Economy's resilience means higher interest rates remain a possibility this year

Article content

Statistics Canada on March 31 said Canada’s economy surged back to life at the start of the year after stalling at the end of 2022, complicating the Bank of Canada‘s efforts to get inflation back to its two-per-cent target. Here’s what you need to know:

Advertisement 2

Article content

- Gross domestic product, as measured by industrial output, increased 0.5 per cent in January from the previous month, more than reversing a 0.1 per cent drop in December.

- GDP increased an additional 0.3 per cent in February, according to Statistics Canada’s “flash estimate,” which is based on preliminary data.

- Seventeen of the 20 broad industries that Statistics Canada monitors posted gains, led by wholesaling, which increased 1.8 per cent from December. Mining, quarrying, and oil and gas gained 1.1 per cent.

- The Canadian dollar increased somewhat, and short-term bond yields rose, as traders repositioned amid expectations that the Bank of Canada will leave interest rates high for long

Article content

Article content

Backstory

Canada’s economy was supposed to be in a recession by now. At least that was the vibe for much of last year, as economists reckoned the most severe burst of inflation in four decades and the most aggressive series of rate hikes in the Bank of Canada’s history would combine to sink the recovery from the COVID-19 crisis.

Article content

Advertisement 3

Article content

The economy slowed, but nowhere near as much as forecasters predicted, as a surprisingly strong labour market offset the effects of higher living costs. Earlier this year, it looked like Canada’s impressive run had finally run out of track when Statistics Canada reported that GDP growth stalled in the fourth quarter, aligning with the Bank of Canada’s prediction that there would be essentially no growth for the first part of 2023.

But some economists observed the fourth-quarter numbers were influenced by an unusually large depletion of inventories, suggesting the economy might still have some spark. That appears to be the case, as many industries that posted declines in December rallied in January.

Where is the growth coming from?

Advertisement 4

Article content

The latest GDP numbers suggest the rebound from December was a mix of predictable reversions to trend and a surprisingly resilient current of demand.

Recall that Enbridge Inc. spent time in December cleaning up a spill from its Keystone pipeline in Kansas, which slowed oil exports to the United States. Shipments had resumed to normal in January. Another example of one-off explanations: output by wholesalers of machinery and equipment surged 2.4 per cent in January as suppliers received a batch of imports destined for the massive LNG Canada liquefied natural gas project in British Columbia.

But math doesn’t explain everything.

The jobless rate is near a historic low, which appears to be offsetting higher inflation and debt-servicing costs. Wages are growing faster than prices for the first time in two years, bolstering consumer confidence. Retail trade, accommodation and food services, and arts and entertainment — industries that are closely linked to consumer discretionary spending — all posted solid gains. The demand destruction that so many economists predicted hasn’t happened yet.

Advertisement 5

Article content

What does it mean for interest rates?

The Bank of Canada stopped raising interest rates for the first time in a year on March 8. Headline inflation had been steadily dropping from its peak in June, so policymakers said it was appropriate to pause and assess the situation. Governor Tiff Macklem had made it clear he didn’t want to cause a recession if he could avoid it.

However, policymakers emphasized they were still worried about inflation and would err on the side of getting year-over-year increases in the consumer price index back to two per cent. (Inflation was 5.2 per cent in February.) That means another interest rate increase will be on the table when Macklem and his deputies gather to update policy on April 12.

Advertisement 6

Article content

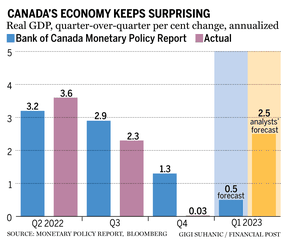

Faster economic growth will be a concern for the central bank only because it will exert upward pressure on inflation. (That’s why it tends to take a recession to bring price increases under control.) But policymakers will probably look at these numbers and call it a wash. Their quarterly economic outlook in January predicted a 1.3 per cent annual rate of growth in the fourth quarter, not zero, which is what Statistics Canada’s actual tally produced.

The Bank of Canada’s outlook for growth in the first quarter was 0.5 per cent, and some economists said the January and February monthly figures imply the economy is growing at an annual rate of about 2.5 per cent.

Advertisement 7

Article content

The gains in January and February could represent some of those sparks of strength the Bank of Canada already thought it was seeing. That calculation will probably be enough to leave interest rates unchanged in April. But the economy’s resilience means higher interest rates remain a possibility this year, and the rate cuts that some forecasters see on the horizon remain a distant bell.

• Email: kcarmichael@postmedia.com | Twitter: carmichaelkevin

An earlier version of this story stated that the Bank of Canada predicted the economy grew at an annual rate of 0.5 per cent in the fourth quarter. That was its prediction for the first quarter. The mistake has been corrected.

Canada's economy jumps back to life after stalling last year: What you need to know - Financial Post

Read More

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation