Peel is in a tug-of-war with one of its most important sectors—the trucking industry. The region relies on a robust logistics sector to support its local economy. Almost half the region’s jobs are connected to the sector and the movement of goods contributes $49 million annually to Peel’s gross domestic product with about $1.8 billion of goods traversing its highways and roads each day.

But Peel has also committed to mitigating its climate footprint, and while a vitally important industry, trucking is a significant contributor to greenhouse gas emissions.

The Atmospheric Fund (TAF), a non-profit organization set up by the City of Toronto in 1991 to help finance climate action, studies carbon emissions across the Greater Golden Horseshoe.

Data from TAF show that throughout 2019 and 2020, Peel emitted 10 megatonnes of carbon, the second highest amount next to Toronto at 13.2 megatonnes.

A dramatic shift away from dirty transportation is needed if the world is to limit global warming below cataclysmic thresholds. So how can Peel continue to support a vital piece of its economy—that is a significant greenhouse gas contributor—while also reaching its own climate targets?

Is an economic shift in Peel’s future? Not likely.

But if solutions aren’t found, risks could upend the industry.

Earlier this year, Peel’s Regional Audit and Risk Committee received a report from staff detailing how climate change is impacting the goods movement sector across the region.

The findings are damning and showcase a multitude of vulnerable areas in the transportation network across Ontario. If the planet warms to the irreversible two degrees above pre-industrial levels—widely viewed by experts as a point of no return for devastating climate impacts—keeping the industry going will be costly.

Done in collaboration with the Toronto Region Conservation Authority (TRCA) and the University of Waterloo’s Terrametrics Research Lab, the study reviewed key climate hazards and how they will impact the movement of goods. The study did not focus just on trucking, but incorporated goods movement through the Pearson International Airport and along the Canadian National (CN) Railway Company lines as well.

The study relied on evidence from past environmental disasters in Peel to inform its findings.

The first natural disaster mentioned was the 2013 rain storm which flooded most of Peel, Toronto and cost $1 billion in damages according to the Insurance Board of Canada. Not only did it disrupt the trucking industry, it stranded people on GO Transit, overwhelmed stormwater systems and left widespread property damage. Another flood in 2018 cost a further $80 million and once again the Region saw a domino effect across the supply chain.

Not only does the study believe these sorts of weather events will continue, researchers also found continuous flooding has impacts beyond those caused by the initial flood.

“Another problem expected to arise due to increased flooding is the subsequent increase in erosion,” the review reads. “Erosion caused by floods affects both the underlying soil structure and built infrastructure designed to meet specified ranges in the underlying ground conditions.”

The report explains further investigation is needed in Peel to understand if the stormwater management system can withstand the projected increases in precipitation.

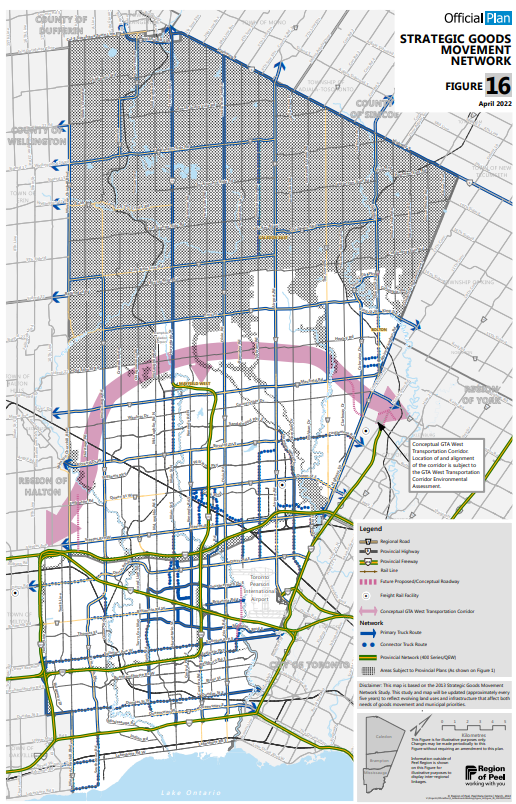

The Region of Peel Official Plan finalized in April 2022 set out to define roadways networks most important to the movement of goods.

(Region of Peel)

Roadways are also unique because of the expensive pavement surface and the ongoing budget requirements to maintain them. Despite being used everywhere, asphalt does not hold up well under the elements. Any driver is familiar with the sickening thud that can come from striking a pothole. These potholes are often created by the freeze and thaw of the pavement which cracks the surface. Freeze-thaw cycles are becoming more common with the changing climate, and the degradation to ground-related infrastructure is expected to get worse.

When water seeps underneath pavement or train tracks it is malleable, when it freezes it becomes hard, creating cracks. According to a City of Mississauga press release in March, the municipality had seen a 75 percent increase in the number of potholes in 2022 compared to the previous year.

One idea to reduce the reliance on highway infrastructure is a shift within the goods movement sector to the province’s rail network. But similar to roadways, railways come with their own set of vulnerabilities in a warming climate.

The train network in Ontario is small, and one disruption to a portion of track would trigger a chain reaction causing delays down the line.

“The rail system has a set of interconnecting components that lend themselves to failure much more easily than roads which may have alternative paths to ensure continuous operations,” the study explains.

Regional Councillor Annette Groves told The Pointer in order to relieve stress on local roadways, Peel should be investing in existing thoroughfares that are important to the sector. She pointed to Highway 407, the vastly underused toll road that bisects the region.

“Give the truckers a couple of lanes on there at no cost so that they can move their goods to market, because goods need to get to market today, not 10 years from now, not 15 years from now.”

According to researchers, extreme heat days and higher than usual temperatures will be widely felt across all transportation systems. Along with creating an increased demand for cooling systems on trucks carrying things like food or medicine, the hotter temperatures will negatively impact those forced to step out and work in these extreme temperatures.

Hotter days have dire impacts on human health and the well-being of employees. The consequences would be seen in sectors requiring outdoor work such as loading/unloading cargo, maintenance to infrastructure and trucks and airport activity. This warming is already being felt in Peel where data from the Credit Valley Conservation Authority found that since 1940 the region has been warming at twice the rate of the global average.

The City of Mississauga estimates each pothole takes about 20 minutes to fill.

(City of Mississauga)

According to the Audit and Risk study, heat days—which can lead to lost work hours—are particularly a concern for rail networks, since buckling of tracks in summer months is expected along with issues of equipment malfunction in higher temperatures.

The Intergovernmental Panel on Climate Change (IPCC) has produced various reports referenced often throughout the study. The United Nations panel has released damning scientific studies in recent years detailing the consequences that will befall the planet should a lack of climate mitigation continue. One theme throughout the IPCC’s reports raises the issue of more extreme and compounding events.

Instances of mass weather changes, increasing deadly storms — like the one seen a few weeks ago that killed a person in Brampton — tornadoes and extreme heat and cold snaps are expected to become more frequent.

“Drawing on an examination of projected weather patterns, it is likely that the Peel Region will experience similar intensifying concurrent weather patterns leading to the need for preplanning for critical services to residents and services,” the report warns.

If solutions to mitigating climate change are not found, Peel will have costly, potentially deadly disruptions in the future.

“The impact of a single event in one aspect of the system can result in cascading impacts on the overall stability and predictability of the region’s economy,” the report’s authors wrote.

The Region’s director of the Office of Climate Change and Energy Management made it clear at a council meeting that if Peel wants to accomplish the goal of reducing GHG emissions by 45 percent below 2010 levels, an acceleration of work and further funding is needed.

“The planet is now on a dangerous trajectory of warming. The Region of Peel is not immune,” Christine Tu said. “Act now, be bold.”

Peel’s Climate Change Action plan is 50 pages of ideas on how to reduce its corporate carbon footprint, this includes any buildings, systems, vehicles and organizational groups the Region directly oversees. According to the plan, buildings, water and wastewater and employee commuting create the most GHG emissions for Peel. Since the municipalities under the Region have public transit systems, their carbon emissions for Peel are not included in the breakdown.

The transport industry is largely the responsibility of the province which is supposed to take ownership of the increasing GHG emissions.

Statistics Canada says Ontario’s largest carbon emitting industry is the transportation sector with 36 percent of total emissions, followed by buildings at 17 percent. This contributed to a 2019 total of 163 megatonnes of carbon emitted in the atmosphere. According to Canada-wide data, Ontario is the second largest emitter of carbon in the country following Alberta.

The Ontario government website explains a decrease can be seen from 2000 to 2015 in total carbon emissions with transportation emissions staying consistent.

(Province of Ontario)

What Peel does oversee is the planning on where and how the Region will grow. Land-use policies are one of the most valuable tools in shaping a municipality’s future. In April, Peel councillors voted to open almost 11,000 acres of greenfield lands to expand the urban boundary. Some of the discussions surrounding the expansion hinted at the idea of Caledon becoming a freight village.

In 2018 Caledon Mayor Allan Thompson made a comment in an interview to Business View magazine on his aspirations for Caledon to become a “freight village.” These words have haunted the Mayor who initially walked back the comment.

But actions speak louder than words.

Since his election in 2018, Thompson has been pushing to expand Caledon’s trucking industry, create more warehouses and zone land as employment. This can be seen in the multiple Minister’s Zoning Orders (MZO) the Town Council has asked for, allowing farmland to be paved over. When Peel was passing its Official Plan (OP) until 2051, Thompson tried to force a motion at the last minute allowing Caledon to increase the amount of employment land within the OP.

It was not on the public agenda during the meeting and would have opened up huge swaths of land around Bolton and north of Mayfield Road for development, mirroring the proposed Highway 413, another project Thompson has aggressively pushed, to help create his “freight village”.

His close council ally, Jennifer Innis, has supported the same initiatives and is vying to become Caledon’s next mayor, after Thompson steps down later this year.

But her main rival for the job has a different vision.

“I don't support a freight village. I don't believe that a freight village is a good fit with what we want to do with respect to climate change and the climate change action plan that we have,” Groves, who is also running to become Caledon’s mayor, told The Pointer. “I don't know what a freight village would look like.”

A balance is needed to keep a valuable industry alive while also minimizing the impacts it has on the environment. As Peel and the world barrel toward human activities that will speed up climate change, industries are still figuring out how to adapt.

Similar to electric vehicles (EVs), the largest industrial sized green “big rigs” are hitting the market. An article from Autoweek describes the lengths at which manufacturing companies are going to ensure carbon pollution is limited. The piece explains how various large truck manufacturing companies like MAN and Scania with car companies like Volvo and Tesla are introducing electric technology into commercial transport trucks. The difficulties of switching over the industry as a whole is around the available technology for batteries to withstand long distances and pull thousands of pounds of goods.

Freightliner’s eCascadia vehicle has a travel range of 250 miles with two or three times the cost. Since these trucks travel much farther than average family vehicles, companies are unsure how they will hold up over time. Charging infrastructure along trucking routes is also scarcely available.

“There's got to be a way to do this and to do it right,” Groves said. “I'll be honest, I don't have those answers. But I think that if we put our heads together, along with the industry, we can come up with some very good solutions.”

Email: [email protected]

Twitter: @taasha__15

COVID-19 is impacting all Canadians. At a time when vital public information is needed by everyone, The Pointer has taken down our paywall on all stories relating to the pandemic and those of public interest to ensure every resident of Brampton and Mississauga has access to the facts. For those who are able, we encourage you to consider a subscription. This will help us report on important public interest issues the community needs to know about now more than ever. You can register for a 30-day free trial HERE. Thereafter, The Pointer will charge $10 a month and you can cancel any time right on the website. Thank you

Adblock test (Why?)

Trucking is a huge part of Peel's economy; how can its toll on the climate be reduced? - The Pointer

Read More