A few weeks ago, I was buying an iced coffee near my home in San Francisco. I went to pay with cash, and the barista asked me to pay with Apple Pay or a card—she could give me back bills, but did not have any coins.

I would not have thought anything of it, save for the fact that I’ve had similar experiences over and over again of late. My younger son drinks infant formula; I haven’t been able to buy our preferred brand more than once or twice in his lifetime. My older son recently needed an antibiotic for an ear infection; the pediatrician warned my husband he might not be able to find it. My dogs’ veterinarian told me this fall that we should find a new vet; he’s so overbooked that he’s dropping clients. My family is relocating, so we are now scrambling to find nursery-school spots for our kids. As for reasonably priced movers—I’m not sure they exist. I’m probably going to drive the truck myself.

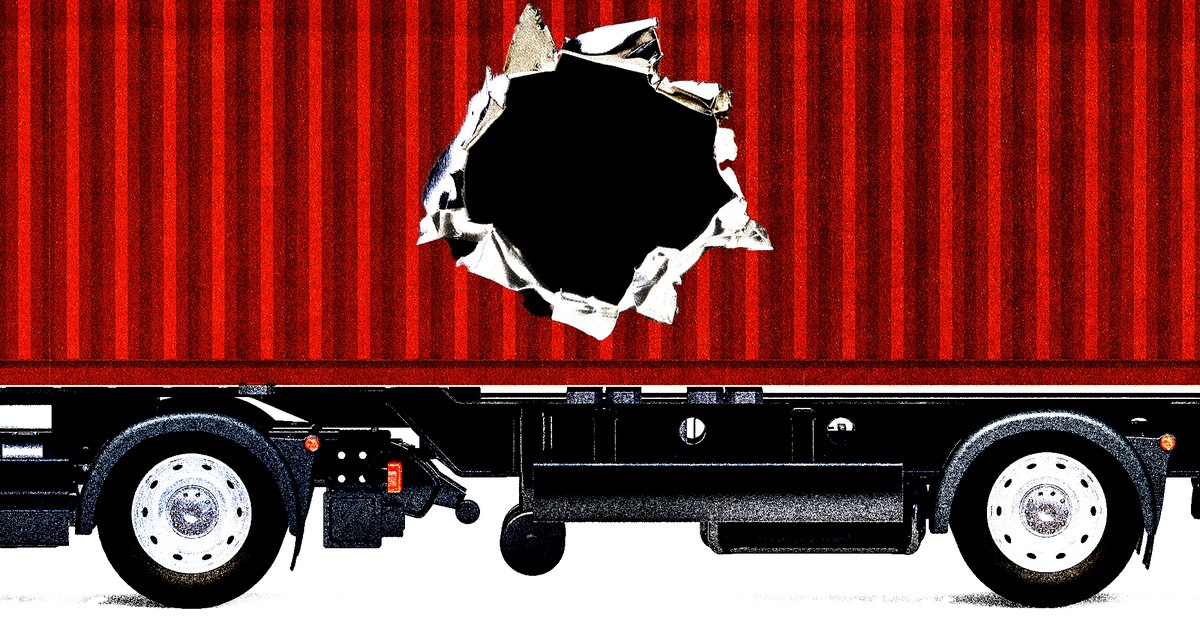

Since the pandemic hit, the economy has been plagued by shortages, some caused or worsened by COVID and many not. Indeed, none of the supply crunches I just cited—coins, formula, antibiotics, veterinary services, early-childhood education, truck drivers—has much to do with the virus still afflicting the world. Something deeper is going on. After the Great Recession, we went through a decade in which economic life was defined by a lack of demand. Now, after the COVID recession, we’ve entered a period in which economic life is defined by a lack of supply.

During the aughts and 2010s, the primary problem was that most families did not earn enough money. Unemployment and underemployment were rampant. Wage growth was slack because companies had no incentive to compete for workers. The middle class was shrinking. And inequality yawned, with the haves getting richer while the have-nots struggled.

This era—which lasted from 2007 until 2018, give or take—was one of extremely loose monetary policy and stingy fiscal policy. The Federal Reserve made it as cheap as it possibly could for businesses and individuals to borrow, but only corporations and the wealthy had the cash on hand to take advantage; Congress, for its part, declined to do much long-term investment and kept its spending stable. It was also an era of low GDP growth, low inflation, and a steady debt-to-GDP ratio, outside of the Great Recession itself. In this environment—let’s call it Demand World—the fundamental problem was the economy’s low appetite for goods and services.

Today, we live in Supply World. People’s primary economic fixation is getting their hands on enough of the stuff they want to buy. Families, for once, have plenty of money. By the middle of the Trump administration, the unemployment rate had fallen low enough and stayed low for long enough that wages started increasing. Businesses began bidding against one another to win over workers. (A Panda Express near my home had a sign up offering $86,000 a year plus a bonus for managers and $19 an hour for its lowest-paying kitchen jobs.) Then the government showered families with money during the pandemic, in the form of stimulus checks, child allowances, small-business relief, and extended unemployment-insurance payments. As a result, inequality has—in a remarkable and underappreciated trend—declined, a lot and fast.

This era—which began in 2018—is one of massive government spending. Congress approved $5 trillion in COVID-related stimulus while the Fed once again dropped borrowing costs to zero during the early pandemic, before hiking rates to tamp down on the torrid pace of cost increases. It is an era of good GDP growth, high inflation, and a ballooning debt-to-GDP ratio.

The issue in Supply World is that shortages, accompanied by rising costs, are keeping businesses and families from getting the things they want and need. We have a labor shortage, caused by COVID-related retirements, COVID-related disability and death, changes in immigration, and low-wage industries struggling to retain workers. The number of people coming into the United States has plummeted, thanks in no small part to the Trump administration’s restrictive border policies and anti-immigrant rhetoric: Immigration added more than a million people to the population in 2016, and a quarter of that many in 2021. At the same time, COVID pushed millions of older Americans to retire, though some are coming back to the labor force now; the virus also killed thousands of workers and maimed millions more. And many industries have struggled to attract workers, due to burnout, dangerous labor conditions, persistently low wages, or some combination of the three.

Then there is the housing shortage, a long-simmering, GDP-stifling national catastrophe, one responsible for problems as varied as the homelessness crisis, falling fertility rates, low productivity growth, and the lack of cool new music. For decades, places like New York and the Bay Area have created more new jobs than they have permitted new homes, leading to escalating prices and long commutes. Those superstar cities have exported their shortages around the country in recent years.

Finally, we face persistent shortages of consumer goods and services: life-saving CPAP units, children’s cough medicines, mid-range couches. Service shortages are in some cases a direct result of the housing shortage and the labor shortage: Getting affordable child care in cities such as Seattle and New York is impossible because they are so expensive for child-care workers to live in, and because there aren’t enough workers in the country to begin with, thanks in part to President Donald Trump. As for the ongoing shortages of stuff, they are due to COVID-related supply-chain disruptions, the sudden surge in consumer spending, and a lack of corporate investment in the Demand World era.

Indeed, Demand World in no small part created Supply World: The entire economy tilted toward producing goods and services for the tiny elite, rather than the middle class. And the lack of demand made it hard to see the lack of supply as a problem. Homelessness got cast as a poverty problem, not a housing-stock problem. The decline of domestic manufacturing got cast as a crisis for the Rust Belt, not for everyone who might want to feed their preemie or bike to work.

With the economy slowing and interest rates going up, might we end up back in Demand World? I asked that question of the former Treasury Secretary Larry Summers, who in 2013 began warning that the global economy was entering a period of “secular stagnation,” characterized by low investment, low productivity growth, and low interest rates. To boost growth, he argued, the government might have to run deficits indefinitely.

“I don’t think anybody can know whether we’re headed back to secular stagnation or not,” he told me. On one hand, he said, the country’s workforce had gotten older. The pace of technological change seemed to have slowed. The cost of capital goods had fallen, and corporate profit shares had grown. On the other hand, he noted, the country was running large deficits. Labor unions had gotten more active, and the government more progressive. He also said that he imagined the clean-energy transformation might provide a burst of growth.

So might investment in child care, housing, and domestic manufacturing. So might letting in millions more immigrants. So might deploying the astonishing new technologies emerging from Silicon Valley. Strong demand and ample supply—that’s the world we all should want.

The Economy's Fundamental Problem Has Changed - The Atlantic

Read More

No comments:

Post a Comment