[unable to retrieve full-text content]

Jailed Imran Khan Favored in Survey to Run Pakistan's Economy BloombergJailed Imran Khan Favored in Survey to Run Pakistan's Economy - Bloomberg

Read More

[unable to retrieve full-text content]

Jailed Imran Khan Favored in Survey to Run Pakistan's Economy Bloomberg[unable to retrieve full-text content]

Jailed Imran Khan Favored in Survey to Run Pakistan's Economy BloombergCanada’s economy is set to grow at the third-fastest pace among advanced peers, ranking behind the United States and Spain in the International Monetary Fund’s (IMF) latest forecast.

While overall growth is still below its average from 2000 to 2019, IMF chief economist Pierre-Olivier Gourinchas sees a combination of steady expansion and weakening inflation paving the way for a “soft landing” for the global economy.

“Risks to global growth are now broadly balanced,” Gourinchas stated in a news release on Tuesday. “We find that the global economy continues to display remarkable resilience, and we are now in the final descent towards a ‘soft landing’ with inflation declining steadily and growth holding up.”

The IMF’s World Economic Outlook calls for global growth of 3.1 per cent in 2024, up two-tenths of a percentage point from the global lender’s October forecast.

Canada’s economy is expected to grow 1.4 per cent, a two-tenths of a percentage point decrease versus the IMF’s October estimate. India and China topped growth expectations for 2024, with estimates of 6.5 per cent and 4.6 per cent, respectively. The United States is seen leading advanced economies in 2024, with an expected growth rate of 2.1 per cent, followed by Spain at 1.5 per cent.

Last week, the Bank of Canada said economic growth has stalled in this country since the middle of 2023, and is now expected to stay close to zero for the first quarter of 2024. Stubborn core inflation measures led the Bank to leave its trend-setting lending rate at a 22-year high last Wednesday.

“As you move further into 2024, we expect global growth to start picking up,” Bank of Canada Governor Tiff Macklem told reporters at a press conference in Ottawa. “Most importantly for Canada, U.S. growth picks up. That increases demand for our exports.”

Business leaders say borrowing costs at this level are having a chilling effect on the economy. However, a recent survey of individual Canadians suggests fewer are struggling due to the central bank’s rate hikes, compared to a year ago.

Statistics Canada is set to release a fresh snapshot of the economy on Wednesday via gross domestic product data for November 2023.

Jeff Lagerquist is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jefflagerquist.

Download the Yahoo Finance app, available for Apple and Android.

Canada’s economy shrank in the fourth quarter of 2023 by 0.2%. That’s the second quarter of shrinkage in a row. In the third quarter, it fell 0.3%.

Advertisement 2

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Article content

Technically that means Canada is in recession, since the definition of a recession is two consecutive quarters of Gross Domestic Product shrinkage. Yet no one in the government or over at the toady Bank of Canada will use the “R” word.

Article content

To make matters worse, several bank economists have pointed out that, if the rapid growth of immigration is factored in, Canada’s per capita GDP has declined by nearly 5% in the last year.

Per capita GDP — a country’s total value of goods and services divided by its population — is a good indication of its standard of living. And by that measure, Canadians’ standard of living is falling.

Also, as Statistics Canada pointed out on Tuesday, Canada was saved from an even steeper decline only by government spending.

Your Midday Sun

Your noon-hour look at what's happening in Toronto and beyond.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of Your Midday Sun will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

Article content

That is not a good thing. Governments (most of the spending is federal) cannot continue to increase spending without also jacking up taxes, because only working Canadians and businesses create taxable income. The government has little money of its own to sustain artificial economic increases.

Meanwhile, the Americans’ GDP grew more than 5% in the third quarter and by 3.3% in the fourth.

While we are in a recession no one wants to admit, the Americans are in a boom — a mild one, but a boom nonetheless.

Canada and the U.S. have similar inflation rates and unemployment rates. Rents and mortgage payments in both countries have risen substantially in the past year (and by similar amounts), although the effects are being felt differently, because American housing prices and rents were so much lower than ours to begin with.

Advertisement 4

Article content

We apologize, but this video has failed to load.

America’s housing inflation has made the affordable market for homes slightly tighter, while Canada’s housing price increases have made already unaffordable homes even more so.

Still, it is unusual for our two countries’ economies to be so out of sync on growth. And they will likely remain out of sync for the rest of 2024.

American growth is projected to be somewhere between 2% and 3% in the coming year. Meanwhile, last week Bank of Canada Governor Tiff Macklem admitted, “Right now growth has stalled. It stalled around the middle of last year. We expect growth to continue to be close to zero,” through the whole of 2024.

That would make six consecutive quarters of no growth or decline.

How is it that there is such a noticeable gap between Canadian and American growth rates? We are seldom so far behind our largest trading partner, if only because when the Americans are doing well they buy more of our goods and services. That helps our economy grow, too.

Advertisement 5

Article content

So, why the shortfall this time?

The answer has to be Liberal government policies on the environment, interest rates, housing, hobbling the energy industry, immigration and more.

Whatever the problem, the Liberal “solution” almost always makes matters worse. That’s because they know more about fashionable woke fads than economics.

The idiocy of their approach to housing and immigration is obvious. The market is building housing for about 300,000 new families a year, while the Liberals are giddily admitting well over one million immigrants, refugees and foreign students.

Or look at the Trudeau government’s approach to food inflation. Rather than, for instance, taking the carbon tax off food production and transportation, or enabling more competition among grocery store chains, the Liberals’ solution has been to try to command an end to higher prices.

Is it any wonder with the current group of economic illiterates in charge that investment in Canada has fallen, along with our productivity and standard of living, while taxes and inflation have skyrocketed?

Article content

Share this article in your social network

This Week in Flyers

People walk through the Kurfuerstendamm shopping street, in Berlin, on Dec. 18, 2023.LISI NIESNER/Reuters

The euro zone’s economy stagnated last year, underperforming the rest of the world as former powerhouse Germany struggled with an industrial malaise that has no end in sight, data showed on Tuesday.

The 20 countries that share the euro barely avoided a recession in the final quarter of last year even as the global economy expanded and the euro zone’s biggest trading partner, the United States, chalked up impressively brisk growth.

The euro area’s underperformance was mostly due to weakness in Germany, which has seen its business model relying on cheap energy from Russia and intense two-way trade with China upended by geopolitical events.

Europe’s largest economy shrank by 0.3 per cent in the last three months of 2023 while the bloc as a whole saw steady output, helped by expansions in Spain and Italy, Eurostat’s flash or preliminary figure showed.

That marked the sixth consecutive quarter of no or little growth.

Economists expect more of the same in the coming months before a timid recovery in the summer, which should lead to another year of meagre growth for the euro area.

“Stronger household consumption as the effects of the shock to energy prices subside and inflation falls, supporting real income growth, is expected to drive the recovery,” the International Monetary Fund said on Tuesday in its World Economic Outlook.

Still, it downgraded its euro area economic growth forecast to 0.9 per cent this year and 1.7 per cent in 2025.

Private-sector economists were also downbeat, with S&P Global Market Intelligence warning of a “challenging” year “amid faltering demand and increasing geopolitical tensions”.

This was in stark contrast with the United States.

While both economies have been subject to a steady diet of interest rate hikes by their central banks in response to a surge in inflation, the U.S. economy shrugged off dire predictions of recession and grew by 2.5 per cent last year.

Eurostat did not provide an annual figure for the euro zone overall with the report, which is subject to change, particularly due to possible revisions in Irish output, but the IMF put it at just 0.5 per cent.

The new year kicked off with a wave of strikes and protests over inflation, including several by farmers in Germany and France who oppose plans to gradually reduce subsidies from the European Union.

With inflation now falling, workers are likely to regain some purchasing power this year. Meanwhile, anticipated rate cuts by the European Central Bank should also ease pressure on the battered construction sector.

But this may prove too little, too late, according to Christoph Weil, an economist at Commerzbank.

“A significant upturn is also unlikely for the rest of the year,” he said. “In view of persistently high inflation, the ECB is unlikely to lower its key rates before the summer, and this is unlikely to have a positive impact on the economy until 2025.”

As if the Chinese economy didn’t have enough to contend with: Slowing growth, falling prices, tanking stock markets, a shrinking workforce and fleeing foreign investors.

A Hong Kong court added another cause for concern Monday: It ordered the liquidation of China Evergrande Group, the world’s most indebted property developer with more than $300 billion in liabilities and hundreds of unfinished apartment complexes across the country.

It is unclear whether Chinese authorities will recognize the Hong Kong court’s ruling and allow international creditors to seize the company’s assets. But the decision will fuel fears about the state of China’s property market — which makes up about one-fifth of the economy — and could ripple through the world’s second largest economy, already flailing.

“Nobody believes the economic situation is going to get any better,” said Alicia García Herrero, chief Asia-Pacific economist at investment bank Natixis, after Evergrande’s share price slumped 20 percent on the Hong Kong Stock Exchange before trading was suspended.

Once China’s largest seller of real estate, Evergrande has been trying to avoid formal bankruptcy since 2021, when it defaulted on $330 billion in debt and sent shock waves through global markets. The company was seeking more time to come up with a restructuring plan, but after 18 months without progress, Justice Linda Chan said Monday that “enough is enough” and ordered it to liquidate.

Evergrande’s chief executive, Xiao En, told Chinese media Monday that the company would try to continue normal operations and safeguard “the legitimate rights and interests of creditors both at home and abroad.”

“Today’s decision by the Court is contrary to our original intention,” he told the 21st Century Business Herald, a Chinese financial publication. “We can only say that we have done our best and that we regret it very much.”

Beneath Evergrande’s bankruptcy is a wider fear that the Chinese economy may be sinking into a prolonged and steep slowdown that could hamper its — and the global economy’s — recovery from the worst days of the coronavirus pandemic.

Recent news has not been positive.

China recorded a gross domestic product growth of only 5.2 percent last year — the slowest in three decades, excluding the three initial pandemic years — and its stock market has been performing particularly badly.

China’s financial authorities have been scrambling to stop a nosedive in Chinese and Hong Kong stocks — they’ve lost about 10 percent in value this year alone amid an exodus of foreign investors — but the piecemeal support measures have done little to restore faith.

International investors, suffering whiplash from strict “zero covid” policies and politically motivated crackdowns on tech giants once considered the future of the Chinese economic miracle, continue to pull money out of Chinese companies.

There are few reasons to be optimistic: China’s population shrank in 2023 for the second consecutive year despite official efforts to encourage more children. Even with a shrinking workforce, young people entering the job market are struggling to find well-paying and fulfilling work. Some prefer to check out and “lie flat” or become “full-time children” instead.

And on top of that, people are not spending like they use to, causing prices to drop and meaning China is one of the few countries in the world that is flirting with deflation.

At the center of the economic malaise is the embattled real estate sector — and the flailing behemoth that is Evergrande.

Starting in the 1990s, China’s huge property developers had easy access to bank loans and could aggressively expand using a borrow-to-build model that took advantage of surging demand for homes and local government reliance on land sales for income.

But a shift in government policy in 2020 turned off funding flows to developers that for decades had taken out huge loans to rapidly expand, using new projects to keep borrow and building.

Evergrande was left on the verge of collapse, in a crisis that many saw as marking the end for China’s housing boom. It also fueled concerns that foreign creditors would be shortchanged in Beijing’s efforts to contain the crisis.

To avoid the effects of the company’s more than $300 billion pile of debt rippling through the economy, Chinese authorities opted for what analysts called a “controlled demolition” — essentially managing the corporation through a gradual collapse without worsening a slump in the sector that could slow the tepid pandemic recovery.

At the same time, some key company leaders disappeared.

Evergrande’s billionaire chairman, Xu Jiayin — who is also known by the Cantonese pronunciation of his name, Hui Ka Yan — was detained in September on “suspicion of illegal crimes” and has not been heard from since.

Other sitting and former executives of China Evergrande Group and its subsidiaries were also reportedly being investigated by Chinese authorities for potentially breaking rules over the use of bank deposits.

The company has continued to limp on, posing a continual headache for policymakers trying to restore confidence in the real estate sector.

The top priority for the government has been completing the forests of unfinished apartment complexes across the country and placating tens of thousands of angry homeowners who paid upfront.

But smaller contractors have collapsed as China’s property market has come under increasing strain, and home buyers and banks alike increasingly fear that developers won’t be able to finish half-done projects, let alone return to the go-go days when they would break ground on a new project weekly.

For two and a half years, property has been a “serious and persistent drag” on the economy despite “the burst of enthusiasm and positive animal spirits after the reopening from covid restrictions,” Andrew Batson, director of China research for economic consultancy Gavekal, wrote in a recent note.

Monday’s ruling raises questions about how far Chinese authorities are willing to go to protect the interests of international creditors.

In 2021, some jurisdictions in China agreed to recognize liquidation rulings from Hong Kong, but each case required a separate application, and the deal has been applied only five times.

If creditors outside the country are unable to recoup some of their losses, it would be another blow to confidence in China’s business environment. Foreign direct investment in China’s economy fell by 8 percent last year, the first decline since 2012.

“Evergrande shows to foreign investors how risky it is to invest in Chinese entities in Hong Kong,” García Herrero said. “It was clear before, but with the liquidation that does not allow any access to assets, it will be even more crystal clear.”

Vic Chiang in Taipei, Taiwan, and Lyric Li in Seoul contributed to this report.

[unable to retrieve full-text content]

Thai Officials Pile Pressure on BOT to Ease, Citing Bank Profits Bloomberg[unable to retrieve full-text content]

Germany Is Sick Man After All With Illness Crippling Economy BloombergGerman officials insist their economy doesn’t merit the “sick man of Europe” label, but a new study suggests illness is really playing a part in its poor performance.

Gross domestic product would have risen 0.5 per cent last year if it hadn’t been for work absences due to poor health — a tally that surpassed pandemic totals to reach a record in 2023, according to analysis by VFA, Germany’s association of research-based pharmaceutical companies.

Article content

Some €26 billion (US$28.2 billion) in real income was lost due to illnesses among employees — equivalent to about 0.8 percentage point of total output, economists Claus Michelsen and Simon Junker wrote in a report released on Jan. 26. High levels of absences in November and December point to another hit in the current quarter too.

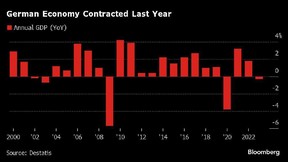

The German economy shrank 0.3 per cent in 2023, its worst performance in two decades barring the financial crisis year of 2009, and 2020, when the pandemic hit. Its underperformance compared to regional peers was so pronounced that it evoked the “sick man of Europe” label previously used to describe it a quarter century ago.

Bundesbank president Joachim Nagel has rejected the comparison, and last week, Finance Minister Christian Lindner insisted the country was more like a tired man just needing coffee.

“In 2023, Germany was the ‘sick man’ in the truest sense of the word — its economic performance was significantly more affected by the wave of illness than in other countries,” Michelsen and Junker wrote. “What’s still true though is that Germany’s economy faces significant structural problems and is confronted with major challenges in international competition.”

Share this article in your social network

Israel’s war on Gaza, now well into its fourth month, has taken a toll on its own economy with many industries pausing business even as a few continue to get new investments.

Since October, Israel’s government has subsidised the salaries of reportedly 360,000 mobilised reservists deployed to Gaza – many of whom are high-tech industry workers in finance, artificial intelligence, pharmaceuticals and agriculture.

In November, the Bank of Israel put the war’s “gross effects” on Israel at 198 billion shekels ($53bn) and pared back its estimates for economic growth to 2 percent per year for 2023 and 2024, down from 2.3 percent and 2.8 percent.

In December, Israel’s Finance Ministry said that the war will likely cost Israel approximately $13.8bn this year if its high-intensity phase concludes during the first quarter of 2024.

In the midst of that, experts are watching to see how business is doing on the ground.

One of the industries that have continued to do well is the high-tech sector, its fastest-growing area for several years, which today accounts for close to 20 percent of the country’s gross domestic product (GDP) and 14 percent of jobs.

Since the Israeli start-up scene exploded in the 1990s, Israel has established itself as the largest tech centre in the world, second only to Silicon Valley. More than 500 multinational corporations – from Google to Apple, IBM to Meta, and Microsoft to Intel Corp – operate in Israel.

And while there are concerns if companies would continue investing in a nation at war, for the moment at least, there’s no evidence to say that’s a real threat.

Within one week of October 7, more than 220 venture capital firms, including Bain Capital Ventures, 8VC, Bessemer Venture Partners, and GGV Capital, signed a public statement to express solidarity with Israel and called on investors worldwide to continue to support its tech ecosystem.

From December 17-20, dozens of senior executives from US-based venture capital, tech and private equity firms took part in the Israel Tech Mission, entailing meetings in Jerusalem and Tel Aviv between these executives and top Israeli government officials. Essentially, it was a high-profile delegation showing the Israeli tech sector support amid this war.

Ron Miasnik is an investor for Bain Capital Ventures who co-organised the Israel Tech Mission with David Siegel, the CEO of Meetup.com.

“We are longtime investors in the Israeli startup ecosystem, and have made it a priority to visit the region and meet with teams there to continue to support stability and economic prosperity in the area,” Miasnik told Al Jazeera. “In the long term, we believe in the resilience of the Israeli startup ecosystem and are committed to not only continuing but deepening our focus on the area,” he added.

Hillel Fuld, a tech columnist and startup adviser based in Beit Shemesh, Israel, pointed out that in December, US chipmaker Intel Corp confirmed its plans to build a $25bn chipmaking factory in southern Israel – a development hailed by Netanyahu as the “largest investment ever” in Israeli history. With a $3.2bn grant from the Israeli government, Intel’s planned investment is a big boost to Israel’s tech sector amid this war.

In the final quarter of last year, Israeli startups managed to raise $1.5bn and “out of those deals, high-risk ‘seed’ funding was $220m in 31 rounds”, Fuld said.

Palo Alto Networks, a Santa Clara, California-headquartered multinational cybersecurity company founded by American-Israeli entrepreneur Nir Zuk, has a history of acquisitions in Israel. On October 29, it acquired Dig Security for roughly $300m, then it acquired Talon Cyber Security for $615m.

But the picture is slightly mixed, said Benjamin Bental, a principal researcher and economics policy programme chair at the Jerusalem-based Taub Center for Social Policy Studies. “When one looks at the number of players, one sees a decline. When one looks at the sums invested, one sees basically stability, meaning that those who stay invest more,” he said.

Israeli officials face the challenge of needing to restore confidence and a sense of security – which will not prove easy – to boost investments.

“Beyond a clear military and political outcome both in the Gaza Strip and along the Lebanese border, and a repatriation of the hostages, this requires a clear and goal-oriented economic policy. It is not yet clear how this will eventually be addressed,” Bental told Al Jazeera.

Tens of thousands of people have been displaced in the last few weeks on both sides of the Israel-Lebanon border as Israeli troops and Hezbollah fighters have fired missiles at each other.

Perhaps the sector of the Israeli economy that has suffered the most amid this war is tourism which accounted for 2.6 percent of GDP before the pandemic in 2019, before falling to 1.1 percent in 2021. Both foreign and domestic tourism in Israel have flatlined since the start of the war.

Across Israel, restaurants and stores remain empty. Soon after Hamas’s incursion into southern Israel and the eruption of the war on Gaza, a long list of airlines cancelled or suspended the majority of their flights to Tel Aviv, and many tourists cancelled their plans to visit Israel.

Nonetheless, some major airlines such as Lufthansa and some of its subsidiaries, including Swiss International Air Lines and Austrian Airlines, resumed their flights to Israel earlier this month.

Prior to Operation Al Aqsa Flood, visitors to Israel numbered above 300,000 each month. In November, that figure reportedly sank to 39,000.

“War is not only tragic, it’s also expensive. The impact on tourism, for example, is a very real one and there is no ignoring it,” Fuld told Al Jazeera.

Construction, accounting for 14 percent of Israel’s GDP, has taken a huge hit since this war began. Across Israel, construction projects have been paused since October and Israel indefinitely froze worker permits for Palestinians who make up 65-70 percent of the workforce in Israel’s construction sector.

Consequently, industry in Israel and the West Bank’s economy have taken a huge hit. Of the 110,000 Palestinians who had permits to work either in Israel-proper or on illegal settlements in the West Bank and East Jerusalem, most were working in construction.

The gap has not been filled by Israeli workers, given how the reservists have been called to fight in the war, nor by foreign workers who have, in large numbers, fled Israel amid this conflict.

In November, the Israel Builders Association said that Israel’s construction industry was operating at roughly 15 percent of its pre-October 7 capacity. A month later 8,000-10,000 Palestinian workers were permitted to resume work on Israeli settlements in the West Bank – a decision the government made after it came under significant pressure from business and factory owners hit hard by “supply shocks”.

But that’s far from sufficient and to fill the gap, Israel plans to bring in approximately 70,000 construction workers from China, India, Moldova and Sri Lanka.

The Gaza war’s ripple effects throughout the greater Middle East are also negatively impacting Israel’s economy.

Israel imports diamonds, cars, petroleum, and broadcasting equipment, among other things, goods that come via the Red Sea. The recent Houthi missile and drone attacks in this body of water in retaliation for Israel’s attack on Gaza have not only disrupted global trade but also impacted Israel’s imports. Many of Israel’s imports from Asia are now being rerouted around Africa, bumping up costs.

Roughly 20 percent of the Israeli public reports their household income being hit to a “large” or “very large” extent since the start of their country’s war on Gaza.

In a recent survey, aid organisation “Latet” (“to give”) found that more than 45 percent of the public fear that economic hardship awaits them either later on in this war or after the war finishes. What is clear is that those Israeli families who were already living in poverty or who qualified as food insecure prior to October 7 will suffer the most from the economic problems stemming from this war.

“It’s hard to know what’s going on in the minds of our politicians, but Netanyahu and his government are facing unprecedented global diplomatic pressure to end the war and the economics of the war is playing less of a role in the decision-making,” said Fuld.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

[unable to retrieve full-text content]

World Economy Latest: ECB Keeps Interest Rates Unchanged Bloomberg

Deserted villas in a suburb of Shenyang, in China's northeastern Liaoning province, on March 31, 2023.JADE GAO/Getty Images

China’s leaders launched a barrage of new policies this week to prop up languishing financial markets and rekindle growth in the world’s second-largest economy.

The moves to support lending and spending with billions of dollars of fresh cash gathered pace when the central bank cut bank reserve requirements and issued new rules to encourage banks to lend more to property companies.

A collapse in China’s real estate market has been one of the key factors hindering the country’s recovery from the shocks of the COVID-19 pandemic. What’s at stake: stable financial markets and a major driver of global economic growth.

The Chinese economy grew at a 5.2 per cent annual pace in 2023, exceeding the government’s target, and many indicators including factory output and retail sales show signs of improvement. But most economists are forecasting a slowdown this year and next that will drag on global growth. Meanwhile, Chinese stock markets have swooned since late 2023, deepening losses that amount to trillions of dollars over the past several years. A real estate downturn, job losses and other trials of the COVID-19 pandemic have left consumers cautious about spending. That threatens to become what some economists say could be a deflationary spiral as prices for housing and other goods fall, discouraging investment that would create jobs and spur a stronger recovery.

The weakening economy and crackdowns on the technology industry, along with disruptions during the pandemic and trade tensions with the United States, have left foreign investors wary about the business outlook in China. Premier Li Qiang chaired a meeting of the State Council, or Cabinet, this week where he said more has to be done to “stabilize the market and boost confidence.” Last week, speaking at the World Economic Forum in Davos, Switzerland, he sought to sell investment in China as “not a risk, but an opportunity.”

A vital priority is ensuring growth is fast enough to generate ample jobs for young workers as they leave school. The rate of unemployment among young Chinese surged in 2023 to a record of over 21 per cent. It’s fallen since to about 15 per cent but still remains perilously high, adding to the urgency to get growth back on track.

The central bank will cut the ratio of reserves it holds on behalf of banks by 0.5 percentage points as of Feb. 5. People’s Bank of China Gov. Pan Gongsheng said that would free up an extra 1 trillion yuan ($140-billion) in funds. The PBOC also reduced the interest rate banks charge each other and issued new rules meant to expand access to commercial bank loans for property developers. Until the year’s end, real estate companies will be allowed to use bank loans pledged against commercial properties such as offices and shopping malls to repay their other loans and bonds. Earlier, regulators cut mortgage rates and lifted curbs on property buying. After share prices tumbled, state-owned institutional investors reportedly were ordered to buy shares.

Dozens of developers defaulted on their debts after the government cracked down on excessive borrowing in the industry several years ago. The largest, China Evergrande, is still trying to resolve more than $300-billion in debts and a Hong Kong court is due to hold a hearing on its restructuring plans next week.

It’s unclear what impact the new policies might have on the overall crisis gripping the property market. Land sales have long been a major revenue source for local governments that also are now heavily in debt. At the same time, stalled construction of new homes has hit contractors and suppliers of construction materials and home furnishings. That has wiped out untold numbers of jobs, rippling through the economy. Sales of new homes and home prices have been falling, discouraging consumers from spending since Chinese families tend to have much of their wealth tied up in property. The industry as a whole accounts for more than a quarter of business activity in China.

As China’s rapid rise as an economic superpower loses momentum, foreign investors and consumers are watching for signs that Beijing has a clear game plan for navigating the economy through an era of slower growth.

The moves to put more money into the economy and encourage bank lending might not go far enough, many analysts said. The cut in required bank reserves frees up more credit, but “it doesn’t tackle the root issue; hence you can lead a horse to water, but you cannot make him drink,” Stephen Innes of SPI Asset Management said in a report. Economists tend to concur that longer-term reforms, such as creating a better social safety net to enable families to spend rather than stashing their rainy day savings in banks, are needed to sustain strong growth. Too much of the nation’s wealth still goes into construction of infrastructure such as roads and railways, and uncertainty over policies has discouraged investment in small, private businesses that create the most jobs.

Kyle Schaefer is worried that his days as a fishing guide are numbered.

He was one of five witnesses who appeared before the Senate Budget Committee on Wednesday to detail how climate change threatens the “blue economy,” a term that ecompasses the many ways that the world’s oceans contribute to the global economy.

“The climate trends pose a significant increase in risk and weaken my confidence in a prosperous future for my fishing businesses,” said Schaefer, an American who owns a small business in the Bahamas. “I may be forced to close my charter business within the next few seasons simply because there won’t be enough fish left.”

Climate scientists and economists have warned that climate change could do significant damage to the global economy in future decades — and that some of those changes are already happening now. A severe drought is hampering ships in the Mississippi River and global ocean temperatures reached record heights for nine straight months last year.

Sea level rise is somewhat counterintuitively also a risk, combining with more powerful storms to threaten crucial ports.

“Sea level rise impacts coastal ecosystems and infrastructure that underpin the blue economy including supply chains, real estate, infrastructure, agriculture, insurance markets, health costs and more,” Andrea Dutton, a professor at the University of Wisconsin-Madison in the department of geoscience, told the hearing.

Sen. Sheldon Whitehouse, D-R.I., chair of the Senate Budget Committee, called for urgency. His state counts ocean industries as a particularly important part of its economy.

“Ocean economies face particular risk from climate changes,” he said at the hearing. “You’ve heard the warnings. You saw the witnesses. They were serious grown-ups, experts in their fields. The early evidence of their warnings coming true is already visible. It’s time to wake up.”

The blue economy is projected to grow faster than the global economy in the coming decades and reach $3 trillion by 2030, according to the Organisation for Economic Co-operation and Development. According to the National Oceanic and Atmospheric Administration, 40% of people in the United States live on the coasts and are at higher risk of high-tide flooding, hurricanes, sea level rise, erosion and climate change.

Climate change — and most notably what to do about it — remain a highly politicized issue in Washington, though more Republicans have begun to embrace calls for urgent action.

Sen. Ron Johnson, R-Wisc., said the U.S. would need to balance its economic interests with its climate actions and pushed to hold China and India accountable for their output of harmful greenhouse gases.

“I’m not a climate change denier. I’m just not a climate change alarmist,” he said at the hearing.

Although no specifics were given on how government money can be spent in future bills to specifically aid the blue economy, witnesses and legislators all pointed to diminishing fossil fuel reliance as the core solution.

“Because humans are driving the rapid warming of our planet, that means that we are also the solution to this problem,” Dutton said. “Our climate future is not just a place that we get to go to, it is a place that we get to create together.”

CORRECTION (Jan. 25, 12:29 p.m. ET): An earlier version of this article misidentified the committee that heard testimony on climate change and the economy. It was the Senate Budget Committee, not the Senate Banking Committee.

WASHINGTON (AP) — The nation’s economy grew at an unexpectedly brisk 3.3% annual pace from October through December as Americans showed a continued willingness to spend freely despite high interest rates and price levels that have frustrated many households.

Thursday’s report from the Commerce Department said the gross domestic product — the economy’s total output of goods and services — decelerated from its sizzling 4.9% growth rate the previous quarter. But the latest figures still reflected the surprising durability of the world’s largest economy, marking the sixth straight quarter in which GDP has grown at an annual pace of 2% or more.

Consumers, who account for about 70% of the total economy, drove the fourth-quarter growth. Their spending expanded at a 2.8% annual rate, for items ranging from clothing, furniture, recreational vehicles and other goods to services like hotels and restaurant meals.

The GDP report also showed that despite the robust pace of growth in the October-December quarter, inflationary measures continued to ease. Consumer prices rose at a 1.7% annual rate, down from 2.6% in the third quarter. And excluding volatile food and energy prices, so-called core inflation came in at a 2% annual rate.

Those inflation numbers could reassure the Federal Reserve’s policymakers, who have already signaled that they expect to cut their benchmark interest rate three times in 2024, reversing their 2022-2023 policy of aggressively raising rates to fight inflation. Some economists think the Fed could begin cutting rates as early as May.

Nathan Sheets, global chief economist at Citi, said that recent experience suggests that economic growth can remain solid even as inflation cools.

“It underscores for the Fed that they don’t have to be in a hurry” to ease borrowing rates to aid the economy, said Sheets, who thinks the first rate cut will occur in June.

The state of the economy is sure to weigh on people’s minds ahead of the November elections. After an extended period of gloom, Americans are starting to feel somewhat better about inflation and the economy — a trend that could sustain consumer spending, fuel economic growth and potentially affect voters’ decisions. A measure of consumer sentiment by the University of Michigan, for example, has jumped in the past two months by the most since 1991.

There is growing optimism that the Fed is on track to deliver a rare “soft landing” — keeping borrowing rates high enough to cool growth, hiring and inflation yet not so much as to send the economy into a tailspin. Inflation touched a four-decade high in 2022 but has since edged steadily lower without the painful layoffs that most economists had thought would be necessary to slow the acceleration of prices.

The economy has repeatedly defied predictions that the Fed’s aggressive rate hikes would trigger a recession. Far from collapsing last year, the economy accelerated — expanding 2.5%, up from 1.9% in 2022.

“Our expectation is for a soft landing, and it looks like things are moving that way,’’ said Beth Ann Bovino, chief economist at U.S. Bank. Still, Bovino expects the economy to slow somewhat this year as higher rates weaken borrowing and spending.

“People are going to get squeezed,’’ she said.

The economy’s outlook had looked far bleaker a year ago. As recently as April 2023, an economic model published by the Conference Board, a business group, had pegged the likelihood of a U.S. recession over the next 12 months at close to 99%.

Even as inflation in the United States has slowed significantly, overall prices remain nearly 17% above where they were before the pandemic erupted three years ago, which has exasperated many Americans. That fact will likely raise a pivotal question for the nation’s voters, many of whom are still feeling the lingering financial and psychological effects of the worst bout of inflation in four decades. Which will carry more weight in the presidential election: The sharp drop in inflation or the fact that most prices are well above where they were three years ago?

The Fed began raising its benchmark rate in March 2022 in response to the resurgence in inflation that accompanied the economy’s recovery from the pandemic recession. By the time its hikes ended in July last year, the central bank had raised its influential rate from near zero to roughly 5.4%, the highest level since 2001.

As the Fed’s rate hikes worked their way through the economy, year-over-year inflation slowed from 9.1% in June 2022, the fastest rate in four decades, to 3.4% as of last month. That marked a striking improvement but still leaves that inflation measure above the Fed’s 2% target.

The progress so far has come at surprisingly little economic cost. Employers have added a healthy 225,000 jobs a month over the past year. And unemployment has remained below 4% for 23 straight months, the longest such streak since the 1960s.

The once red-hot job market has cooled somewhat, easing pressure on companies to raise pay to keep or attract employees and then pass on their higher labor costs to their customers through price hikes.

It’s happened in perhaps the least painful way: Employers are generally posting fewer job openings rather than laying off workers. That is partly because many companies are reluctant to risk losing workers after having been caught flat-footed when the economy roared back from the brief but brutal 2020 pandemic recession.

“Businesses are getting rid of job openings, but they’re holding onto workers,” Bovino said.

Another reason for the economy’s sturdiness is that consumers emerged from the pandemic in surprisingly good financial shape, partly because tens of millions of households had received government stimulus checks. As a result, many consumers have managed to keep spending even in the face of rising prices and high interest rates.

Some economists have suggested that the economy will weaken in the coming months as pandemic savings are exhausted, credit card use nears its limits and higher borrowing rates curtail spending. Still, the government reported last week that consumers stepped up their spending at retailers in December, an upbeat end to the holiday shopping season.

Credit card balances and rates were at record highs even before the recent solid holiday shopping season. And buy-now-pay-later plans, which let shoppers break up the cost of an item over time, have spiked.

___

AP Economics Writer Christopher Rugaber in Washington contributed to this report.

Paul Wiseman, The Associated Press

Kyle Schaefer is worried that his days as a fishing guide are numbered.

He was one of five witnesses who appeared before the Senate Budget Committee on Wednesday to detail how climate change threatens the “blue economy,” a term that ecompasses the many ways that the world’s oceans contribute to the global economy.

“The climate trends pose a significant increase in risk and weaken my confidence in a prosperous future for my fishing businesses,” said Schaefer, an American who owns a small business in the Bahamas. “I may be forced to close my charter business within the next few seasons simply because there won’t be enough fish left.”

Climate scientists and economists have warned that climate change could do significant damage to the global economy in future decades — and that some of those changes are already happening now. A severe drought is hampering ships in the Mississippi River and global ocean temperatures reached record heights for nine straight months last year.

Sea level rise is somewhat counterintuitively also a risk, combining with more powerful storms to threaten crucial ports.

“Sea level rise impacts coastal ecosystems and infrastructure that underpin the blue economy including supply chains, real estate, infrastructure, agriculture, insurance markets, health costs and more,” Andrea Dutton, a professor at the University of Wisconsin-Madison in the department of geoscience, told the hearing.

Sen. Sheldon Whitehouse, D-R.I., chair of the Senate Budget Committee, called for urgency. His state counts ocean industries as a particularly important part of its economy.

“Ocean economies face particular risk from climate changes,” he said at the hearing. “You’ve heard the warnings. You saw the witnesses. They were serious grown-ups, experts in their fields. The early evidence of their warnings coming true is already visible. It’s time to wake up.”

The blue economy is projected to grow faster than the global economy in the coming decades and reach $3 trillion by 2030, according to the Organisation for Economic Co-operation and Development. According to the National Oceanic and Atmospheric Administration, 40% of people in the United States live on the coasts and are at higher risk of high-tide flooding, hurricanes, sea level rise, erosion and climate change.

Climate change — and most notably what to do about it — remain a highly politicized issue in Washington, though more Republicans have begun to embrace calls for urgent action.

Sen. Ron Johnson, R-Wisc., said the U.S. would need to balance its economic interests with its climate actions and pushed to hold China and India accountable for their output of harmful greenhouse gases.

“I’m not a climate change denier. I’m just not a climate change alarmist,” he said at the hearing.

Although no specifics were given on how government money can be spent in future bills to specifically aid the blue economy, witnesses and legislators all pointed to diminishing fossil fuel reliance as the core solution.

“Because humans are driving the rapid warming of our planet, that means that we are also the solution to this problem,” Dutton said. “Our climate future is not just a place that we get to go to, it is a place that we get to create together.”

CORRECTION (Jan. 25, 12:29 p.m. ET): An earlier version of this article misidentified the committee that heard testimony on climate change and the economy. It was the Senate Budget Committee, not the Senate Banking Committee.

Discussions move from how high to how long

The Bank of Canada held its key overnight interest rate at five per cent for the fourth consecutive time, as inflation remains higher than desired and economic growth has not slowed enough to warrant a cut.

“The Council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation,” the central bank said in a Jan. 24 statement.

Advertisement 2

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Article content

Article content

“Governing Council wants to see further and sustained easing in core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

The central bank did, however, signal a shift in discussions.

“With overall demand in the economy no longer running ahead of supply, governing council’s discussion of monetary policy is shifting from whether our policy rate is restrictive enough to restore price stability to how long to stay at the current level,” Bank of Canada governor Tiff Macklem said during a Jan. 24 news conference.

However, he said this doesn’t mean the central bank has ruled out rate increases, if necessary.

“We may still need to raise rates,” Macklem said, echoing caution that has characterized previous hold decisions.

Nevertheless, many economists expect the Bank of Canada will begin to trim interest rates later this year after a record run-up since early 2022, given Canada’s tepid economy and the central bank’s own outlook.

In response to questions from media about the timing of a potential cut, which market signals and some economists anticipate will come as early as April or June, Macklem declined to spell out a timeline.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

Article content

“I worry that putting it on a calendar, it’s a false sense of precision,” he said, adding that there have been mixed economic indicators over several quarters.

“In the months ahead, we will continue to see this push and pull” between economic indicators, he said.

Moreover, he said rate hikes this past summer are still working their way through the system.

“We need to give these higher rates time to do their work,” Macklem said.

Total CPI inflation stood at 3.4 per cent in December 2023, above the central bank’s target rate of two per cent, with shelter costs the biggest contributor to above-target inflation.

One metric Macklem said could cause rates to be raised again, rather than lowered, is an unexpected surge in house prices. This is not in the Bank of Canada’s base case projection for inflation and growth in the Canadian economy, he said.

The decision to hold rates on Jan. 24 drew a forecast of more activity in the real estate market from Christopher Alexander, president of RE/MAX Canada, who called the Bank’s decision “a welcomed one” for many Canadian homebuyers.

Advertisement 4

Article content

“We might see a boost in housing market activity, especially for those that have been taking a ‘wait and see’ approach and are waiting for the right time to re-enter the market,” Alexander said. “This could very likely result in an active first quarter of 2024 and a strong spring market, reminiscent of what we experienced at the top of the pandemic in early 2020.”

James Orlando, senior economist at Toronto-Dominion Bank, said while the central bank is not ready to set timing on a rate cut, markets are signalling it happening in either April or June.

We echo this sentiment,” he said in a note after the Bank’s announcement.

“(With) the realization that the BoC can’t set policy just based on elevated shelter inflation, it is clear that the central bank is getting ready to signal a rate cut in the coming months,” he wrote.

Part of the reason so many are expecting a cut is Canada’s tepid economic growth. And while the global economic picture is brighter, Bank of Canada officials have cited ongoing geopolitical risks, with wars in the Middle East and Russia-Ukraine as well as shipping disruptions in the Red Sea, as a concern.

Advertisement 5

Article content

“In Canada, the economy has stalled since the middle of 2023 and growth will likely remain close to zero through the first quarter of 2024,” the central bank said in its Jan. 24 statement.

“Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted.”

But while labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs are being created at a slower rate than population growth, wages are still rising by around four to five per cent.

The Bank of Canada expects economic growth to strengthen gradually around the middle of 2024.

“In the second half of 2024, household spending will likely pick up and exports and business investment should get a boost from recovering foreign demand,” the central bank said in the statement, adding that spending by governments will contribute materially to growth through the year.

Recommended from Editorial

Advertisement 6

Article content

“Overall, the bank forecasts GDP growth of 0.8 per cent in 2024 and 2.4 per cent in 2025, roughly unchanged from its October projection.”

As for global growth, the Canada’s central bank forecasts global GDP growth of 2.5 per cent in 2024 and 2.75 per cent in 2025.

“With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025,” the Bank of Canada said in its Jan. 24 statement.

• Email: bshecter@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Share this article in your social network

Comments

This Week in Flyers

[unable to retrieve full-text content] Lapid blasts government's 'confused' wartime restrictions as economy reopens but schools...

Comments