Consumers in the eurozone are flocking back to bars and restaurants, booking holidays and travelling to work again, according to unofficial data that suggest pre-pandemic patterns of economic activity are re-emerging.

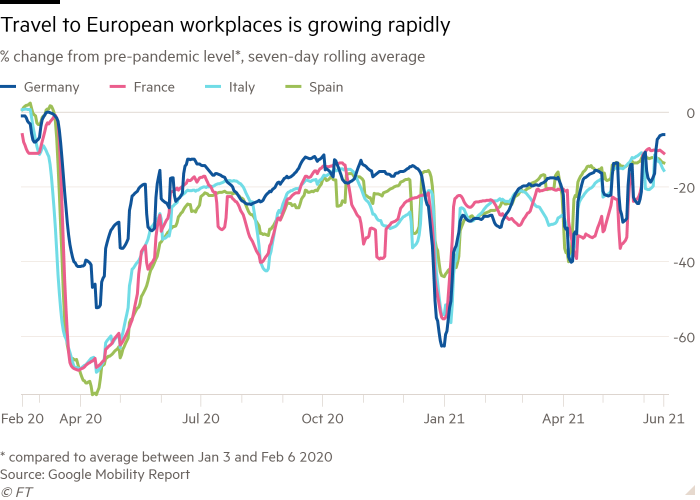

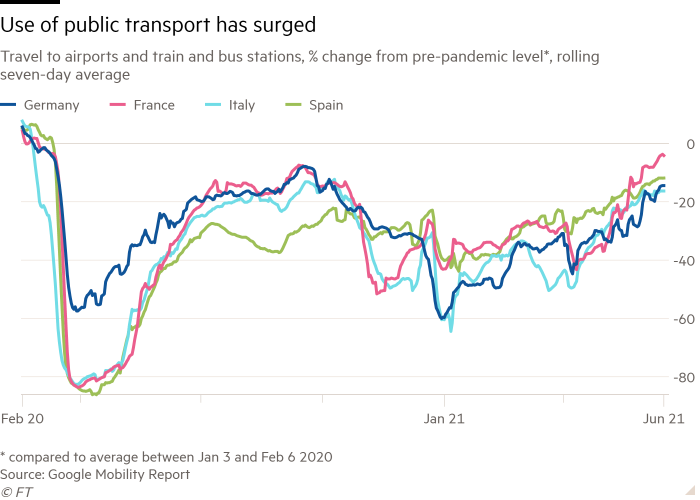

The use of public transport and journeys to workplaces have hit their highest levels since early last year in many countries, according to high-frequency data. The alternative indicators have become widely watched since the start of the pandemic because they offer a more timely gauge of activity, although they are less comprehensive and reliable than official data.

“We’re going back to a form of normality very quickly now,” said Bert Colijn, economist at ING. Several measures of activity are already outperforming their levels last summer, he added: “This fuels expectations of a quick economic rebound.”

Most EU member states are reopening their economies as the virus retreats, boosting households’ confidence. Coronavirus infections have fallen rapidly since May and about half of the EU population have received at least one dose of a Covid-19 vaccine, although concerns are growing about the spread of the more contagious Delta variant.

The easing of restrictions is “making the public more willing to return to old habits”, said Jack Allen-Reynolds, economist at Capital Economics.

By mid-June, travel to workplaces across the eurozone’s largest economies was about 10 per cent below January 2020 levels, but that is well above the level of June last year and the highest since the start of the pandemic, according to Google Mobility data.

As people return to their offices, traffic to web conferencing and ecommerce sites is sharply down on the start of the year, data from SimilarWeb, which tracks web traffic, shows.

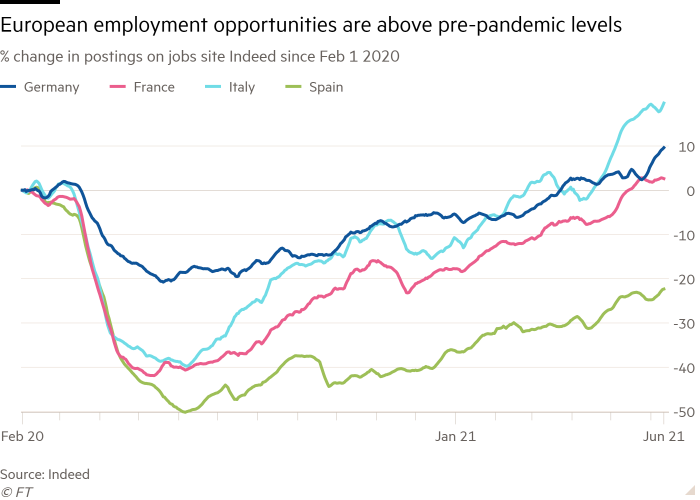

And more people are back in work. The most recent furlough data for Spain and Germany showed that by May, the number of people receiving employment subsidies had decreased to the lowest level this year. Meanwhile, the website Indeed reported strong growth in job postings since April.

More people have also begun to go out and about. In some eurozone countries travel to airports and train and bus stations is at its highest since the start of the pandemic, according to Google data that also showed that travel to retail and entertainment venues had hit its highest level since last summer in many places.

In Germany, restaurant bookings and consumer spending are both higher than their levels in June 2019, according to OpenTable and Fable Data, which tracks bank transactions.

Allen-Reynolds said some consumers had large amounts of savings left over from last year that they might be “eager to spend”, making household consumption the likely driver of economic growth over the rest of the year.

However, some areas of the economy are far from normal, including supply chains. Because of disruptions and input shortages “industrial activity is likely to remain subdued” until the second half of this year, said Chiara Zangarelli, economist at Nomura.

Some parts of the leisure industry such as nightclubs, shows and theatres remain closed in large parts of Europe. Cinemas have reopened in some countries, but with restricted capacity and low revenues.

In mid-June, European flight traffic was half that in the same period of 2019, according to Eurocontrol. However, it was near its highest level since the start of the pandemic.

“We are a little less optimistic on the prospects for a full recovery of the tourism sector this year, particularly for countries heavily reliant on foreign tourists,” said Fabio Balboni, economist at HSBC.

But Tomas Dvorak, economist at Oxford Economics, said web search data indicated that tourism-related activity “has picked up sharply in recent weeks, suggesting there’s strong demand building up”.

Another encouraging sign is online holiday reservations data from Transparent, showing rapidly rising short-term rental bookings.

In most regions in Germany and France bookings are much higher than June 2019 levels, suggesting travellers are holidaying in their home countries rather than flocking to the Mediterranean. Dvorak expects domestic tourism to “be quite strong” this year relative to pre-pandemic levels, but “less so than in 2020”.

“It’s a good sign that consumers respond to relaxed restrictions pretty readily even when it comes to tourism,” he said.

All in all, economists’ expectations for the eurozone’s economic recovery are rising. The European Central Bank last week increased its forecast for 2021 eurozone growth by 0.6 percentage points to 4.6 per cent, and economists say the bloc could have fully recovered from the impact of the pandemic as early as this autumn.

“Judging by buoyant sentiment surveys, the strong inflow of orders and the rebound in consumer footfall data, the eurozone should be back at its pre-pandemic GDP [level] in [the third quarter of] 2021,” said Holger Schmieding, chief economist at Berenberg.

Eurozone economy edges back towards pre-pandemic norms - Financial Times

Read More

No comments:

Post a Comment