CIBC economists see long stretch of higher rates and low growth ahead

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

Good Morning!

Advertisement 2

Article content

A lot of weird things have been happening in our economy lately. Roaring inflation that took everybody by surprise, a drum-tight labour market and now the prospect of sputtering growth, if not outright contraction.

The explanation for these unexpected and in some cases unprecedented conditions, argue CIBC economists, is that COVID continues to disrupt the functioning of the economy.

Canada, the U.S. and Europe have tried to move on from the pandemic, lifting vaccine mandates and restrictions on activity, thus resulting in an increase in consumer demand.

“But COVID isn’t fading away as a supply constraint, or as a health issue,” CIBC economists Avery Shenfeld and Andrew Grantham wrote in a recent note.

Variants that spread more rapidly have meant that more people have died of COVID in 2022 than the previous year, even though fewer cases were fatal, they said.

Advertisement 3

Article content

And while demand has recovered, supply chains have not, partly because of the war in Ukraine, but also because of COVID.

The lockdowns this year in China are the most obvious example. Omicron restrictions here caused exports to fall even more than during the first 2020 lockdown.

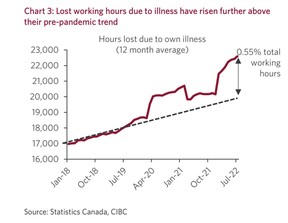

In Canada it is showing up in employee illness. “Flights are cancelled when crew members call in sick, hospitals cut back services because staff members are ill and live entertainment shows are postponed for the same reason,” wrote the economists. Omicron has been associated in Canada with a significant increase in working hours lost to illness.

Long COVID has caused some to actually withdraw from the workforce. The numbers are small in Canada, they said, but the U.K. serves as an example of what could happen if we fail to control future waves of the virus.

Advertisement 4

Article content

In Britain, where public health restrictions have been lighter, 0.6% of the population have been “severely affected” by Long COVID, according to a recent study.

COVID is also impacting capital spending, said the economists. An uncertain outlook due to potential waves of the virus in future may be contributing to businesses’ reluctance to spend, but COVID supply-chain issues have also made getting capital equipment more difficult as well.

“The result is less production capacity in sectors where equipment is on back order, or where COVID uncertainties have forestalled investment,” they said.

The unprecedented COVID recession and recovery is also why there is a mismatch between job availability and hiring in the economy today, argue the economists.

Advertisement 5

Article content

During the pandemic some work was almost completely shut down and stayed dormant for a long period. Now that the economy has reopened, those employers are scrambling to rehire in great numbers, a situation we have not seen before, they said.

“A typical recession doesn’t see air travel drop by 90% and doesn’t see live theatres close outright. A typical recovery doesn’t see the sudden opening we’re experiencing in these same sectors,” they wrote.

Workers who held these jobs, like restaurant staff and baggage handlers, in 2020 had two years to move on, unlike a typical recession that lasts just two or three quarters.

CIBC believes this mismatch will eventually even out, but the impact of COVID on supply chains and missed work could remain.

Advertisement 6

Article content

So what does the future hold?

While traders are already talking about rate cuts after the hiking cycle winds up either at the end of this year or early 2023, CIBC sees the Bank of Canada keeping rates at 3.25% through the whole of 2023.

It also sees GDP growth slowing to 0.9% in the fourth quarter of this year and gaining only 1.5% in 2023.

“Even if a recession is avoided, we’re in for a protracted period of sub-par growth,” said the economists.

The policy of dropping COVID mandates meant to improve the economy may actually be working to extend the economics costs of the virus, they said.

“While helping on the demand side, diminished public health restraints, particularly during surges in case counts, are cutting into the economy’s supply capabilities. Their absence is likely elevating the peak levels for COVID cases, and thereby increasing the costs of worker absenteeism, and perhaps, as we’ve seen in the UK, risking longer term labour market damage due to Long COVID,” they said.

Advertisement 7

Article content

The economists said lockdowns should be behind us, but a push for the use of masks, global vaccination and improvements of indoor air quality would help reduce the economic impact of COVID.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

Check out the latest from Sea Doo maker BRP Inc. This electric surfboard called the Sea-Doo Rise in one of three products that Bombardier Recreational Products announced recently in its first foray into electric vehicles. The EV push also means a return to the award-winning two-wheeled motorcycles that BRP produced in the ’70s and ’80s. The Can-Am Origin and Can-Am Pulse motorcycles, along with the Sea-Doo Rise, will all be electric and will be available to purchase in mid-2024, said BRP. Photo by BRP

Advertisement 8

Article content

___________________________________________________

- Blockchain Futurist Conference begins in Toronto

- Toronto Ontario Lieutenant Governor Elizabeth Dowdeswell delivers Speech from the Throne

- Unifor’s 4th Constitutional Convention

- Jonathan Wilkinson, minister of natural resources, will make an announcement to support electric vehicle charging infrastructure in Manitoba

- Earnings: Hydro One, Bausch Health Companies, Nuvei, Kinaxis, Coinbase Global___________________________________________________

_______________________________________________________

Advertisement 9

Article content

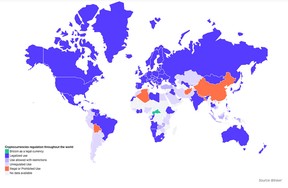

Cryptocurrencies have been having a rough go of it lately, with Bitcoin shedding 47% of its value so far this year. The crypto bear market has become entrenched after a spate of company bankruptcies and the failure of major decentralized finance project Terra in May — and despite small rallies fails to meaningfully recover ground. Fans, however, might take heart from the map below that shows how common cryptocurrencies have become. According to Hellosafe, a comparison site for financial products, 99 out of 195 countries in the world now allow the use of cryptocurrencies, or 50.8% of them. Cryptos are legal in all the European Union countries and in 18 countries or 51.4% of the Americas continent. Only two countries in the world, however, have legalized Bitcoin as legal tender: El Salvador on Sept. 7, 2021 and the Central African Republic on April 27, 2022.

Advertisement 10

Article content

____________________________________________________

Being a good investor means doing your homework. From learning strategies for beginners to understanding the difference between buying and short selling, there’s a lot of ground you can cover on your own with the help of this learning program from our content partner StackCommerce.

Stock Market & Trading Beginner’s Bundle features 12 courses on day trading, analysis, and more. Classes are taught by One Education, which features industry professionals teaching courses designed to boost professionals.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven (@pamheaven), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Array

Advertisement

Posthaste: Sorry, but the economy isn't over COVID — and won't be for some time - Financial Post

Read More

No comments:

Post a Comment