European stocks fell and U.S. index futures were mixed as an earnings-driven rally stalled amid a deepening supply crunch and coronavirus curbs in China. The Treasury yield curve steepened before the Federal Reserve’s policy meeting.

December contracts on the Dow Jones Industrial Average slipped after the underlying gauge surged past the 36,000 mark on Monday. Russell 2000 contracts rose. The yield on the 30-year U.S. bond widened its gap with the two-year rate by three basis points. Iron-ore futures tumbled on shrinking steal output in China. Tesla Inc. led premarket losses in New York.

Bond and currency markets are bracing for the Fed to announce a tapering of asset purchases as an initial step to eventually raising interest rates to contain inflation. Equity markets, on the other hand, are focusing on earnings growth and valuations. Meanwhile, mixed data on the global economic revival is further clouding the picture as the pandemic is making a comeback in parts of the world.

“We expect volatility in financial markets to remain high as not only the Fed, but other central banks around the world, extract liquidity to combat the rise in inflation,” Lon Erickson, portfolio manager at Thornburg Investment Management, wrote in a note. Despite Fed rhetoric, “we’ve started to see the market price in earlier policy rate moves, perhaps losing confidence in the ‘transitory’ nature of inflation.”

Yields on the two-year and five-year Treasuries fell. Australia abandoned a key pandemic-response tool by dropping its yield control policy, thus joining global central banks inching closer to policy tightening. However, the central bank’s insistence on remaining patient with rate hikes pushed traders to pare back hawkish bets in Australia as well as in global bond markets during European hours.

Equity investors paused to reflect on a rally that’s taken U.S. and European stocks to record highs. With a post-pandemic supply crunch stoking inflation and pushing central banks to tighten monetary policy, they have begun to question valuations. Economic recovery is also under strain as countries from China to Bulgaria report rising Covid cases.

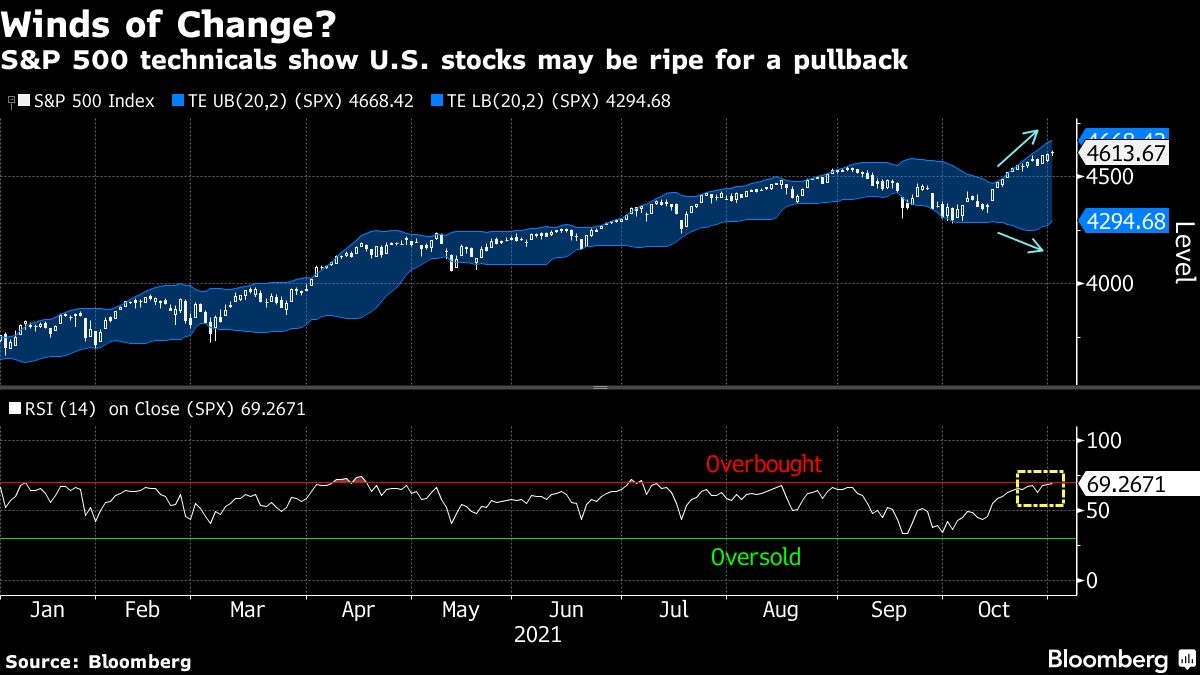

Both the S&P 500 Index and the Dow have been scaling new peaks as U.S. companies post another stellar quarter for earnings. Of the 295 companies in the equity benchmark that have reported results, 87 per cent have either met or surpassed estimates.

Europe’s Stoxx 600 gauge slipped from a record high as miners and travel companies posted some of the biggest losses.

In New York premarket trading, Tesla fell 5.2 per cent after Elon Musk said the carmaker’s deal with Hertz Global Holdings Inc. was not done yet and it won’t compromise on the profit margin to get the contract.

Elsewhere, iron-ore futures extended losses below US$100 a ton on expectations of lower Chinese steel output. Oil surrendered gains as traders awaited a Thursday meeting of the OPEC+ grouping on output plans.

Here are some events to watch this week:

- Fed rate decision, U.S. factory orders and durable goods, Wednesday

- OPEC+ meeting on output, Thursday

- Bank of England rate decision, Thursday

- U.S. trade, initial jobless claims, Thursday

- U.S. unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 were little changed as of 6:41 a.m. New York time

- Futures on the Nasdaq 100 fell 0.2 per cent

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 fell 0.1 per cent

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at US$1.1596

- The British pound fell 0.2 per cent to US$1.3631

- The Japanese yen rose 0.4 per cent to 113.54 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 1.55 per cent

- Germany’s 10-year yield declined four basis points to -0.14 per cent

- Britain’s 10-year yield declined two basis points to 1.04 per cent

Commodities

- West Texas Intermediate crude fell 0.2 per cent to US$83.91 a barrel

- Gold futures fell 0.1 per cent to US$1,793.70 an ounce

Equity bulls pause as Fed, economy risks dominate - BNN

Read More

No comments:

Post a Comment