There were a lot of surprises for the U.S. economy in 2022.

Maybe the most surprising is the fact that it was so resilient in the face of 9% inflation while the Fed went on one of the most aggressive interest rate tightening cycles in history.

A lot of people thought it was a foregone conclusion that we were either (a) already in a recession in 2022 or (b) destined to go into one in short order.

A strong labor market combined with consumers who love to spend money helped the economy exceed expectations.

The question is: What happens next?

Households can only spend down their savings for so long. Eventually higher interest rates are going to have an impact on economic activity. Businesses will be forced to make some difficult decisions.

Something has to give…right?

The way I see it there are three realistic scenarios for the U.S. economy from here:

Scenario #1: Hard Landing. History shows the only way high inflation has been resolved in the past is through a recession.

Sometimes the Fed forces it to happen while sometimes the economy simply overheats but we’ve never had a period of high inflation that didn’t turn into a recession eventually.

Most investment professionals, economists and pundits assume this is the base case.

If you believe what the Fed is saying, a hard landing should be the base case because they keep telling us they have no choice but to cause an economic contraction to get inflation down to their target rate.

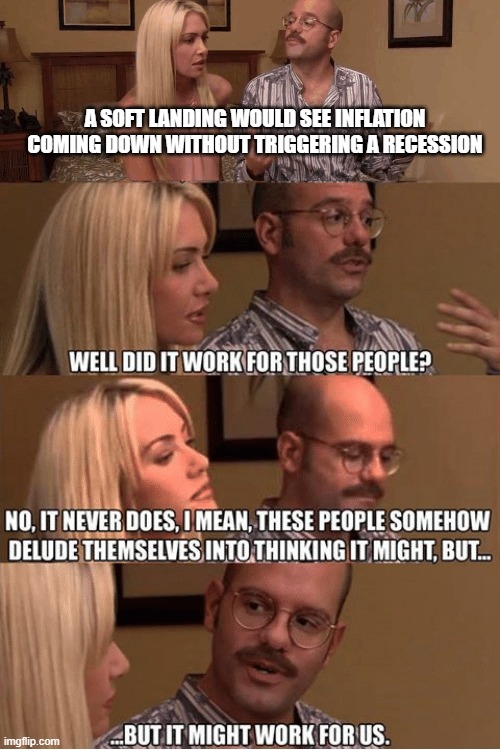

Scenario #2: Soft Landing. This is the dream scenario where the Fed is forced to back off because the economy threads the needle with inflation coming down without a meaningful slowdown in the economy or a significant increase in the unemployment rate.

There is no historical precedent for this but there is no historical precedent for a pandemic combined with a ginormous amount of fiscal stimulus, a supply chain shock and a labor shortage unlike anything we’ve experienced.

A soft landing would look something like this:

- Inflation continues to come in at an annualized rate of 3-4% (as it has for the past 3 months).

- The number of job openings falls but the unemployment numbers don’t go up all that much.

- Wage growth slows but not below the inflation rate.

- Economic growth continues through some combination of consumer spending, lower input costs for corporations and a labor market that remains stronger than inflation.

I’m not sure how anyone actually believes a soft landing is a possibility right now.

It does seem unlikely but we are living through an economic experiment where history might not be the best guide.

Stranger things have happened.

Scenario #3: No Landing. This is your pilot speaking. Uhhhhhnfortunatley…there’s some inclement weather where we’re supposed to land so we are going to continue to circle the airport for the foreseeable future. We hope to get out of this holding pattern as soon as we can.

The no landing scenario would be frustrating for impatient people who just want a resolution one way or another.

My definition of a holding pattern would be more of the same in terms of the current environment.

That would be inflation coming in but remaining above target, the labor market remaining strong, the Fed staying committed to tightening and the economy continuing to muddle through…until some sort of external shock (good or bad) snaps us out of this environment.

There are varying probabilities for each of these scenarios but none of them would surprise me in 2023 and beyond.

Oddly enough, even if you told me the exact economic scenario for the coming years, I’m not sure I could tell you how the financial markets will react.

It would make sense for the stock market to roll over with a hard landing because earnings would likely fall in a recession.

But you could also make the case that stocks would bottom well before the onset of a recession assuming that’s already been priced in.

It would make sense for the stock market to resume its upward trajectory in a soft landing.

But that probably depends somewhat on where bond yields and the Fed Funds Rate go in that scenario.

Bonds could revert back to being a portfolio stabilizer in a hard landing but it probably depends on where inflation goes from here and how far the Fed goes with monetary policy.

I also have no idea what would happen to bond yields in a soft landing scenario. Maybe they fall but what if they just stay where they are for a while?

Sometimes the economy takes its cues from the stock market. Sometimes it’s the other way around. Sometimes they are at odds with one another.

I’ve reached the point in my investing career where I’ve given up on trying to predict the timing of the next recession with the understanding that I know there will be one at some point no matter what I think will happen.

You can’t control the economy but you can control your reactions to the inevitable ups and downs it will give us.

Michael and I talked about some potential paths for the stock market and the economy in 2023 and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Are We Heading For a Recession?

What Kind of Landing Are We Going to Get in the Economy? - A Wealth of Common Sense

Read More

No comments:

Post a Comment