Check here for the latest news

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

Advertisement

Article content

But the conflict will have consequences for the whole world as it cuts off crucial energy and crop supplies, disrupts businesses and upsets financial markets, already under extreme stress as central banks prepare to tighten.

There is a lot going on out there so check here for the latest news on how the conflict is affecting markets, businesses and the economy.

3:42 p.m.

Rich Russians invest in luxury goods as ruble plunges

Russia’s wealthy are putting their money into luxury jewelry and watches to preserve the value of their savings as sanctions hit, reports Bloomberg.

Sales in Bulgari SpA’s Russian stores have risen in the last few days, the Italian jeweller’s chief executive officer said, after the international response to the nation’s invasion of Ukraine severely restricted the movement of cash.

Advertisement

Article content

“In the short term it has probably boosted the business,” Jean-Christophe Babin said in an interview with Bloomberg, describing Bulgari’s jewelry as a “safe investment.”

“How long it will last it is difficult to say, because indeed with the SWIFT measures, fully implemented, it might make it difficult if not impossible to export to Russia,” he said, referring to restrictions on Russian access to the SWIFT financial-messaging system.

Even as consumer brands from Apple Inc. to Nike Inc. and energy giants BP Plc, Shell Plc and Exxon Mobil Corp. pull out of Russia, Europe’s biggest luxury brands are, so far, trying to continue operating in the country.

— Bloomberg

2:52 p.m.

H&M pauses sales in Russia

Swedish fashion group H&M is temporarily pausing all sales in Russia, it said on Wednesday, joining a growing list of companies shunning the country since it invaded Ukraine.

Advertisement

Article content

The world’s second-biggest fashion retailer said it was deeply concerned about the tragic developments in Ukraine and “stand with all the people who are suffering.”

Russia was H&M’s sixth biggest market with four per cent of group sales in the fourth quarter of 2021. While it has been reducing the number of physical stores in many markets, it has been increasing store count in Russia.

“H&M Group has decided to temporarily pause all sales in Russia,” the company, whose biggest rival is Inditex, said in a statement.

— Reuters

1:46 p.m.

Abramovich is selling Chelsea after almost 20 years in ‘club’s best interest’

Russian businessman Roman Abramovich has decided to sell Chelsea Football Club, 19 years after buying the London side, and promised to donate money from the sale to help victims of the war in Ukraine.

Advertisement

Article content

“I have always taken decisions with the club’s best interest at heart,” Abramovich said in statement published by the reigning European and world soccer champions on their website.

“In the current situation, I have therefore taken the decision to sell the club, as I believe this is in the best interest of the club, the fans, the employees, as well as the club’s sponsors and partners.”

Abramovich said he would not ask for loans he has made to the club — reported to total 1.5 billion pounds (US$2.0 billion) — to be repaid to him and the sale would not be fast-tracked.

He said he had told his aides to set up a charitable foundation which would receive all net proceeds from the sale.

“The foundation will be for the benefit of all victims of the war in Ukraine,” Abramovich said in the statement.

Advertisement

Article content

“This includes providing critical funds towards the urgent and immediate needs of victims, as well as supporting the long-term work of recovery.”

— Reuters

1:01 p.m.

Russians pile into crypto because it’s more stable than the ruble

The surge of Russians buying cryptocurrencies amid a tumbling ruble has one analyst calling it a moment of crypto returning to its roots.

“Russians buying crypto actually represents a use case of the sort for which crypto was intended,” said George Monaghan, thematic analyst at analytics firm GlobalData, in a report. “Crypto, being decentralized, is less vulnerable to government regulations than FIAT currencies. Sanctions have excluded some Russian banks from SWIFT and Mastercard and VISA have frozen their operations in Russia, but it seems that Russians can still make crypto transactions.”

Advertisement

Article content

Monaghan added that while the Russian government refused to open the Moscow exchange, Russians are still able to trade in crypto assets. The Russian government won’t be able to move day-to-day operations into crypto, but it has given citizens a way to preserve some of their wealth, Monaghan noted.

“This activity reminds us what crypto was really meant to be, before the hype and the memecoins and the gains: decentralized and unregulated,” he wrote.

GlobalData made it clear that Russians were not piling into the space because it looked promising or had strong prospects for growth, but because it was more stable compared to the ruble.

The amount traded from the rouble into cryptocurrencies have doubled since the beginning of the Russian invasion into the Ukraine and reached US$60 million a day on Monday, according to data from crypto analytics firm Chainalysis.

Advertisement

Article content

— Stephanie Hughes

11:45 a.m.

A broad range of companies, from energy giant BP Plc to Apple Inc. to the world’s largest banks are pulling up stakes and cutting ties with Russia after its attack on Ukraine, leaving billions of dollars in business behind.

The departures come as Western countries, including Canada, the U.S. and much of Europe, have imposed harsh sanctions on Russia in a bid to constrict its economy and compel it to end the invasion.

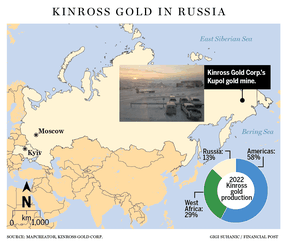

But at least one Canadian company, Toronto-headquartered Kinross Gold Corp., which operates a high-grade underground mine in the far east of Russia, has abstained from criticizing Russia and indicated it plans to continue operating there as long as possible.

Gold recently pierced a one-year high, reaching US$1,930 per ounce, up eight per cent in the past 30 days, a surge most attribute to the increase in geopolitical tensions as a result of the invasion.

Advertisement

Article content

Kinross chief executive J. Paul Rollinson told analysts during the company’s fourth quarter earnings call on Feb. 18, as Russian troops were gathering on the border of Ukraine but had not yet invaded, that the company’s Kupol mine had all the supplies and workforce it needs to continue operating.

“All I can say is we’ve operated there successfully for many years with strong support from the Russian government,” Rollinson said, adding. “We’re good in our communities. We pay our taxes. And we think we’re quite welcome there, and it’s been a great place for us.”

Keep reading the story from the Financial Post’s Gabriel Friedman.

10:15 a.m.

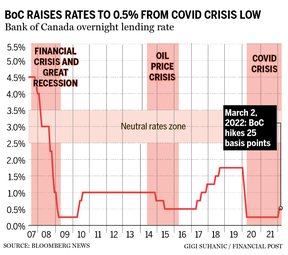

The Bank of Canada raised interest rates by 25 basis points to 0.50 per cent this morning, citing high inflation as one of the main factors behind its decision.

Advertisement

Article content

Prices were already rising, but the conflict in Ukraine is adding to inflationary pressures, policy makers said in today’s statement. The bank now expects inflation rates, now at 5.1 per cent, to stay higher for longer.

“Price increases have become more pervasive, and measures of core inflation have all risen. Poor harvests and higher transportation costs have pushed up food prices. The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities. All told, inflation is now expected to be higher in the near term than projected in January,” the statement said.

The bank reiterated its commitment to using its policy tools to bring the inflation rate back down to its 2 per cent target.

— Victoria Wells

9:48 a.m.

Hockey equipment company Canada Cycle and Motor Company Limited (CCM) will drop Alex Ovechkin and other Russian hockey players in their global marketing campaigns.

“Although Mr. Ovechkin is not responsible for the Russian government’s actions, we took the decision to not use him (or any Russian player) on any global CCM communication at this point,” CCM chief executive Marrouane Nabih wrote to TSN in an email.

In the past, Ovechkin has been a vocal supporter of Russian president Vladimir Putin. In 2017, he started a social movement called “PutinTeam.”

— Marisa Coulton

Advertisement

Article content

9:45 a.m.

The list of companies exiting or refusing to do business with Russia grows.

Boeing has suspended technical support for Russian airlines and Apple Inc has stopped selling iPhones and other products in Russia.

U.S. energy firm Exxon Mobil said it would exit Russia

9:36 a.m.

North American stocks open higher after a rough week so far as Federal Reserve Chair Jerome Powell signaled the central bank would start raising rates this month despite uncertainties stemming from the Ukraine crisis.

The Dow Jones Industrial Average rose 84.56 points, or 0.25 per cent, at the open to 33,379.51.

The S&P 500 opened higher by 16.30 points, or 0.38 per cent, at 4,322.56, while the Nasdaq Composite gained 65.07 points, or 0.48 per cent, to 13,597.53 at the opening bell.

Advertisement

Article content

The Toronto Stock Exchange’s S&P/TSX composite index was up 117.07 points, or 0.56 per cent, at 21,121.58.

8:26 a.m.

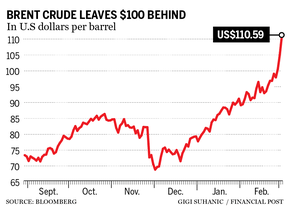

Whoa, oil prices are getting crazy.

Brent crude spiked higher this morning touching $113.02 – its highest since 2014 — and U.S. crude came close to passing its 2013 peak as traders scrambled to find alternatives to Russian oil in an already tight market.

But according to some economists, it’s possible we ain’t seen nothing yet.

If the conflict escalates and Russian exports are choked off altogether, oil could rise to a range of US$120 to US$140, says Capital Economics.

Capital also had a few thoughts on gold, which it expects will climb higher in coming weeks and months because of safe-haven demand. It forecasts that gold will remain firmly above US$2,000 an ounce in the first half of this year, but if there is an escalation in the conflict the yellow metal could soar to US$2,500.

Gold was down this morning, pressured by a higher U.S. dollar and yields, at US$1,924.00 per ounce.

Additional reporting by Reuters and Bloomberg

Advertisement

Live updates: How Russia-Ukraine crisis is impacting markets, economy - Financial Post

Read More

No comments:

Post a Comment