Stocks climbed to a record as President Joe Biden’s bipartisan US$579 billion infrastructure deal added to optimism the economic recovery will keep pushing ahead. The dollar fell.

Companies that stand to benefit the most from a rebound in activity outperformed -- with financial and energy shares leading gains in the S&P 500. Caterpillar Inc., the world’s biggest maker of mining and construction equipment, jumped alongside raw-material producers such as U.S. Steel Corp. and Nucor Corp. Banks rallied before the results of the Federal Reserve’s stress tests, while Tesla Inc. extended its three-day advance to almost 10 per cent.

The bipartisan legislation is expected to move through Congress alongside a separate bill that would spend trillions more on what Biden called "human infrastructure" that the GOP opposes. Earlier Thursday, Atlanta Fed President Raphael Bostic and his Philadelphia counterpart Patrick Harker urged more spending on infrastructure investment -- noting that it could boost U.S. productivity and growth.

"Infrastructure spending strengthens an already very strong economic growth outlook," said Jeff Buchbinder, equity strategist at LPL Financial. Those investments will "bolster the outlook for corporate profits and should keep this bull market going strong well beyond 2021," he added.

Data Thursday showed applications for U.S. state unemployment insurance fell slightly last week, though were higher than forecast, while orders for durable goods rose in May at the fastest pace since January.

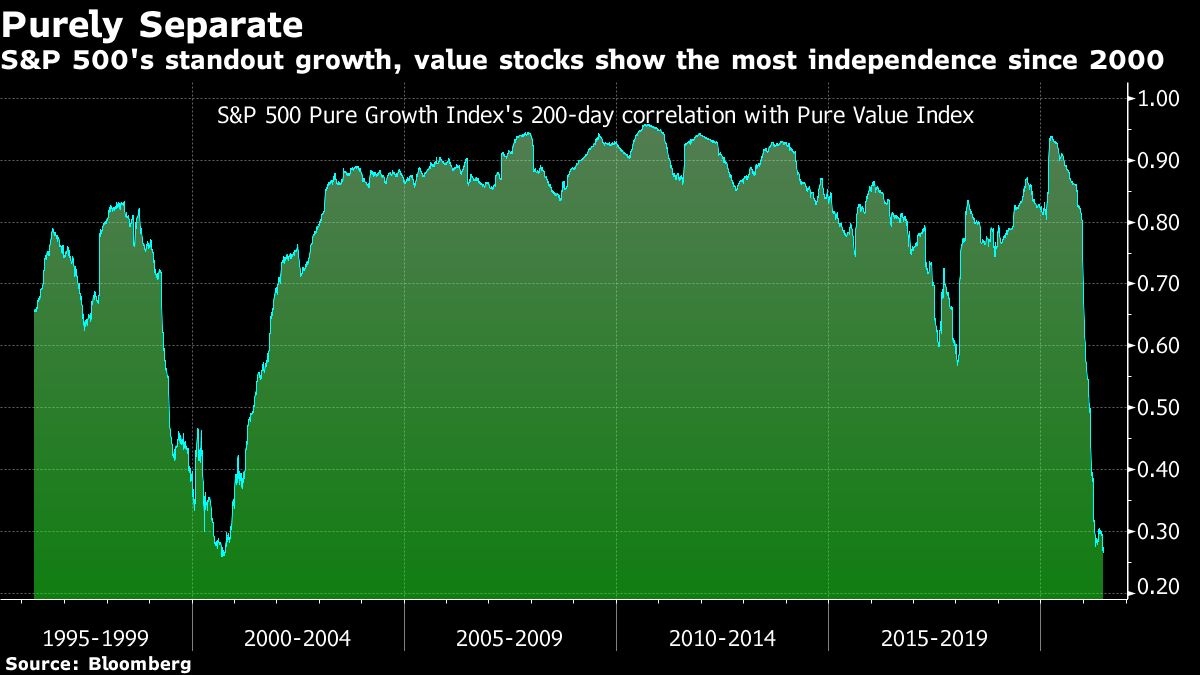

Shares of the fastest-growing U.S. companies have stopped moving in lockstep with the cheapest stocks. The shift is evident from the correlation between the S&P 500 Pure Growth and Pure Value indexes during the past 200 trading days, which plummeted after setting an eight-year high in April 2020.

Elsewhere, the pound fell after the Bank of England pushed back against speculation that a surge in inflation means it’s preparing to boost interest rates -- saying the economy still needs support.

Here are some events to watch this week:

- U.S. personal income/spending, University of Michigan sentiment on Friday

These are some of the main moves in markets:

Stocks

- The S&P 500 rose 0.6 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.6 per cent

- The Dow Jones Industrial Average rose 1 per cent

- The MSCI World index rose 0.6 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro was little changed at US$1.1935

- The British pound fell 0.2 per cent to US$1.3936

- The Japanese yen rose 0.1 per cent to 110.84 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 1.49 per cent

- Germany’s 10-year yield declined one basis point to -0.19 per cent

- Britain’s 10-year yield declined four basis points to 0.74 per cent

Commodities

- West Texas Intermediate crude rose 0.2 per cent to US$73.26 a barrel

- Gold futures fell 0.5 per cent to US$1,774.70 an ounce

--With assistance from Sunil Jagtiani, Namitha Jagadeesh, Vildana Hajric and Claire Ballentine.

US stocks hit record on bets economy is pushing ahead - BNN

Read More

No comments:

Post a Comment