[unable to retrieve full-text content]

How China's Economic Slowdown Will Impact Its Rise to Top Economy BloombergHow China's Economic Slowdown Will Impact Its Rise to Top Economy - Bloomberg

Read More

[unable to retrieve full-text content]

How China's Economic Slowdown Will Impact Its Rise to Top Economy BloombergAlberta hasn't seen this type of population influx since 1981, and it’s providing a turbo-boost to the economy

Energy royalties are dipping and the province has trimmed its budget expectations for both oil and natural gas prices this year, yet economic growth in Alberta isn’t gearing down.

In fact, it’s picking up steam.

The province’s first-quarter financial update on Thursday predicted Alberta’s economy will expand by three per cent this year — up from estimates made in February’s budget — while the unemployment rate has been “contained.”

Advertisement 2

Subscribe now to read the latest news in your city and across Canada.

Subscribe now to read the latest news in your city and across Canada.

Create an account or sign in to continue with your reading experience.

What’s behind the gravity-defying trend?

Alberta’s soaring population is on pace to increase by 4.4 per cent for the census year (the period ending in June, once final data is released by Statistics Canada).

It’s the fastest annual growth since 1981, back when Peter Lougheed was the province’s premier and the original Raiders of the Lost Ark was tops at the movie theatres.

In other words, it’s been a very long time since we’ve seen this type of population influx and it’s providing a turbo-boost to the economy.

“That’s a very, very high number,” Finance Minister Nate Horner told reporters.

“I know our economists within the department have a hard time believing it, but we’re seeing strong (increases) not only immigration, but interprovincial migration and a lot of Ukrainian refugees adding to that number in a big way.”

In the latest financial report card, the province projects a $2.4-billion surplus in this fiscal year — up about $94 million from the February budget — even as it trimmed expectations for oil and natural gas prices.

The province sliced its projections for benchmark West Texas Intermediate crude prices to US$75 a barrel for the 2023-24 fiscal year. That’s down $4 a barrel from the initial budget estimates after global oil markets softened during the April-to-June period.

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of Headline News will soon be in your inbox.

We encountered an issue signing you up. Please try again

Advertisement 3

(Oil prices have rebounded over the past month and closed Thursday at $83.63 a barrel.)

The government also chopped its expected royalty take from Alberta natural gas by 47 per cent, cutting it to an estimated $1.3 billion this year.

The forecast price for Alberta natural gas has been lowered to C$2.50 per gigajoule (down from $4.10) reflecting weak prices, high inventory levels and growing production in North America.

Although bitumen royalties are anticipated to rise by another $515 million in this financial year to $13.1 billion, natural resource revenues have collectively fallen by nearly $700 million in just a few months.

This would normally be an ominous sign for the government’s finances.

Yet, the economy is outperforming initial budget expectations.

The province has now hiked the economic growth this year to three per cent in the fiscal year, up slightly from budget figures, and 2.9 per cent next year. “The majority of the uplift in the outlook for this year is being driven by recent population trends,” the report states.

The population growth has come from several different areas, with more than 46,000 people relocating to Alberta from other parts of the country so far this census year.

Advertisement 4

“Net international migration is also on track to reach a record high, bolstered by unprecedented net inflows of non-permanent residents,” which includes international students, refugee claimants and temporary foreign workers, it stated.

Marc Desormeaux, an economist with Desjardins, said the budget estimates were in line with expectations, given the relative state of energy prices.

“One number really stood out, which is the population growth forecast for 2023,” he said.

“The first thing it signifies is Alberta’s draw to people in other parts of the country at this time. Rates of interprovincial migration, particularly from Ontario, have been very strong in the past year.”

There have also been increases in international immigration to the province, along with natural population growth, which means these trends should persist into the next few years, Desormeaux added.

After several years of young Albertans moving to other places last decade following the drop in oil prices, the province is now seeing younger Canadians relocate here, said Janet Lane, director of the Human Capital Centre at the Canada West Foundation.

Advertisement 5

Unlike past population booms, this upswing isn’t as directly tied to rising energy prices, but to people taking jobs in many different economic sectors — and due to the lower cost of living compared with larger provinces, she said.

“It’s a combination — I can live a little cheaper (here) and I can get a decent job,” she said.

From an economic standpoint, a growing population means greater economic momentum, but also more demand on services and infrastructure.

Recent reports of surging rent levels and escalating housing prices, and the need for more teachers and doctors, are signs of a province grappling with growth pressures.

In Calgary, Kelly Ernst with the Centre for Newcomers said the front-line group is seeing rising demand for its services, such as housing and language training, and waiting lists are expanding.

“First and foremost, they see Alberta as a place of opportunity where they can get a job. So that’s our reputation right now,” said Ernst, the centre’s chief program officer.

“The infrastructure does need to be there . . . We’ve got to do this really quickly.”

Advertisement 6

Next year, the province projects the population increases will slow to 2.3 per cent.

Horner agreed that it’s “inevitable” Alberta could lose some of its affordability advantages over provinces as housing prices rise and inflation hits.

And housing starts are down over the past year, with the Danielle Smith-led government now projecting lower housing starts than it did in the budget, noted NDP MLA Samir Kayande.

On the employment front, the report said the province has added more than 60,000 jobs since December.

University of Calgary economist Trevor Tombe pointed out the government now anticipates the jobless rate will average six per cent in 2023, which is down 0.4 percentage points from the budget.

“That’s a pretty meaningful drop,” he said.

“So there is real broader-based economic strength in the province, beyond just the scale effect that comes from the population changes.”

Chris Varcoe is a Calgary Herald columnist.

Advertisement 1

[unable to retrieve full-text content]

How China's Economic Slowdown Will Impact Its Rise to Top Economy Bloomberg

While climate activists have targeted big corporations in their demonstrations for a long time, now, they're increasingly targeting ultra-wealthy individuals for their impacts on the planet, with private jets, super yachts and mansions. Global's Anne Gaviola speaks with The Peak Podcast's Brett Chang about climate and creating a fairer economy that works for everyone. Plus, Canada's corporate ethics watchdog is investigating several retailers over allegations of forced labour in company supply chains and operations. Additionally, a U.S. class-action lawsuit was brought forth against Burger King, alleging their Whopper burgers are too small — suggesting false advertising.

Readers consuming the flood of media reports on the dire state of China over the last few weeks may be convinced that the country's economy is doomed.

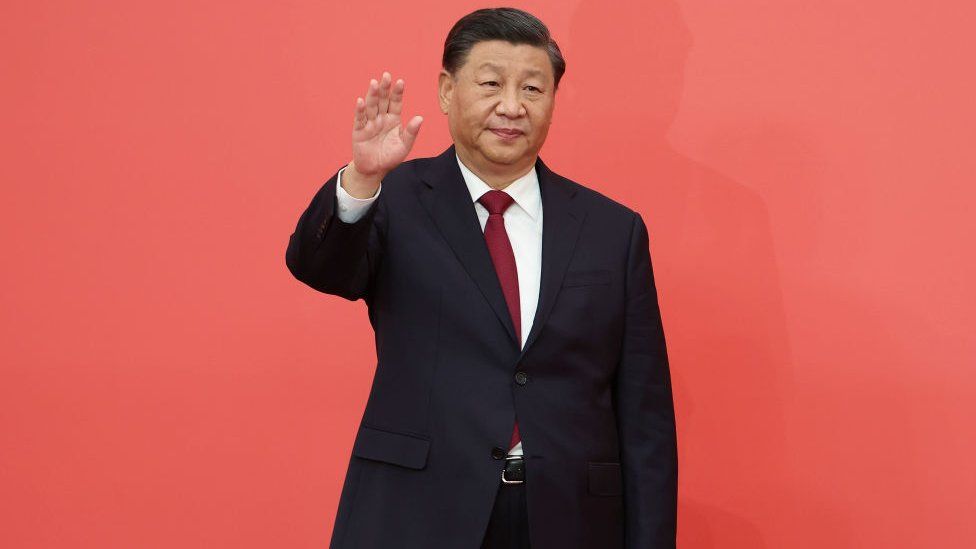

And perhaps not just the economy. China scholar Charles Burton this week offered the view that the leadership of Chinese autocrat Xi Jinping may itself be threatened as rising youth unemployment adds to popular disillusionment with the leadership in Beijing.

Burton, in an opinion piece for The Globe and Mail, reminds us that in 1930, as he was struggling to hold his revolution together against pessimists, Mao Zedong, the communist founder of the People's Republic of China, quoted the Chinese proverb that "a single spark can start a prairie fire." Could disenchanted youth be a new spark for the next Chinese revolution?

And it is not just youth who are disenchanted. Shares in the Chinese property giant Evergrande lost more than 80 per cent of their value this week. Meanwhile, Evergrande's competitor Country Garden, previously seen as safe, was struggling to avoid default.

The property sector accounts for 30 per cent of China's economy. So citizens, mom and pop investors, and businesses hoping for a commercial rebound after the government's draconian pandemic lockdown have been disappointed. Consumers are reconsidering spending plans as deflation begins to bite.

It's all being framed by some as China's Lehman moment, when trouble in the U.S. property market turned into the crash of Lehman Brothers, one of the world's most influential banks, resulting in the 2008 collapse of the U.S. economy. Others are instead characterizing it as China's Minsky moment — a similar phenomenon when excessive investment leads to a crash — caused in this case by too much debt.

Others yet are comparing it to the overinvestment by Japanese banks, supported by their government, causing what had been seen as the 1980s Japanese economic miracle to be transformed into its 1990s "lost decade."

"We could possibly be at a crossroads where things could turn in a direction we haven't seen for a while," said Steve Tsang, director of the China Institute at the University of London's School of Oriental and African Studies, in a phone conversation this week.

Most China watchers, including those I spoke to, stop short of expecting anything like a new Chinese revolution. But as Gordon Houlden, director emeritus at the University of Alberta's China Institute, told me, accidents can happen.

After 30 years of spectacular market-led economic growth that raised living standards, based partly on a glut of public spending, the country is suffering from financial indigestion.

And while the whole world may have a similar malady, as outlined by commentator Martin Wolf in his recent book on the important links between politics and business, what he calls "China's form of despotic capitalism" may be dangerously brittle.

"The move towards an Orwellian 'Big Brother' society, in which surveillance technology is employed by the party-state down to the very last individual, may work. But it is terrifying, threatening to crush the human desire for autonomy and self-expression," Wolf wrote in The Crisis in Democratic Capitalism, published earlier this year.

Duration 2:01

"Arbitrary state power makes all private property insecure and so threatens the market economy."

As Tsang and others have observed, China's moment of instability arrives just as the structural advantages that powered its economic boom are waning. That includes new signs of a declining population.

"Instead of having a demographic bonus, it's now starting to suffer from a demographic deficit," said Tsang. "All the easy to reach fruits have been picked."

Tsang says there are signs that the country may not attain the kind of economic growth that could complete its transition from a developing country into something more like high-income Japan, South Korea, Europe and North America. In other words, it will fail to break out of what is called the "middle income trap."

Other advantages that sparked the boom and made the country the factory to the world are also disappearing, such as Western technical transfers and investment, says Tsang, as countries like Canada look for more reliable partners. Local government borrowing that spurred investment, including in the glutted housing sector, has reached a breaking point. And that retrenchment has damaged the enthusiasm that acted as a virtuous circle of new investment and spending.

"The real estate market... has a huge impact on people's feel-good factor," said Tsang. "Things that have been very beneficial to China are being turned on their heads."

So, will the latest structural and property crisis lead to some sort of Chinese economic or political collapse? Gordon Houlden is skeptical.

"I've lived through a thousand supposed collapses of the Chinese economy and we're not there yet," said the longtime China watcher from Penticton, B.C., last week.

It is true that a Google search for news stories warning of China's imminent Minsky moment shows they go back at least a decade.

As we've seen with the Canadian property market, in economics coverage, doom sells. And while major cracks in Canadian housing or the Chinese economy could still happen, it is reasonable to assume there will be more dire warnings than there are collapses.

"If you said the Chinese economy has got some serious structural problems — particularly debt, slower growth, aging population? Absolutely," said Houlden. "Does this mean we are on the brink of some gigantic meltdown? I don't think so."

But can accidents happen? "Absolutely," he said, and China and its leadership must overcome a list of difficult conundrums, including that its startling growth rates of more than 20 per cent were simply unsustainable. Inevitably, growth has declined.

"To me that's simply coming back to real-world growth rates that are more or less the same as more mature economies," said Houlden.

The issue, according to Burton and others, is that current and future rates of growth may not be enough to satisfy the "post-Tiananmen bargain" — a tacit agreement that popular agitation for more democracy was relinquished in exchange for a promise of government-led widespread prosperity. The endless boom is not turning out the way the Chinese people expected.

By that way of thinking, in order to keep its mandate to govern, the Xi-led government must struggle to prevent its economy from declining further, including by depending less on exports and creating a strong domestic consumer economy.

"That hasn't worked out as well as they thought," said Houlden, "partly because Chinese are prodigious savers, and when things get a little bit dicier, they save even more."

Like Tsang, Houlden notes the effects of declining population that he says are unlikely to be reversed. Government spending, especially at the regional level, cannot continue at recent levels. Dependence on imports has proven hard to break. But he says China has advantages including that, unlike the U.S., its borrowing is domestic.

China’s Japanification <a href="https://t.co/NJEEoTXcIu">https://t.co/NJEEoTXcIu</a>

—@ftchina

Houlden says he is not an optimist but a realist and that even at relatively low levels of growth, the enormous Chinese economy remains on track to exceed that of the United States over the next decade.

"I call it the 'tyranny of the headlines.' When we see indications of the Chinese economy slowing we say 'Oh my God! Collapse! The miracle's over.' It's not," said Houlden.

Like Wolf, he thinks restricting information about the economy from the people trying to make the economy function, as we've seen with banning of youth employment statistics, is not productive. He says previous leaders assumed a strong economy required a more open economy and more widespread knowledge of how it was functioning.

"Xi is a different kind of cat," said Houlden, but he says he sees a recent pullback on attempts to micromanage the economy.

"I think that there may have been some recognition by Xi and his advisers that there's a risk that they can kill the golden goose by over-regulation," he said.

Like Houlden, Tsang says Xi will be willing to make changes in the short term to try to get the economy back on track to growth.

"This guy is first and foremost focused on staying in power," said Tsang pointing to Xi's reversal on stringent lockdowns after widespread public demonstrations. "So if he sees those problems as potentially going to threaten his hold on power, he'll make changes."

But Tsang is worried that the kind of fixes Xi will be willing to try just won't work, and if China's economic downturn stretches out from months to a year or more, it will be very hard to disguise the fact that Xi's economic strategy has failed.

"If and when that point is reached, Xi will turn to much harsher repression and xenophobia to stay in power," predicted Tsang.

"Sell in May and go away" is a timeless stock market adage, describing the market's penchant for dropping as summer begins and investors turn their attention away from bar charts and to the beach.

But while markets sell off in the month of May, it's got nothing on September.

Historically speaking, September is the worst month for stocks by a mile.

This may be a particularly stormy September, as mounting fears across the market give investors pause, forcing them to wonder if this year's rally may finally run out of steam.

Julian Emanuel, a senior managing director at Evercore ISI, recently published a note for clients warning them of what may be ahead. He detailed what investors should be wary of heading into September, where they should be investing, and why a bad September for stocks may be a blessing in disguise.

The once-roaring stock market rally has stalled out since the S&P 500 hit a high at the end of July as investor optimism begins to fade.

A simple indication of this: earlier this year the market was dragged higher as Nvidia announced stellar first-quarter earnings that pointed to a bright future for AI in general, and tech stocks in particular.

Somehow Nvidia topped that performance with its second-quarter earnings announcement. But instead of celebration and buying, investors greeted the news with a shrug and a sell-off.

Perhaps this sell-off is a natural part of summer turning to fall, and investors simply wanted to take their winnings and run.

But is the recent market weakness really just due to seasonality?

Emanuel doesn't think so. He believes the market has reconstructed the 'Wall of Worry' that it had seemingly demolished back in July, when fears of a recession gave way to optimism.

"The "Wall of Worry" that had all but disappeared by July is being rebuilt – U.S. 10 year yields above 4%, anxiety rising in China, Europe's economy slumps, and a more sober tone from some U.S. retailers," Emanuel wrote.

Emanuel is particularly concerned about bond yields — specifically 10-year yields, which, historically, have a habit of hurting markets any time they rise above 4%, as they did in late 2022 and early 2023.

Emanuel noted that stocks and bonds spent 2022 and the first quarter of 2023 positively correlated, with stocks heading down and yields rising as inflation volatility kept investors jumpy.

But that all changed in March as the banking crisis hit, and investors were suddenly willing to take on risk again, buying into the stock market's sudden surge and sending stocks higher. Yet bond yields rose as well even as investors bought into a "risk on" mentality, Emanuel wrote.

"'Risk On' returned as the combination of AI leaders' gains rekindling animal spirits, the knowledge that the Fed 'has depositors' backs' and raising the debt ceiling to fund spending further toward infinity is 'business as usual,'" he wrote.

But if that risk-on attitude changes to risk off, Emanuel believes that's the first warning sign that markets are in trouble and a recession may be imminent.

"While stocks have indeed become 'queasy' with yields continuing to grind higher during August, the bigger risk would be if the 'paradigm flipped' to 'Risk Off' and both stocks and yields started to move lower, as they did during prior periods of 'Risk On/Risk Off' within the previous Positive Correlation epoch – 1998, 1987, 1974, all Bear Market years," Emanuel wrote.

There are two other warning signs Emanuel is keeping an eye on. First, he's been pleased with the strength of the US industrials sector, which has weathered the weakness in Europe and China well.

However, if the industrials sector falls below its 200-day moving average, it's a sign that this key sector has capitulated, and could indicate that the rest of the economy will fall with it.

Finally, Emanuel believes that the most important indicator of the economy's health is jobs. Initial jobless claims in particular are the "gold standard" of jobs data, and the August 31 report will be a key data point for determining what's ahead for the US economy, he wrote.

While jobless claims have trended higher recently, Emanuel wrote that a warning sign will be if they rise to over 250,000 per week, and a glaring indication that a recession has arrived will be if jobless claims spend four or more weeks above 300,000.

While a difficult September in the face of all the aforementioned worries above may seem like an investor's nightmare, historically speaking, it's actually a good thing.

With a sell-off in September, October can present investors with an opportunity to buy at a lower price point. And in the years that a September sell-off doesn't occur, as was the case in 2018 and 2007, the market has a habit of making investors pay for it.

With all that said, how should investors take advantage of the buying opportunity after the September doldrums fade away?

Emanuel wrote that he remains bullish on energy and healthcare stocks right now. He's also investing in tangentially AI-related companies, including Vertiv Holdings (VRT), JPMorgan (JPM), Booking Holdings (BKNG), and Domino's Pizza (DPZ), when opportunities present themselves to buy in cheaply.

"We also want to continue owning Zero Cost Collar Option hedges on growth centric, rate sensitive QQQ," Emanuel wrote.

Emanuel concluded his message to investors by succinctly summarizing how best to handle a market downturn in September.

"Stay defensive into October, the high conviction buying opportunity still lies ahead, at lower prices."

The past six months has brought a stream of bad news for China's economy: slow growth, record youth unemployment, low foreign investment, weak exports and currency, and a property sector in crisis.

US President Joe Biden described the world's second-largest economy as "a ticking time bomb", predicting growing discontent in the country.

China's leader Xi Jinping hit back, defending the "strong resilience, tremendous potential and great vitality" of the economy.

So who is right - Mr Biden or Mr Xi? As is often the case, the answer probably lies somewhere in between.

While the economy is unlikely to implode any time soon, China faces huge, deep-rooted challenges.

Central to China's economic problems is its property market. Until recently, real estate accounted for a third of its entire wealth.

"This made no sense. No sense at all," says Antonio Fatas, professor of economics at the business school INSEAD in Singapore.

For two decades, the sector boomed as developers rode a wave of privatisation. But crisis struck in 2020. A global pandemic and a shrinking population at home are not good ingredients for a programme of relentless housebuilding.

The government, fearing a US-style 2008 meltdown, then put limits on how much developers could borrow. Soon they owed billions they could not pay back.

Now demand for houses has slumped and property prices have plunged. This has made Chinese homeowners - emerging from three years of tough coronavirus restrictions - poorer.

"In China, property is effectively your savings," says Alicia Garcia-Herrero, chief Asia economist at wealth management firm Natixis. "Until recently, it seemed better than putting your money into the crazy stock market or a bank account with low interest rates"

It means that, unlike in Western countries, there has been no post-pandemic spending boom or major economic bounce back.

"There was this notion that Chinese people would spend like crazy after zero-Covid," Ms Garcia-Herrero says. "They'd travel, go to Paris, buy the Eiffel Tower. But actually they knew their savings were getting hammered by the fall in house prices, so they've decided to keep hold of what cash they have."

Not only has this situation made households feel poorer, it has worsened the debt problems faced by the country's local governments.

It is estimated that more than a third of their multi-billion dollar revenues come from selling land to developers, which are now in crisis.

According to some economists, it will take years for this property pain to subside.

The property crisis also highlights problems in the way China's economy functions.

The country's astonishing growth in the past 30 years was propelled by building: everything from roads, bridges and train lines to factories, airports and houses.It is the responsibility of local governments to carry this out.

However, some economists argue this approach is starting to run out of road, figuratively and literally.

One of the more bizarre examples of China's addiction to building can be found in Yunan province, near the border with Myanmar. This year, officials there bafflingly confirmed they would go ahead with plans to build a new multi-million dollar Covid-19 quarantine facility.

Heavily indebted local governments are under so much pressure that this year some were reportedly found to be selling land to themselves to fund building programmes.

The bottom line is that there is only so much China can build before it starts becoming a waste of money. The country needs to find another way of generating prosperity for its people.

"We're at an inflection point," Professor Fatas says. "The old model is not working, but in order to change focus you need serious structural and institutional reforms."

For example, he argues, if China wanted a financial sector to fire up its economy and rival the US or Europe, the government would first need to loosen regulation considerably, ceding large amounts of power to private interests.

In reality, the opposite has happened. The Chinese government has tightened its grip on the finance sector, scolded "westernised" bankers for their hedonism and cracked down on big technology firms like Alibaba.

One way this has been reflected is in youth unemployment. Across China, millions of well-educated graduates are struggling to find decent white-collar jobs in urban areas.

In July, figures showed a record 21.3% of jobseekers between the ages of 16 and 25 were out of work. The following month, officials announced they would stop publishing the figures.

According to Professor Fatas, it is testament to a "rigid, centralised economy" struggling to absorb such a high number of people into the labour force.

A top-down system is effective when you want to build a new bridge, but looks cumbersome when the bridge has already been built and people are still looking for work.

A change of economic direction requires a change of political ideology. Judging by the Chinese Communist Party's (CCP) tightening grip on life recently and President Xi's tightening grip on the CCP, this doesn't look likely. The leadership might argue it is not even necessary.

In some ways, China is a victim of its own success. The current rate of growth is only considered "slow" when you compare it with the staggeringly high numbers of previous years.

Since 1989, China has averaged a growth rate of around 9% per year. In 2023, that figure is predicted to be around 4.5%.

It is a big drop off, but still much higher than the economies of the US, the UK and most European countries. Some have argued that this suits China's leadership just fine.

Western economies tend to be powered by people spending, but Beijing is wary of this consumerist model. Not only is it deemed wasteful, it is also individualistic.

Empowering consumers to buy a new TV, subscribe to streaming services or go on holiday may help stimulate the economy, but it does little for China's national security or its competition with the US.

Essentially, Mr Xi wants growth, but not for the sake of it. This may be behind the recent boom in cutting-edge industries, such as semiconductors, artificial intelligence and green technology - all of which keep China globally competitive and make it less reliant on others.

This idea might also explain the government's limited response to the faltering economy. So far it has only tweaked around the edges - easing borrowing limits or shaving a fraction off interest rates - rather than pumping in large amounts of money.

Foreign investors in China are worried and want the government to take action quickly, but those in charge seem to be playing the long game.

They know that, on paper, China still has massive potential for more growth. It may be an economic powerhouse, but average annual income is still only $12,850. Almost 40% of people still live in rural areas.

So on the one hand, not being tied to election cycles has allowed and will allow China the luxury of taking such a long-term view.

But on the other, many economists argue that an authoritarian political system is not compatible with the kind of flexible, open economy needed for living standards matching those in officially "high-income" countries.

There could be a danger that Mr Xi is prioritising ideology over effective governance, or control over pragmatism.

For most people, this is fine when the economy is doing well. But as China comes out of three years of zero-Covid, with many struggling to find a job and family homes plunging in value, it is a different story.

This takes us back to Mr Biden's "ticking time bomb" description, which suggests civil unrest or, even more seriously, some kind of dangerous foreign policy action in response to it.

At the moment, though, that is pure speculation. China has emerged from any number of crises in the past. But there is no doubt that the country's leadership is now facing a unique set of challenges.

"Are they worried about the current situation? Of course, they see the numbers," Professor Fatas says.

"Do they understand what needs to be done? I'm not sure. My guess is they're missing certain things that are fundamental for the future of China."

Anyone looking for firm direction from the world's most powerful central banker in his much-anticipated speech on Friday in Jackson Hole, Wyo., will inevitably be disappointed.

Investors may be glad that U.S. Federal Reserve chair Jerome Powell did not use his 15 minutes in the global spotlight to crash the markets the way he did last year.

But taken literally, the Fed chair's colourful statement that he is "navigating by the stars under cloudy skies" is a frightening reminder that as we head into the autumn, one of the world's key economic leaders seems a little bit lost.

For more than 40 years, the people who ultimately decide how much you pay for your house and whether you will have a job next year have been putting their heads together at a stunning wilderness resort in Wyoming named after a local trapper from the 1800s, Davey Jackson.

Rather than Jackson's cabin, Powell and crew stayed at the luxury Jackson Lake Lodge during the three-day Jackson Hole Economic Symposium that ended on Saturday. But anyone even one-quarter as familiar with the outdoors as a 19th-century trapper will know that counting on travelling by the stars when they are obscured by clouds is a hopeless and even dangerous endeavour that could well leave you stranded in a swamp or devoured by bears.

Even as they donned checked shirts for their mountain escape from their normal habitat of skyscrapers and smog, it is only fair to say that Powell and his speech writers likely did not grasp how portentous their analogy would be to, say, an experienced Canadian hiker imagining being lost in the woods at dusk without a compass.

In many other portions of his short speech, Powell made it clear — as the Bank of Canada governor recently did even as he hiked interest rates — that the central bank remains flummoxed by conflicting data and that a false trail could lead us all in the wrong direction.

"Uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little," Powell told the Jackson Hole audience of central bankers, economists and financial reporters last week.

"Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy."

Despite his fear of doing economic damage, Powell insisted that inflation was still too high and that the bank would raise rates again if it appeared core inflation was not getting back down to what he said still remains the central bank's two per cent inflation target.

The difficulty faced by Powell and his opposite number in Canada is that the data is all over the place.

The automobile sector, he said, was an area where a combination of a doubling in auto purchase loan costs and an end to supply chain blockages shows signs they are working together to bring inflation to heel.

"As the pandemic and its effects have waned, production and inventories have grown and supply has improved. At the same time, higher interest rates have weighed on demand," Powell said. "Motor vehicle inflation has declined sharply because of the combined effects of these supply and demand factors."

Specifically in the case of the United States, house prices and rents are showing signs of falling — but the slow pace of reduction may be one more example of the well-known lag effect, as interest rate impacts only slowly appear in the economy because they are still "in the pipeline," he said.

"Because leases turn over slowly, it takes time for a decline in market rent growth to work its way into the overall inflation measure," Powell said.

Canadians renters are also waiting for that slow process to emerge here, although intense housing demand north of the border may stand in the way.

In many other sectors, Powell said that any slowdown in price growth has been "modest" — and in jobs, consumer spending and rising gross domestic product, the bank sees signs that another hike in rates could be needed.

Widely discussed last week and hinted at by Powell is the idea that interest rates could stay higher for longer as an alternative to more hikes.

Unlike Powell, Canadian economist Vivek Dehejia was able to put some real numbers on what kind of interest rates to expect. In a phone conversation, the associate professor of economics at Ottawa's Carleton University suggested a path out of the woods is one where interest rates remain near their current levels until inflation approaches the central banks' target.

Duration 2:27

"Given that inflation seems to be trending down in both the U.S. and Canada, I think the more prudent course is to wait a bit, be a little patient and see what happens," Dehejia said.

But he said he thinks that Canadian borrowers expecting interest rates to decline to the low levels near zero that pushed real estate prices to current heights are likely to be disappointed.

The fact is that over the longer term, central bank interest rates on both sides of the border average out closer to five per cent. Even after the current "restrictive" rate hikes are over, Dehejia expects rates to "normalize," which will be in the three-to-four per cent range.

And then in the longer term, if the central banks should overshoot and put the economy into a deeper recession, Dehejia said, that would allow them to cut a little "because when you're at or near zero, there's no room to manoeuvre."

As Powell stares up at the clouds and hopes for a glimpse of the stars behind, there is one sign he may be close to the right path. While some critics bashed his brief speech for moving us toward recession with higher rates, others worried he was too soft on inflation.

As Dehejia suggests, it is reasonable to think that until the economy shows its true direction with clues such as this Friday's U.S. jobs data — Canada's data is coming out on Sept. 8, too late to help Bank of Canada governor Tiff Macklem with his rate decision on Sept. 6 — the U.S. central banker will hold off on any policy rate decision until it proves necessary.

"This uncertainty underscores the need for agile policy-making," Powell said.

[unable to retrieve full-text content] Fed report says U.S. economy solid but notes disruption from Minnesota immigration crackdown The ...

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation