The province’s new leader will have to grapple with a different kind of behemoth: How should Alberta best handle a multibillion-dollar surplus?

Article content

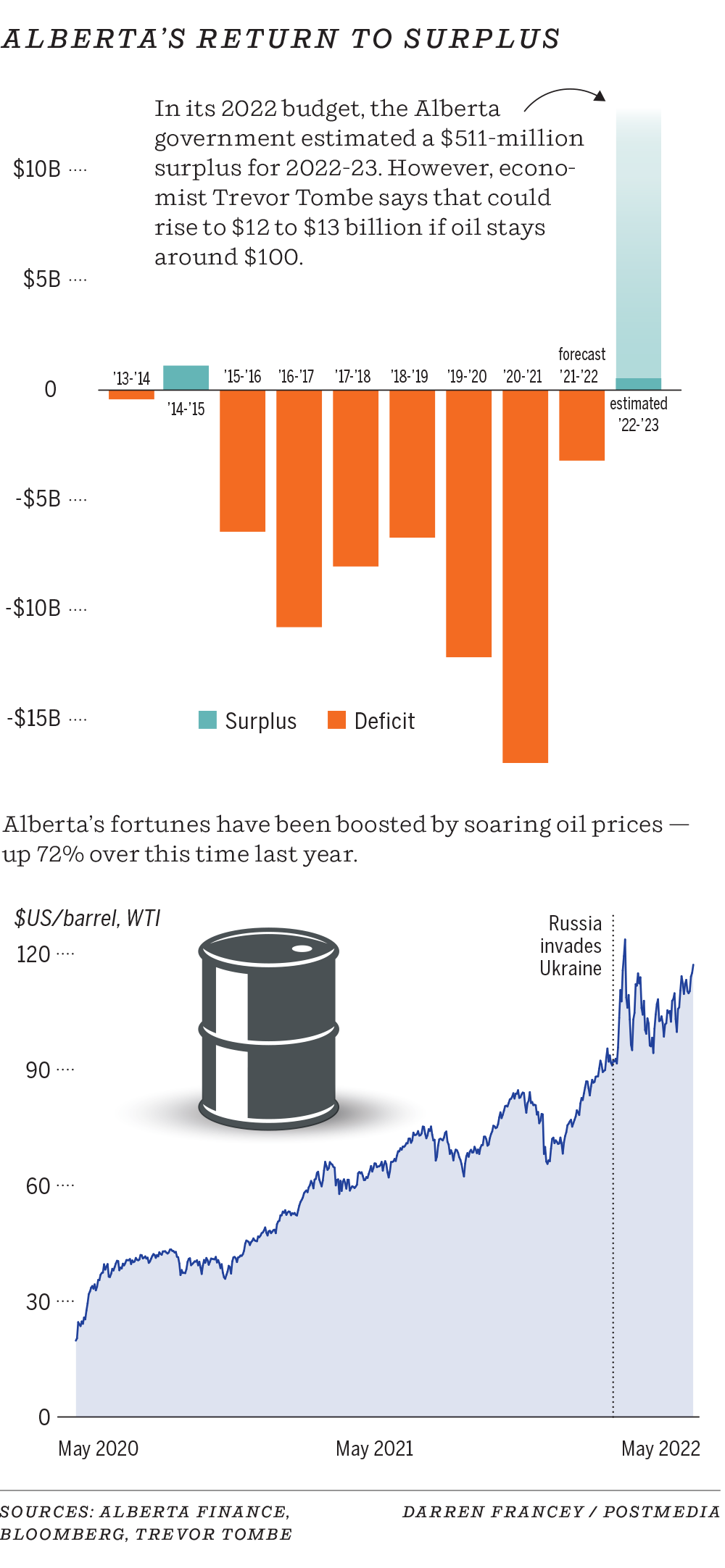

Alberta premiers have spent much of the past decade wrestling with unwieldy budget deficits.

Advertisement 2

Article content

The province’s new leader will soon have a different kind of behemoth to grapple with: How should Alberta best handle a multibillion-dollar surplus?

Benchmark oil prices closed above US$117 a barrel on Monday as the war in Ukraine continues and the European Union is contemplating a ban on all Russian crude imports.

In Alberta, the economy is continuing to grow. Commodity prices are heading higher, putting the province on track to easily eclipse the $511-million surplus forecast in February’s budget.

The financial blueprint was based on oil averaging $70 a barrel and the economy growing by 5.4 per cent this year.

Since the start of the fiscal year in April, West Texas Intermediate (WTI) crude prices have averaged $105 a barrel.

Advertisement 3

Article content

Even if oil prices suddenly tumbled back to $70 a barrel, the province would still be looking at a $2.5-billion surplus, said University of Calgary economist Trevor Tombe.

If oil remains around $100 a barrel, the surplus would clock in around $12 billion to $13 billion, he estimated.

“At $110 a barrel, we are talking about every single month that goes by, the projected surplus for the entire year needs to be revised upwards by a billion dollars, so it’s truly massive,” said Tombe.

“Right now, where the futures (prices) are, we’re absolutely in surplus territory in excess of $10 billion.”

The economy is also expected to expand at a rapid clip.

The Conference Board of Canada will put out a report Tuesday that projects Alberta’s gross domestic product will expand by 6.6 per cent this year, up from its previous estimate of 5.9 per cent.

Advertisement 4

Article content

Board chief economist Pedro Antunes expects U.S. oil prices to average $94 a barrel in 2022, leading to a surge in provincial resource royalties.

“This is a time when we should be running surpluses and should be putting some of that away for the tougher times — because oil prices probably are not going to stay where they are for the longer term,” Antunes said Monday.

Alberta has recorded 12 budget deficits in the past 13 years, but the province’s fiscal picture has improved dramatically since a massive $17-billion deficit was recorded in the first year of the pandemic.

The February budget released by Finance Minister Travis Toews forecast three small surpluses of less than $1 billion annually for the coming years. Yet, every $1-per-barrel jump in WTI oil prices over the course of the budget year increases provincial revenues by $500 million.

Advertisement 5

Article content

“I believe there still remains volatility risk,” Toews said last week in an interview.

“Yes, we may be dealing with a large surplus, that would be a good problem to have, but (we’re) not counting our chickens too early.”

But as the weeks roll by, the question will be asked — particularly as the UCP chooses a new leader to replace Premier Jason Kenney — what the province plans to do with windfall revenues?

The budget document notes any surplus up to the value of the annual earnings of the Alberta Heritage Savings Trust Fund, pegged at about $2 billion this year, would be retained in the fund, instead of flowing into general government revenues.

“We will stop robbing the Heritage Savings Trust Fund of its investment earnings,” Toews said. “We will then take a look at a combination of debt repayment and additional trust fund reinvestment.”

Advertisement 6

Article content

Provincial taxpayer-supported debt now sits near $95 billion.

Banking on a commodity price boom can be dangerous business, as Toews and other Alberta finance ministers have learned the hard way in the past.

Other economic issues also warrant watching. Concerns surrounding inflation, higher interest rates and the potential of a global recession have increased in recent months.

With oil supply and demand now close to being in balance, it’s likely crude prices will remain above $100 a barrel for the rest of the year, absent a global recession, said Rory Johnston, managing director and market economist at investment firm Price Street.

“Going forward to the end of the year, my bias is we are closer to the $150 mark,” he said.

Advertisement 7

Article content

The provincial government has already committed to some unbudgeted spending, such as removing the gasoline tax of 13 cents a litre at the pumps, costing the treasury about $1.3 billion.

Health-care costs have also risen during the pandemic and as the population ages, governments across Canada face increased pressure to boost funding for the medical system, said Antunes.

“Our priorities would be to help Alberta families and businesses keep up with the cost of living, stabilize and strengthen our health care and education system, and to invest for the future,” NDP MLA Shannon Phillips said in a statement.

The province should use surpluses to increase funding for health care, kindergarten to Grade 12 classrooms, and to help post-secondary institutions that have seen funding slashed, said Alberta Federation of Labour president Gil McGowan.

Advertisement 8

Article content

“If they have this tidal wave of revenue coming, they need to reverse the damage they’ve done to our province through cuts to public services over the past three years,” McGowan said.

Whatever happens next, a broader conversation with the public should take place, said former Alberta treasurer Jim Dinning.

Dinning, finance minister under Ralph Klein when the province chopped spending and later balanced the books in the 1990s, believes it’s tougher to manage expectations during periods of growing budget surpluses than deficits.

“When you have a horn of plenty spilling over the tabletop in surplus times, there are all sorts of ideas — some brilliant, mostly crazy — that everyone from ministers to mayors will come up with,” Dinning said.

“The horn of plenty needs to be properly managed so that people think about the longer term. Peter Lougheed tried to do this with the Heritage Fund. And what better time to be thinking again about the Heritage Fund and some of that abundance being reinvested or plowed in?”

Chris Varcoe is a Calgary Herald columnist.

Varcoe: After years of budget famine, Alberta's finances set to feast on growing economy and high oil prices - Calgary Herald

Read More

No comments:

Post a Comment