Kevin Carmichael: A decline in economic activity of this size will interrupt the momentum the economy had built up

Article content

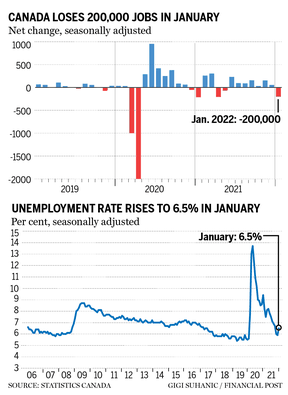

Canadians worked significantly fewer hours in January, and the jobless rate surged, evidence that the Omicron wave of COVID-19 has slowed economic growth.

Advertisement

Article content

Statistics Canada’s January Labour Force Survey found that hours worked dropped 2.2 per cent from December, when hours had returned to pre-pandemic levels. A decline in economic activity of that size will interrupt the momentum the economy had built over the latter half of 2021.

The Bank of Canada last week estimated that gross domestic product (GDP) grew at an annual rate of almost six per cent in the fourth quarter, but acknowledged the fifth wave of coronavirus infections will probably cause growth to slow to two per cent this quarter.

The unemployment rate jumped to 6.5 per cent from six per cent, and employment dropped by 200,000 positions, more than most Bay Street forecasters were expecting. The numbers confirm anecdotal evidence of what happened as provincial governments reintroduced restrictions at restaurants, arenas and other high-touch businesses to limit the spread of the highly contagious Omicron variant.

Advertisement

Article content

Those restrictions are now beginning to loosen. For example, Quebec, which instituted a curfew around Christmas, has dropped that measure, and François Legault’s government allowed restaurants to reopen at half capacity this week. Similar things are happening across the country, including Ontario, where lockdown measures rivalled those of Quebec.

Employment dropped by about 146,000 positions in Ontario, and declined by about 63,000 in Quebec. Increased hiring in the Western provinces was too modest to offset the effect of strict health measures in the country’s two most populous jurisdictions.

The United States reported surprisingly strong employment numbers for January, so the headwinds that slowed Canada’s momentum at the start of the year may dissipate as soon as authorities decide they have done all they can to take pressure off their health systems. The U.S. generally opted against confronting the latest COVID-19 wave with strict health restrictions, tolerating a jump in infections and deaths so the economy could continue to function normally.

Advertisement

Article content

“The Canadian labour market showed impressive ability to rebound after previous waves last year, and some of the prevailing conditions that helped the recovery, like elevated employer hiring appetite, remain,” Brendon Bernard, an economist at Indeed, a hiring site, said in an analysis. “Progress should get back on the right track, but will require ongoing positive economic momentum to sustain it.”

Some economists wondered ahead of the report if the employers most affected by the lockdowns would keep employees on the payroll, rather than risk losing them during a period of extreme competition for workers. That doesn’t seem to have happened. The drop in employment was nearly double the Bay Street consensus.

Advertisement

Article content

Statistics Canada said the number of people who reported working less than their usual number of hours increased by 66 per cent, the biggest jump since March. That will take some of the heat out of demand, since tens of thousands of people suddenly have less purchasing power than they did at the end of 2021.

“While the drop in employment was larger than we had expected in January, job losses were well-expected, and should prove to be very temporary,” Veronica Clark, an economist at Citigroup Global Markets Inc., said in a note to clients, observing that most of the job losses were tied to the hospitality industry. “We expect to see at least some jobs regained in the next report for February and employment continue to rise through the spring.”

Advertisement

Article content

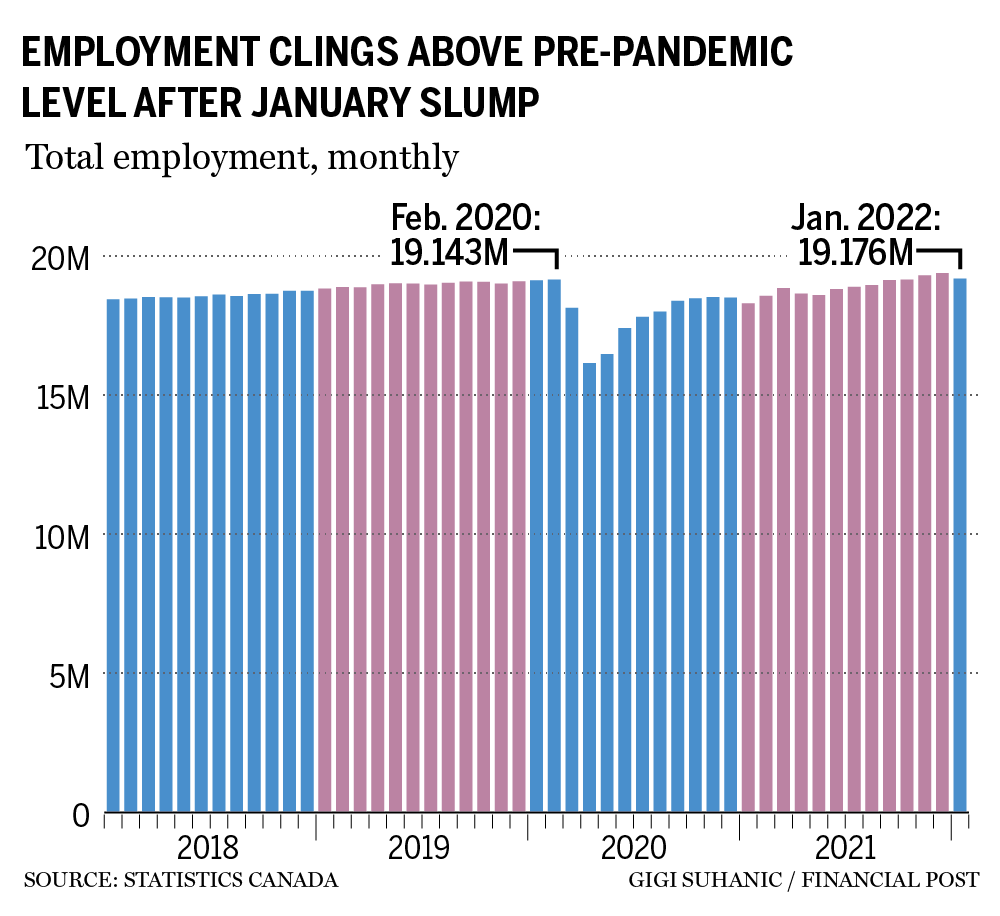

Canada’s economy in December had reached a state that some economists call “full employment,” a theoretical condition where essentially everyone who wants to work could find a job, so additional hiring would put upward pressure on wages and inflation.

One month of data probably won’t change that assessment, especially since pandemic restrictions are already beginning to loosen. The Bank of Canada’s primary concern now is inflation, which is running at its fastest rate in more than three decades.

The jobless rate was hovering around 5.5 per cent in 2019, and yet inflation was benign, suggesting it might be possible to run the economy hotter than the Bank of Canada has thought in the past.

Advertisement

Article content

Governor Tiff Macklem initially thought he might leave borrowing costs unusually low until the unemployment rate returned to that level. But as inflation took off, policy-makers decided it would be too risky to test the limits of their understanding of full employment. Macklem and his deputies made it clear last week that they will quite likely decide to lift interest rates next month.

Statistics Canada offered some positive news on the inflation front. It said average hourly wages grew 2.4 per cent from January 2021, compared with year-over-year gains of 2.7 per cent in the previous two months. That could suggest inflation hasn’t yet affected wage demands, an important indicator of whether the current burst of price increases will fade or become persistent.

“The job losses and rise in the unemployment rate were expected by Bank of Canada and do not change its view of the economy,” said Charles St-Arnaud, a former Bank of Canada economist who now is chief economist at Alberta Central.

Both St-Arnaud and Clark said they still expect Macklem and his deputies to raise the benchmark interest rate at the end of their next round of policy deliberations on March 2.

• Email: kcarmichael@postmedia.com | Twitter:

Advertisement

Canada loses 200,000 jobs, nearly double the blow economists expected - Financial Post

Read More

No comments:

Post a Comment