People with assets of $1 million or more say they're more stressed out about money than they were this time last year

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

Good morning!

Advertisement 2

Article content

Article content

After months of belt tightening by low- and middle-income families, it’s wealthy Canadians’ turn to worry about the economy’s impact on their pocketbooks.

People who have assets of $1 million or more say they’re more stressed out about their finances than they were this time last year, according to a new study out this morning from IG Wealth Management. More than three-quarters, or 82 per cent, say they’re worried about the economy, while 72 per cent are fretting about the cost of energy. Close to half, or 49 per cent, are concerned about rising interest rates.

“Much like other groups, high-net-worth Canadians are concerned about where the economy is going and its impact on their personal situation,” Damon Murchison, chief executive of IG Wealth Management, said in a news release.

Advertisement 3

Article content

Economic worries have become universal as inflation and climbing interest rates take a toll on most people’s budgets. Every day expenses such as grocery bills have been especially squeezed. Prices for food bought in stores rose 11 per cent in October from the same time last year, Statistics Canada data show. But the costs of some dinner staples have surged even more, with pasta prices up 44.8 per cent, lettuce up 30.2 per cent and rice up 14.7 per cent on a year-over-year basis. Meanwhile, gas prices rose 17.8 per cent in October from the same month last year. Combine that with higher debt costs from rising interest rates, and many have been forced to take an axe to their spending by cutting back on streaming services, or other discretionary purchases, to pay the bills.

Advertisement 4

Article content

Making ends meet is less of a worry for high-income Canadians. Instead, they’re more concerned with protecting and growing the wealth they already have amid volatile stock markets and a slowing economy. That’s also leading some to think again about what their retirement will look like. Though they’re not worried about having enough money to retire — 85 per cent say that’s not a concern — half say they will likely need to stash away more than they originally thought to maintain a certain lifestyle. Almost half say they’re rethinking their investment strategies as a result.

And not unlike Canadians’ with lower incomes, the wealthy are also making moves to delay their retirement start dates as life grows more expensive. Close to half, or 46 per cent, say they’re changing when they’ll make the leap to full retirement. More than 50 per cent say they’ll need to keep working longer to reach their savings goals because their investments aren’t performing the way they expected.

Advertisement 5

Article content

Still, most wealthy persons have access to professional advice to help them weather a stormy economy, with three-quarters saying they already work with a financial adviser. However, there could be room for improvement. Only 45 per cent have a plan that covers all aspects of their personal finances, such as lifestyle considerations, income and tax and estate planning. And just over half say their adviser gives them the support they need to overcome any negative impacts the economy might have on their investments.

But for high-net-worth individuals, the solution to getting through these “complicated times” financially intact is simple: get a comprehensive plan in place. That’s where a professional can step in and help, IG Wealth Management said.

Advertisement 6

Article content

“With wealth comes increased complexity,” Murchison said. “It’s especially important during these times to not only seek out the help of a qualified financial adviser who can put things in perspective, but also to select one that will work with you to develop a holistic financial plan that’s stress-tested and keeps pace with your evolving situation.”

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

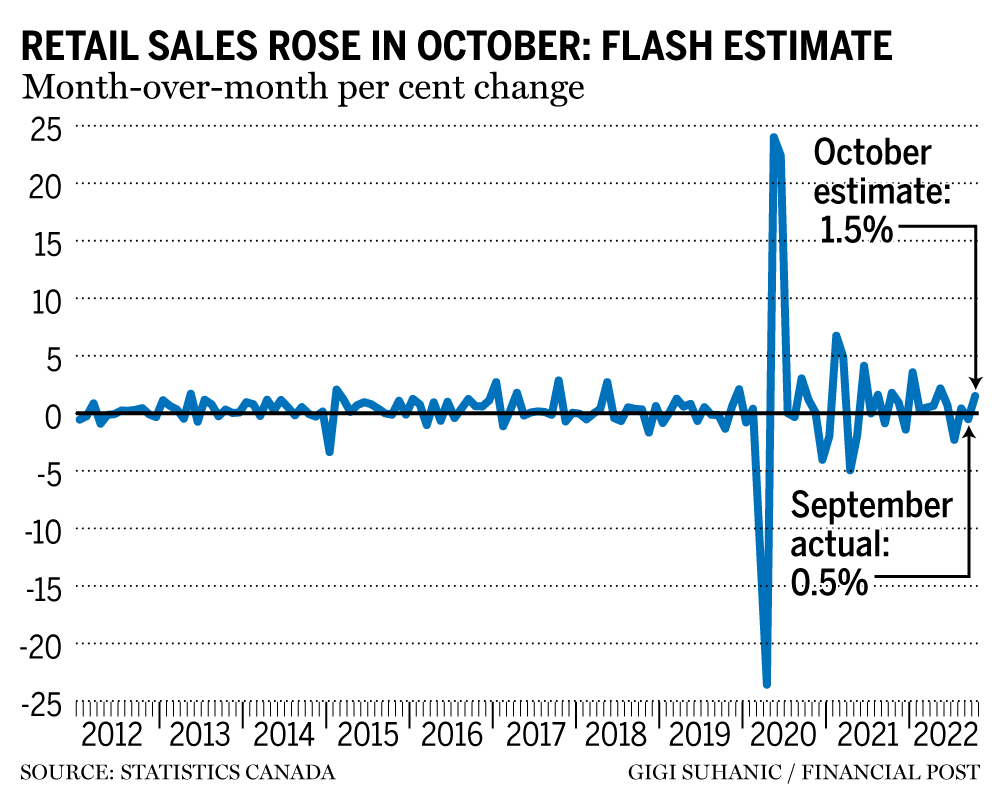

Retail sales are estimated to have risen 1.5 per cent in October, Statistics Canada said Wednesday, casting doubt on just how much the economy slowed in the fourth quarter.

Advertisement 7

Article content

The 1.5 per cent increase in retail sales would be the largest since May and followed a small drop in retail sales of 0.5 per cent in September. A big part of the rebound last month may reflect rising gasoline prices, though the statistics agency didn’t provide details of what drove the October number. Retail sales likely benefited from a 9.2 per cent rise in prices for gasoline.

Sales dropped 0.5 per cent in September and fell in seven of the 11 subsectors, representing 74.9 per cent of retail trade. It was led by lower sales at gasoline stations and food and beverage stores.

___________________________________________________

- Nunavut Tunngavik Inc. hosts a summit on housing in the territory.

- Marilene Gill, Bloc Quebecois MP for Manicouagan; Marilyn Gladu, Conservative MP for Sarnia—Lambton; and Daniel Blaikie, NDP MP for Elmwood—Transcona, will hold a media availability concerning the vote of the third reading of the bill to protect workers’ pension funds in the event of company bankruptcy.

- Prime Minister Justin Trudeau will hold a bilateral meeting with the opposition leader of Belarus, Sviatlana Tsikhanouskaya.

- Natural Resources Minister Jonathan Wilkinson; Adam van Koeverden, parliamentary secretary to the minister of health and to the minister of sport; and Lloyd Longfield, Liberal MP for Guelph, will make a 2 Billion Trees announcement.

- Kody Blois, Liberal MP for Kings—Hants, holds a press conference outlining the additional measures he believes are important to support Nova Scotians struggling with the cost of living.

- Bank of Canada governor Tiff Macklem and senior deputy governor Carolyn Rogers appear before the House of Commons standing committee on finance.

- The Canada-Ukraine Chamber of Commerce hosts a Rebuild Ukraine Business Conference. The conference will showcase investment projects aimed at rebuilding and modernizing Ukraine in the agriculture, construction/infrastructure and energy sectors. It will also highlight the tools and instruments offered by the World Bank, EBRD and EDC to support Canadian companies interested in investing in Ukraine.

- George Pirie, Ontario minister of mines, will make an announcement.

- The 19th edition of the Ontario Economic Summit will be held in Toronto. This year’s theme is Building Ontario’s Growth Agenda.

- Jeremy Nixon, minister of seniors, community and social services, and Matt Jones, minister of affordability and utilities, will announce funding to help support Alberta’s food banks.

- TransLink CEO Kevin Quinn discusses the future of transportation in Metro Vancouver as he delivers his annual address with the Greater Vancouver Board of Trade. A moderated Q&A follows the keynote as Quinn discusses TransLink’s plan to change the way it does business as it expands and diversifies essential services.

- FOMC meeting minutes released at 2 p.m.

- Today’s data: Canadian travel data; U.S. initial jobless claims, durable goods orders, S&P global manufacturing PMI, new home sales, University of Michigan consumer sentiment index

- Earnings: Deere & Co., Nordstrom Inc., First Point Minerals Corp.

Advertisement 8

Article content

___________________________________________________

_______________________________________________________

Advertisement 9

Article content

____________________________________________________

For those hoping to get away for the winter, the ideal time to book for the best deal is three to four months before your trip.. That window is slowly closing for winter getaways, but Black Friday presents a good opportunity to find some deals for your trip to a warmer locale or a ski getaway. MoneyWise Canada columnist Barry Choi shares a list of some of the best packages you can indulge in for this holiday season.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Advertisement

Posthaste: Now it's the wealthy's turn to worry about the economy squeezing their finances - Financial Post

Read More

No comments:

Post a Comment