.

The dollar, though it remains dominant globally, has lost some ground in recent years as more banks, businesses and investors have turned to the euro and, to a lesser extent, China’s yuan. Other countries tend to resent how swings in the dollar's value can hurt their own currencies and economies.

A rising dollar can trigger crises abroad by drawing investment out of other countries and raising their cost of repaying dollar-denominated loans. The United States’ eagerness to use the dollar’s clout to impose financial sanctions against rivals and adversaries is also viewed uneasily by some other countries.

So far, though, no clear alternatives have emerged. The euro lags far behind the dollar. Even more so does China’s yuan; it's hamstrung by Beijing’s refusal to let its currency trade freely in global markets.

But the debt ceiling drama is sure to heighten questions about the enormous financial power of the United States and the dollar.

“The global economy is in a pretty fragile place right now,’’ Obstfeld said. “So throwing into that mix a crisis over the creditworthiness of U.S. obligations is incredibly irresponsible.’’

______

AP Writer Bharatha Mallawarachi in Colombo, Sri Lanka, contributed to this report.

(Bloomberg) — The UK economy will grow faster than Germany this year and avoid a recession, the International Monetary Fund said, after sharply upgrading its forecast on the back of strong household spending and better relations with the European Union.

Falling energy prices will also help Britain expand 0.4% this year, the IMF said on Tuesday in its regular health check on the UK economy. That’s up from the 0.3% contraction the fund projected just last month, and which will lift the UK off the bottom of the G-7 league table.

However, the global economic watchdog warned households that interest rates may need to rise further and stay high to ensure inflation is dealt with properly.

The prospect of faster growth will raise hopes in Prime Minister Rishi Sunak’s government that it can head into an expected general election next year offering tax cuts. The ruling Conservatives trail Labour by a double-digit margin in the polls as the country grapples with soaring inflation, weak growth, public sector strikes and rising taxes.

Sunak is trying to restore the government’s reputation for economic competence after the disaster of former premier Liz Truss’s economic plans last year, which sank the pound and roiled the bond markets.

In its regular Article IV report on the British economy, the IMF said its upgrade reflected better wage growth and “improved confidence amid somewhat reduced post-Brexit uncertainty.” But it also said households should brace for a tough second half of the year when the “peak impact” of higher borrowing costs will be felt.

Interest Rates

The BOE has raised rates to 4.5% from 0.1% since December 2021, the most aggressive cycle since the 1980s, but “some further monetary tightening will likely be needed, and rates may have to remain high for longer to bring down inflation more assuredly,” the IMF said.

Official UK data on Wednesday is expected to show inflation dropping to about 8.4% from 10.1% as a result of falling energy prices. The IMF expects inflation to fall to 5% by the end of the year, meeting Sunak’s pledge to halve the headline rate, but cautioned that it may “plateau at an elevated rate.”

The BOE’s remit is to bring inflation down to 2%, and the fund cautioned against “premature celebrations” by easing up as inflation automatically drops.

It also urged the government to beef up investment and spend more on Britain’s ailing public services to boost growth. Full-expensing, the government’s generous three-year 100% tax relief on capital investment, should be made permanent, planning should be reformed and the immigration regime needs “fine-tuning to alleviate sectoral and skilled labor shortages.”

With little headroom for extra spending, the IMF urged the government to raise funds by scrapping the triple lock on pensions — which ensures they rise by the highest of wages, inflation or 2.5% – and move to the simpler and less expensive “best practice of inflation-indexation.”

On the banks, the IMF said the UK should build a pre-funded deposit insurance regime like in the US to make it easier to handle any future bank collapses like Silicon Valley Bank UK earlier this year.

(Adds interest rates, further details from IMF report starting in seventh paragraph.)

[unable to retrieve full-text content]

Saudi Energy Minister Tells Oil Speculators to 'Watch Out' Bloomberg

Is Europe’s ageing population a ticking time bomb? With its low birth rate and ageing labour force, the continent faces a demographic crisis that could impact its economic competitiveness and public finances.

The number of people of working age – those between 20 and 64 – peaked in Europe in 2010. By 2035, there will be about 50 million fewer people of working age in Europe than in 2010. Demographically, this makes Europe the oldest continent on the planet.

With a shrinking labour force and an ageing population increasingly retiring and drawing on their pensions, European policymakers will soon face an unenviable task of maintaining economic growth while expanding Europe’s labour pool. And in many cases, they will do this against a backdrop of hostile public opinion on using migration as a means of balancing the demographic and economic decline.

To surmount this challenge, the European Union just announced 2023 as the European Year of Skills (EYS) to provide new momentum to reach the EU 2030 social targets of at least 60 percent of adults in training every year and at least 78 percent in employment. But can the EU really achieve this without harnessing the potential of the continent’s largest minority group?

There are about 6 million Roma in the EU’s 27 countries and millions more in the wider EU candidate countries. Contrary to the region’s ageing population, the demographic potential of the Roma is immense and, in many cases, primed to plug the holes coming down the road.

For example, the percentage of Roma under 30 years old in North Macedonia is almost double that of the majority population. In Romania, 59.9 percent of Roma are under 30 years of age, and for the majority population, this rate is just 32.8 percent.

European politicians need to capitalise on the potential of these often highly adaptable, multilingual and entrepreneurial citizens as part of their EYS targets. This would offer multiple benefits to society and offer an economic lifeline to a minority within Europe who is living below the poverty line. It would also stave off the need for increased migrant labour from other parts of the world.

According to a long-term World Bank study published in 2019, excluding Roma communities adds to the costs of the national exchequer. Roma inclusion is not only a moral imperative; demographic ageing in Europe means that it is also smart economics. The benefits of Roma inclusion are not negligible and include the productivity gains associated with higher employment rates and labour earnings, and they include fiscal benefits through greater tax revenues and lower social assistance spending.

The study also illustrated that “among Roma who completed secondary education, the average earnings are much higher than the average earnings among Roma who completed primary education: 83 percent higher in Bulgaria, 110 percent higher in the Czech Republic, 144 percent higher in Romania and 52 percent higher in Serbia.”

To unlock the employment potential of this group, EU leaders will need to overcome a series of domestic challenges.

First, they will have to address prejudice and stop political parties from using populist, anti-Roma rhetoric during election campaigns. After all, democracy is about equal rights. But for many of the six million Roma in the EU, these rights are not fully granted. Roma in Europe still face insults and slurs in the streets, in the media and in political discourse.

Second, member states will need to invest in the education and employment of the Roma community, which would help reduce unemployment and poverty within the communities and provide much-needed skills and talent to the local and national labour market.

Third, we need a bottom-up approach to funding programmes. One of the reasons for the lack of success of some EU funding programmes is the application of a top-down approach that does not consider the realities and voices of Roma at the grassroots level and comes with a heavy administrative burden. A genuine and systemic consultation and inclusion of Roma representatives when integration measures are being planned, implemented and monitored are still lacking. Participation is limited to formal public consultations at the latest stage. Many of the shortcomings identified by the Court of Auditors in its special 2016 audit report are still relevant.

In addition, policymakers need to support training initiatives, so Roma are not left with low-paid jobs that are vulnerable to exploitation.

The Roma Education Fund (REF) has helped more than 6,000 people secure jobs in a range of sectors from construction and carpentry to nursing, hairstyling, coding and working in a tax office. REF made this happen by providing them with qualifications and skills in professions to fill the gap in the job market. Soft skills such as writing CVs, helping with job interview preparation, navigating the job application process and improving digital literacy made a big difference. What the success of this five-year programme shows is that with the right support, Roma can overcome societal and economic barriers to access education and jobs. Without support, survival becomes their objective and not necessarily development.

Last month, while addressing Roma Week 2023, the president of the European Commission, Ursula von der Leyen, said Roma in the EU still struggle when they look for employment and housing. She’s right. This must change. According to a 2022 report from the Fundamental Rights Agency, the poverty levels of Roma have not changed since 2016. Four out of five Roma are at risk of poverty. Only two out of five Roma aged 20 to 64 are in paid work, including part-time, ad hoc jobs, self-employment or occasional work. Employment is much rarer for young Roma and women. While there is some improvement in housing compared with 2016, half of Europe’s Roma still live in a state of housing deprivation – in damp, dark dwellings or housing without proper sanitation facilities. One out of five Roma households do not have access to tap water inside their dwelling.

That’s why the European Year of Skills initiative, which was launched on Europe Day on May 9, offers a great opportunity for national governments to include measures for education and training programmes for Roma – for example, expanding preschool coverage for Roma children, providing scholarships and mentoring support, offering catch-up programmes or back-to-school initiatives (as 70 percent of Roma youth leave school early) and including Roma history and literature in the curricula. All this will help incentivise employers to hire Roma individuals to build a just and inclusive society and lessen the exclusion of Roma from the labour market.

Europe needs to face the demographic time bomb coming down the track and also maintain its position as a global voice championing the values of democracy. Including Roma communities will help the EU drive its economy and be a champion of human rights.

The views expressed in this article are the author’s own and do not necessarily reflect Al Jazeera’s editorial stance.

The deadline for reaching a deal on the US debt ceiling is just days away, and Capitol Hill is deadlocked. On or around 1 June, the federal government will no longer have the money to continue paying its bills, potentially resulting in an unprecedented default that would send catastrophic shockwaves across the world economy.

That such a dangerous game of chicken is being allowed to reach this point is further evidence of the severe crisis of US capitalism, whose standing has already been damaged as a result.

Debt ceiling debates typically go down to the wire, as the Democrats and Republicans attempt to wring concessions out of one another. But the situation for US capitalism today is particularly precarious.

The US ruling class was forced to spend huge sums of money in the recent period, particularly during the COVID-19 pandemic, where the iron lung of state support was the only thing keeping the economy alive. As a consequence, debt has ballooned both in absolute and relative terms.

According to the US Department of the Treasury, total public debt stands at $31.42 trillion, with the new, $31.4 trillion limit agreed by lawmakers last December having been passed in January. Debt now exceeds 100 percent of the country’s yearly GDP, something not seen since the end of World War II.

Meanwhile, the inflation crisis provoked by all this spending, and exacerbated by fallout from the Ukraine War, has forced the Federal Reserve to raise interest rates in an attempt to cool down the economy. This contributed to the demise of two mid-sized banks (SVB and Signature) earlier this year.

The Fed has already undermined confidence in itself by declaring inflation to be “transitory” in 2021, only to unleash subsequently a string of 10 consecutive rate hikes, and refusing to rule out another in June. It then had to intervene to stem the contagion of the SVB and Signature collapse, which was merely a tremor compared to the almighty earthquake a default would unleash.

The ruling class is thus caught between the rock and hard place of needing to spend more (and cover its existing spending), but also limit spending to bring down inflation.

In the meantime, the Fed is weighing up a number of unpalatable options, such as buying Treasury bonds (an emergency method recently employed by the Bank of England) or allowing banks to pledge defaulted securities as collateral against new loans.

In other words, this debt-ceiling deadlock could hardly have come at a worse time. As Chicago Fed President Austan Goolsbee said in a speech last month:

“Moments of financial stress are a particularly bad time to punch yourself in the face by taking actions that could ignite a financial crisis on their own like, say, defaulting on U.S. Treasuries [bonds] in a fight about the debt limit.”

Representatives of the two main bourgeois parties remain at loggerheads. President Joe Biden (whose approval rating is hovering around 40 percent) has stated he will not accept a debt ceiling raise that comes with conditions.

Meanwhile, Speaker Kevin McCarthy is demanding that Biden institute deep spending cuts, and scrap new taxes on corporations and high-earners to raise money for the 2024 budget, in exchange for Republican votes.

In response, Biden has threatened to invoke the 14th Amendment of the US Constitution, allowing him to effectively ignore the debt ceiling altogether if the Republicans don’t give ground, though the legal and constitutional implications of this move make it a nuclear option.

We have seen such charades before. Although the leaders of both parties are happy to exploit the theatrics of the debt-ceiling debate, ultimately, the US capitalist class as a whole has no interest in the federal government defaulting on its debts.

By extension, neither do the Democrats or Republicans in Washington. Hence, they have always come to a compromise, at the expense of working people. Indeed, part of the purpose of these debates is to force through such unpopular cuts.

However, these periodic fracases over the debt-ceiling are becoming more and more acrimonious, creeping closer and closer to the brink, reflecting the deepening splits within the US ruling class.

Already, there have been consequences for the reputation of US capitalism, which in turn has big implications for the entire global economy. The dollar is the world’s de facto reserve currency, and US Treasury bonds are a key asset for investors, fund managers, and ordinary savers in America and internationally. A threat to either haunts the worst nightmares of the world markets.

In any game of chicken, the risk of collision is always implicit, increased in this case by the myopic senility of US capitalism and its political representatives. The New York Times’ Robert Hockett describes the incalculable impact of crossing the x-date threshold without a resolution:

“[It] would undo what Hamilton and his successors sought to ensure: a national credit rating beyond cavil or reproach. We would see a great tottering — if not worse — of U.S. banking, U.S. financial markets and the world’s capital markets.”

The exact effects of a default are hard to measure, but some things can be reliably predicted.

The dollar would plunge, and borrowing costs would rocket. State-sponsored medical care and pension funds would hang in the balance. Social security payments would be delayed. Import costs would surge and the accompanying inflation would make the current post-pandemic rise in prices seem like child’s play. According to Hockett, it “could look more like that of Argentina or Russia 20 years ago than that of the present or even the 1970s.”

There would also be a wave of bankruptcies and business closures, while debt-servicing costs would rise, increasing the state deficit even further. In all, Moody’s Analytics estimates there would be 7.8 million lost jobs and a $10 trillion loss in household wealth in the event of a default.

Furthermore, the US would be faced with an “incapacity to maintain… military bases and other assets abroad” (per Hockett), hobbling the reach of the main imperialist world power.

Especially given the parlous state of US economic growth, as former Treasury Secretary Jacob Lew said last month in a Council on Foreign Relations meeting: “if we were to default, it makes the odds of a recession almost certain.”

And as we saw in 2007–8, a recession for the biggest capitalist economy would be replicated worldwide. While the majority of US debt is held domestically, 24 percent, or around $7.4 trillion, is owned by foreign countries. Huge swathes of the world economy depend on these investments, which are supposed to be ‘as good as gold’.

A default would turn these bonds into an immediate vector for global recession, which would further undermine the dollar’s role as a reliable lubricant for world trade.

In all, to quote US treasury secretary Janet Yellen: “Failure to meet the government’s obligation would cause irreparable harm to the US economy, the livelihoods of all Americans and global financial stability.”

The mere threat of such a scenario is unthinkable. And even if a deal is reached in the coming days, serious damage has already been done to the prestige of the world’s foremost imperialist power, whose reckless representatives are effectively gambling with the future of the entire capitalist system.

In the 2011 debt ceiling showdown, the US saw its credit rating downgraded by S&P from AAA to AA+, despite actually passing a debt ceiling increase in the final moments before the deadline, as the whole symbolic affair meant US Treasury bonds were seen as a riskier investment. This immediately sent global stock markets into convulsions.

The general economic picture is a lot more unstable today than in 2011, with inflation raging, debts precariously piled up, and protectionism on the rise. Thus, even if a deal is reached at the eleventh hour, another serious downgrade could detonate a bomb within capitalism’s fragile fiscal foundations.

The existential danger of a default makes this scenario very unlikely. In recent days, Biden and McCarthy have apparently held “productive” conversations – while ramping up the rhetoric and stressing that a deal has not been reached.

Nevertheless, the main effect of this whole episode is to further erode confidence in the US economy, at home and abroad, which is supposed to be the lynchpin of the global capitalist system. This, at a time when the world is already beset with profound instability and uncertainty.

The political representatives of US capitalism, for their part, are tobogganing towards the edge of a cliff with their eyes wide open! It is testament to the relative decline of US imperialism as the main world power, and the increasing irrationality of capitalism as a whole, that this periodic dance with disaster is allowed to reach such a juncture.

These are all symptoms of an economic and social system that has been allowed to survive well past its natural life. It must be put out of its misery and replaced with a new, rational economic model, based on socialist planning and democratic workers’ control.

For starters, the International Marxist Tendency demands that all national debts be cancelled, with the billionaires’ enormous wealth expropriated to protect the pensions and savings of the working class and the poor. We should not be forced to pay the bosses’ debts, which have been accrued by financing war, subsidising big business, and keeping capitalism on life support.

A workers’ government would place the commanding heights of the economy, i.e., the big banks and large corporations, under democratic workers’ control, as part of a rational, socialist plan of production.

On this basis, we could end the crises of capitalism that cause devastation across society, and end the insanity of constant debates about “balanced budgets” and “debt ceilings”, while providing free and high quality housing, healthcare and education to all.

The resources exist to accomplish this. But in order to realise these goals, we require a workers’ party in the US that is willing to fight on a socialist programme. If you want to fight for such a party and a socialist future in our lifetime, join the IMT!

[unable to retrieve full-text content] Lapid blasts government's 'confused' wartime restrictions as economy reopens but schools...