Rechercher dans ce blog

Thursday, March 31, 2022

Russia’s economy projected to shrink by 10%; Ukraine’s by 20% - Al Jazeera English

The economies of Russia and Ukraine will shrink by 10 percent and 20 percent respectively in 2022, according to the European Bank for Reconstruction and Development (EBRD).

In its first economic forecast since Russia’s invasion on February 24, the London-based lender warned on Thursday that the war had triggered “the greatest supply shock since at least the early 1970s” and would have a severe effect on economies far beyond the immediate area of the conflict.

The EBRD, issuing emergency forecasts based on a series of assumptions about events in the coming months, said it was the first international financial institution to update its guidance since the outbreak of the war in Ukraine five weeks ago. Previously, it had been expecting growth of 3.5 percent for Ukraine and three percent for Russia.

The latest prognoses “assume that a ceasefire is brokered within a couple of months, followed soon after by the start of a major reconstruction effort in Ukraine,” the multilateral bank said.

Under such a scenario, Ukraine’s war-battered gross domestic product should rebound by 23 percent next year.

But the heavy and far-reaching economic sanctions imposed on Russia by Western countries would mean that it would register zero growth.

“Sanctions on Russia are expected to remain for the foreseeable future, condemning the Russian economy to stagnation in 2023, with negative spillovers for a number of neighbouring countries in eastern Europe, the Caucasus and Central Asia,” the EBRD said.

“With so much uncertainty, the bank intends to produce a further forecast in the next couple of months, taking into account further developments.”

Belarus, which also faces Western sanctions over its role in the conflict, was forecast to shrink by three percent this year and then stagnate in 2023.

Supply shock

Founded in 1991, the EBRD works in many emerging economies across eastern, central and southeastern Europe, Central Asia, Turkey and the southern and eastern Mediterranean.

It predicted that its investment zone, excluding Belarus and Russia, would grow by 1.7 percent this year, less than half of the previous growth forecast of 4.2 percent in November.

Growth is then expected to pick up to five percent in 2023.

“Projections are subject to an exceptionally high degree of uncertainty, including major downside risks should hostilities escalate or should exports of gas or other commodities from Russia become restricted.”

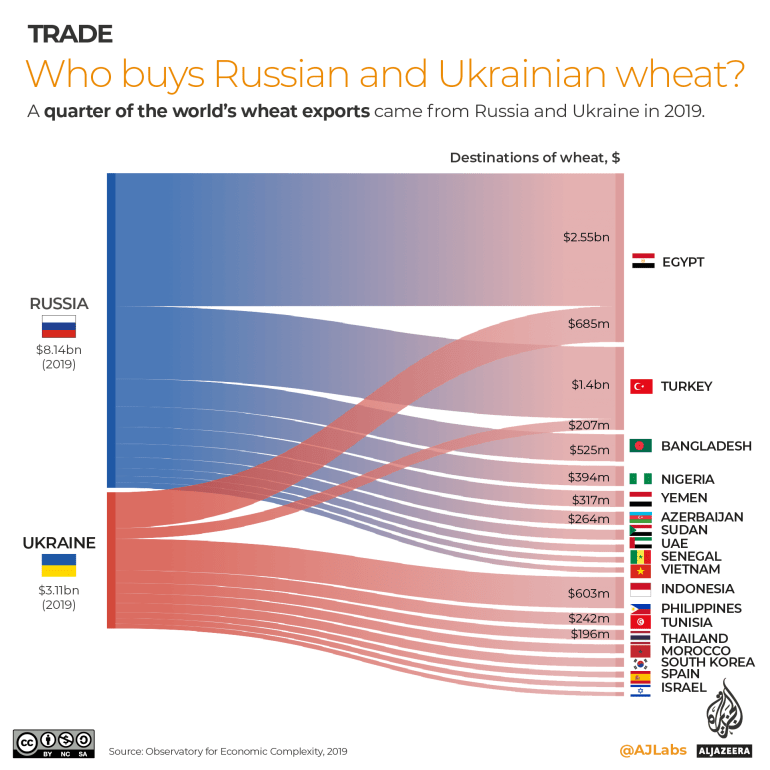

The world economy faced “the greatest supply shock since at least the early 1970s”, it said, pointing out that Russia and Ukraine “supply a disproportionately high share of commodities, including wheat, corn, fertiliser, titanium and nickel”.

EBRD chief economist Beata Javorcik said that inflationary pressures, which were already high before the invasion, “will certainly increase now, which will have a disproportionate effect on many lower-income countries where” the bank invests, “as well as on the poorer segments of the population in most countries”.

The head of the African Development Bank told Al Jazeera this week the war would have a rippled effect on food security and energy supply.

In its update, the EBRD said North African countries and Lebanon were “greatly exposed” to the reduced global supply of wheat from Russia and Ukraine, two of the world’s biggest exporters.

It also warned that Central Asian economies that are heavily dependent on remittances from Russia have been badly hit by the fall in the value of the rouble and restrictions on its convertibility. Meanwhile, tourism is expected to take a hit in a number of countries including Armenia, Estonia, Georgia and Montenegro.

The bank earlier this month unveiled a $2.2bn “resilience” package to help citizens, companies and countries affected by the war in Ukraine, including those hosting refugees.

“Europe has also seen the greatest forced displacement of people since the Second World War, and the report examines the potential consequences of this migration,” it said.

“Skilled workers from Ukraine may provide a boost to some economies in the longer term, particularly in countries with ageing populations,” it said.

But “in the short-term, economies are facing fiscal pressures and administrative challenges as they scale up the provision of housing, healthcare and schooling”.

The EBRD, which has condemned Russia’s invasion of Ukraine, said on Tuesday that it will close its Moscow and Minsk offices in an “inevitable outcome of the actions taken by the Russian Federation with the help of Belarus”.

The group has not undertaken any new investment projects in Russia since 2014, when Moscow invaded and then annexed Crimea.

Russia’s economy projected to shrink by 10%; Ukraine’s by 20% - Al Jazeera English

Read More

Opinion: Is carbon the 'new' staple in our contemporary economy? - Coast Reporter

Harold Innis is no longer a household name in Canada, but perhaps he ought to be.

As Canada progresses forward into the complexities of transitioning energy systems and times, it's worth reflecting on what Innis might think about the state of Canada’s energy economy — particularly where it stands in a global context — and how we might think about evolving it.

Innis is a giant figure in Canada’s economic and political history. His staples theory profoundly helped Canadians define a sense of national identity as the country slowly weaned from the teat of colonial mothering nearly a century ago — as it developed its resources and established international markets for them.

With the tragedy of events unfolding in eastern Europe, once again the notion of Canada as an energy supplier beyond North America’s borders is finding traction in a way that foregrounds the country’s resource economy.

It’s worth dipping back into Canada’s economic and political history and with a dollop of Harold Innis, ponder the twin possibilities of carbon and energy transition thinking powered by people as the new staples of our resource economy.

Like all (economic) theories, Innis’s work on staples comes in and out of fashion. Its key propositions are mostly timeless (and sensible) and any contemporary utility derives from how effectively someone reinterprets and re-engages with them. Like most theoretical frameworks, staples thinking is layered, complicated, and contested but for people outside academic cloisters, it provided (and continues to provide) a common-sense way of thinking about how their lives were lived.

Innis, who died in 1952, saw staples (fish, fur, grains, lumber, etc.) as the commodities that shaped and defined early Canada — geographically, socially, and politically. No news there. The magic in his thinking was more nuanced, in that he employed theoretical frameworks less top down than bottom up in their orientation. His work on the fur trade was seminal and did much to affirm that Canada was more of a product of itself than an outpost of the Empire. He remained concerned, however, that Canada could become overly reliant on the staples themselves and fail to evolve economic utility beyond the provision of raw materials to others. Today, it’s easy to argue that to a degree this has happened — while pointing out plenty of examples where we have advanced well beyond that in terms of adding value.

But Innis never seemed to explicitly valorize individuals directly, even though he was thoroughly grounded in research programs that took him right into Canada’s wilderness and often into direct contact with doers. As such, he would almost certainly concur that you need to be resourceful to manage, sustain, diversify, and advance a resource economy — as well as transition it. Here’s the important thing: Innis also posited that staples opportunities mature and to keep the economy prospering, new markets and opportunities are required.

Innis’s thinking blossomed in Canada at an important juncture in a young country’s history; Canada was seeking to define itself in non-colonial terms and his work contributed significantly to a Canadian sense of self. Arguably, we are at a not-dissimilar point now — in an energy market context significantly more global than Innis could have ever imagined.

Innis probably would have much to say about hydrocarbons as a contemporary staple. He would point to Canada’s market access debate and our need to move our hydrocarbons to tidewater and beyond as the natural evolution of a staples market. He would agree Asian and European markets are logical growth opportunities after decades of dependence on a single customer. He would well understand that when your biggest customer (the United States) becomes your biggest competitor, it’s time to move on and find another market — or another staple.

He might also have suggested value-add thinking. In this case, intellectual value-add on top of molecular value-add.

In that case, why not both people and product?

So, here's the new twist on Innis: Why not consider people and product as a form of joint staple and think creatively about another people-powered commodity produced by our resource heritage: carbon competency.

Most Canadians are wont to believe Canada (Alberta) is a global bad boy when it comes to oil and gas development. Quite the opposite. Canadians are technology and innovation leaders. We are performers par excellence in regulatory matters. We’re also tenaciously tackling the complexities of emissions challenges. Any cursory examination of the emissions landscape reveals there’s a lot of good stuff going on.

We’re just poor at telling the story.

Take carbon management as just one example. We’re incredibly resourceful in matters carbon. There is so much at hand in advanced carbon research and innovation, building on foundations laid down years ago, that it’s difficult to track. It’s not a stretch to claim we’re something of world leaders in everything from carbon sequestration to an exciting future in next-gen (and non-combusted) materials.

But who knows?

Certainly not Joe Canadian, whose mind today is more filled with tripe by activists about how our resource economy is dragging Canada down than about how Canadian innovation talent is building it up. In the past, we were never very good externally as a sector about pairing the product with the way we produce that product.

It’s hard to know what Innis might have made of the ESG movement and its attendant impacts on socio-economic and socio-political thinking. It probably wouldn’t have surprised him and he might even have suggested ESG mastery is a sign of an advancing and evolving resource economy that knows how to imbue its staples with value.

Carbon (and its management competencies) could be the new staple of our resource economy — not just the atom and related molecules, in a manner of speaking, but the skills and talents of people curious about how to change its status from liability to asset. That seed of national pride Innis identified so many decades ago still exists within Canadians associated with energy production.

Innis might well agree (if we could somehow channel him) that it might even be a good thing for the federal and provincial governments to push Canada’s carbon management competencies into new markets (think European Union) long before the hydrocarbons themselves actually arrive to demonstrate how we balance responsible resourcefulness with the resource itself.

Good resource economies are powered by resourceful people — people who can hold in dual balance both environmental and economic performance.

Bill Whitelaw is Managing Director, Strategy & Business Development at geoLOGIC Systems Ltd. & JWN Energy. Bill is a director on many industry sector boards including the Canadian Society for Unconventional Resources and the Canadian Petroleum Hall of Fame. He speaks frequently on the subjects of social licence, innovation and technology, and energy supply networks.

Opinion: Is carbon the 'new' staple in our contemporary economy? - Coast Reporter

Read More

Wednesday, March 30, 2022

Ukraine's Economy to Shrink by a Fifth This Year, EBRD Says - Financial Post

Article content

(Bloomberg) — Ukraine’s economy will shrink by a fifth this year before bouncing back in 2023, according to the European Bank for Reconstruction and Development, under a scenario where a cease-fire is brokered in a couple of months.

The forecast is subject to major downside risks “should hostilities escalate or should exports of gas or other commodities from Russia become restricted,” the EBRD said in its biannual Regional Economic Update published on Thursday.

Russia’s invasion of Ukraine has created the greatest supply shock since at least the early 1970s, the EBRD said, snarling supply chains, upending the energy trade and threatening food exports due to both countries’ key agricultural sectors.

Article content

“Currently, the war is happening on territories that produce 60% of Ukrainian GDP,” the EBRD said in the report. About 30% of businesses have stopped production, and electricity consumption is estimated at 60% of pre-war levels, it added.

The forecasts assume that a cease-fire will be negotiated within a couple of months, and reconstruction of the country can begin in 2023, the economy will grow 23% next year, it said.

Russia’s economy is forecast to shrink by 10% this year and stagnate in 2023, according to the EBRD. Russia’s recession could be deeper if Europe joins a ban on its oil imports or severely reduces the use of Russian natural gas.

©2022 Bloomberg L.P.

Ukraine's Economy to Shrink by a Fifth This Year, EBRD Says - Financial Post

Read More

Lasting effects of Putin's war may be 'demand destruction' and fractured global trade - CBC News

Shortly after Canada and other Western democracies announced sanctions on Russia, the world heard a frightening warning about the impact they would have — not just on Russia, but on the global economy.

The warning came from Russia's deputy prime minister, Alexander Novak, and its focus was the world price of oil.

"It is absolutely clear that a rejection of Russian oil would lead to catastrophic consequences for the global market," Novak said in a televised statement.

"The surge in prices would be unpredictable," he warned. "It would be $300 per barrel, if not more."

Oil above $300 a barrel?

As the North American price of oil fell back to about $100 this week, it was easy to scoff at the Russian official's alarmist warning.

But while there are good reasons that oil prices above $300 US are not in the cards, the invasion of Ukraine has set in motion a series of events that will lead to a serious disruption of the global economy — likely to affect Russia and Western democracies long after the bombs have stopped falling in Ukraine.

There are two key parts of that disruption. One is something called "demand destruction" — the move to use less of the high-priced commodities produced by Russia. The other is a new global quest for greater security in supply chains in a world that has proven itself more volatile than most of us had thought just a few months ago.

As representatives of the oil cartel OPEC gather in Vienna on Thursday, and peace talks in Turkey offer glimmers of hope that the killing of Ukrainian civilians in Vladimir Putin's reckless war might end, the volatile price of oil has retreated again.

But even as Brent crude — the world oil price used outside North America — reached toward $130 US a barrel, experienced oil market watchers like longtime petroleum geologist and energy analyst Art Berman said Novak's prediction was laughable.

"A Russian official's opinion about oil price is worth as much as Donald Trump's opinion about results of the 2020 U.S. election," quipped the Texas-based Berman in a recent email conversation.

Industry caught with pants down

Despite the trillions of dollars at stake, the oil market is complex and difficult to predict. In 2014, for example, despite a fortune spent on research, the global industry was caught with its pants down as the North American price for oil tumbled abruptly from about $100 US a barrel to less than $30 in a year and a half.

That kind of uncertainty leaves an opening for people like Rory Johnston, the founder of Toronto-based Commodity Context who writes about the global energy industry. His latest report, out Tuesday, is titled "Oil's Russia-Sized Hole," about a world market buffeted by a new oil shock.

Despite the recent decline, Johnston sees oil prices remaining strong as large Western companies shun Russian oil and continue to wind down shipping from Russian ports once existing contracts run out.

As United Arab Emirates Minister of Energy Suhail al-Mazrouei said in advance of the OPEC meeting, there is no easy way to replace the 10 million barrels a day Russia contributes to world supply. Of course, all of that supply is not disappearing. There are still many buyers of Russian crude, including China and India — and there are now reports that some of that Russian oil is being laundered and resold as if it came from someplace else.

Canada is increasing production, but Johnston said progress is slow, and any increases fly in the face of Tuesday's federal government plan to cut greenhouse gases from the oil and gas sector. Johnston says that while U.S. shale oil could be brought on more quickly, investors have had their fingers burned in the past when oil prices fell. They fear the same thing will happen again and have been reluctant to risk their cash.

"All us analysts trying to think about where global supply and demand model balances, that is where you get really, really high prices that prompt some kind of demand destruction," Johnston said in a telephone interview. "Prices need to rise high enough in order to get people to drive less and fly less and consume less fuel overall."

For Russia, which in 2019 depended on fossil fuels for 60 per cent of its exports and 40 per cent of government revenue, demand destruction will have a tremendous long-term effect on that country's economy.

Seeking secure living standards

The search for alternatives to Russian oil and gas may be part of a much bigger economic and political split into trading blocks, triggered by the invasion of Ukraine, said economist Dane Rowlands of Carleton University's Norman Paterson School of International Affairs in Ottawa.

Clearly European countries — shocked into action when they realized how much clout Russian energy exports had on their economies — are looking for ways to transition away from fossil fuels altogether as a matter of regional security, even if it is more expensive. Inevitably that may lead to a shrinking of the entire global economy, at least in the short term.

"The shift that people are looking at now is the tradeoff between standard of living itself and the security of that standard of living," Rowlands said. "I don't think the Europeans are going to want to be in a position where Russia dictates to them by the threat of withholding oil and gas."

When supply chains broke down in the wake of the global pandemic, some experts woke up to the security implications of losing access to goods essential for the North American economy. Russia's invasion of Ukraine brought that home with a vengeance, and Western governments, including Canada, are looking for ways to shorten supply lines and find sources of supply from countries with trustworthy democracies, Rowlands said. That includes energy but also green technology.

Replacing Russia's energy will be the hardest part for the West, he said but, but on the other side of that divide, there are already indications that Russia, hit by economic sanctions, is running out of key Western imports that it must now try to produce for itself, which, Rowlands said, will be a much harder task.

"Obviously the amount of restructuring that has to occur in Russia will be huge compared to what it's going to be in the West," Rowlands said.

Trudeau says a shift away from fossil fuels will build environmental economies

Duration 1:32

Follow Don on Twitter @don_pittis

Lasting effects of Putin's war may be 'demand destruction' and fractured global trade - CBC News

Read More

Monday, March 28, 2022

Vietnam Economy Grows Slower in First Quarter to 5% on Covid, Oil Surge - Bloomberg

[unable to retrieve full-text content]

Vietnam Economy Grows Slower in First Quarter to 5% on Covid, Oil Surge BloombergVietnam Economy Grows Slower in First Quarter to 5% on Covid, Oil Surge - Bloomberg

Read More

'New, decentralized, bottom-up economy': Pierre Poilievre wants to make Canada the 'Blockchain capital of the world' - National Post

Speaking in London, Ontario, Poilievre insisted on the importance of decentralizing the power of central banks

Article content

Pierre Poilievre promises to “unleash” the potential of the Blockchain economy if he becomes Prime Minister, and make Canada the “the Blockchain capital of the world”.

Speaking in London, Ont., Poilievre, who is campaigning to become the next federal Conservative leader, said he intended to simplify and streamline rules and taxes to make it easier for Canadians to decide to use cryptocurrency instead of traditional forms of money. He insisted on the importance of decentralizing the power of central banks.

“A Poilievre government would welcome this new, decentralized, bottom-up economy and allow people to take control of their money from bankers and politicians. It would expand choice and lower the costs of financial products, and create thousands of jobs for engineers, programmers, coders, and other entrepreneurs,” read a press release from his announcement.

'New, decentralized, bottom-up economy': Pierre Poilievre wants to make Canada the 'Blockchain capital of the world' - National Post

Read More

Canadians feeling pessimistic about economy as confidence falls to lowest in a year - The Kingston Whig-Standard

Combination of higher inflation, rising interest rates and uncertainty surrounding the war starting to weigh on consumers

Author of the article:

Bloomberg News

Theophilos Argitis

Article content

Canadian consumer sentiment tumbled to its lowest level in more than a year as Russia’s invasion of Ukraine and surging inflation cloud the economic outlook, weekly polling data suggest.

Advertisement 2

Article content

The Bloomberg Nanos Canadian Confidence Index, a measure of sentiment based on weekly polling, fell to 56.3 last week, the lowest reading since January last year. The gauge is down more than three points since the end of February.

For the first time since 2020, the share of Canadians who believe the economy will weaken over the next six months surpassed 50 per cent.

The numbers suggest the combination of higher inflation, rising interest rates and uncertainty surrounding the war is starting to weigh on consumers, with potentially deleterious impacts on spending and growth.

Every week, Nanos Research surveys 250 Canadians for their views on personal finances, job security and their outlook for both the economy and real estate prices. The confidence index represents a rolling four-week average of about 1,000 responses.

Rate hikes

Up until last month, Canadian household consumer confidence numbers held up relatively well compared with other countries, buoyed by a booming housing market and expanding economy. But the surge in oil prices since Russia’s invasion of Ukraine and the beginning of rate hikes from the Bank of Canada are raising worries.

The Bank of Canada will almost certainly take the steeper path to higher rates next month

Quebec's $500 tax break is good stopgap, but won't solve inflation: Desjardins CEO

Canada 'fairly close' to a debt crisis, warns Magna founder Frank Stronach

Pent-up demand has Canadians shrugging off spiralling prices, for now

Advertisement 3

Article content

The survey data show pessimists on the economic outlook outnumber optimists by more than two-to-one, with 51 per cent of respondents expecting the economy to weaken. That’s up 10 percentage points since February.

About 39 per cent of respondents said their finances have worsened over the past year, which is also the highest since 2020, when sentiment figures hit record lows as the COVID pandemic hit.

Sentiment around real estate remains elevated, with 63 per cent of Canadians expecting housing prices to continue marching higher. Job security is also at above historic averages.

Share this article in your social network

Canadians feeling pessimistic about economy as confidence falls to lowest in a year - The Kingston Whig-Standard

Read More

Sunday, March 27, 2022

Bolsonaro Launches Reelection Bid Complicated by Weak Economy - BNN

(Bloomberg) -- Brazil President Jair Bolsonaro is seeking a second term amid growing economic challenges that will potentially determine the outcome of this year’s election.

The right-wing leader is launching his pre-candidacy on Sunday at an event organized by the Liberal Party, which will also host Defense Minister Walter Braga Netto, whom he may tap as running mate. According to Brazilian law, candidates for the October vote will only be considered official when they register with electoral authorities in August.

Bolsonaro was elected in 2018 on a conservative, anti-corruption platform that resonated with Brazilians outraged by a series of graft scandals plaguing the 13-year rule of the leftist Workers’ Party. But economic problems have returned to the forefront since then: Inflation and unemployment are both above 10% in the wake of the pandemic, the economy is expected to grow only 0.5% this year, and poverty has returned to levels last seen in 2010.

It’s a difficult economic situation that has weighed on the president’s popularity and boosted the chances of his main challenger -- Luiz Inacio Lula da Silva, the leftist former president and leader of the Workers’ Party whom many Brazilians associate with a period of economic bonanza that was largely supported by a global commodities boom.

Lula, who was behind bars and unable to run in the 2018 election, would now receive 44% of the votes in a first-round vote, while Bolsonaro would get 26%, according to a XP/Ipespe poll published Friday. He would defeat Bolsonaro with 54% of the votes in a second round, the same poll found.

Yet Lula’s lead over Bolsonaro could shrink as the incumbent rolls out a package of social spending that will inject 165 billion reais ($34.8 billion) into the economy, on top of a program of cash handouts he’s been paying since the beginning of the year.

Old Strategy

So far Bolsonaro has insisted on a rhetoric not very different from the one that got him elected four years ago, warning voters against the threats of corruption and communism that he says Lula and the Workers’ Party represent.

While that still resonates with his most radical supporters, it does little to win the backing of poor Brazilians who have suffered the most during the Covid-19 crisis, or women who in their majority disapprove of the president’s handling of the pandemic and his often sexist remarks.

He’s been trying to plug in those gaps by considering fuel subsidies or larger cash handouts to the poor, while trying to appeal to female voters by showing up in public events accompanied by First Lady Michelle Bolsonaro.

Yet he’s unlikely to depart much of his original platform, according to Deysi Cioccari, a political science professor with the Pontifical Catholic University of Sao Paulo.

“He will likely use the same strategy of 2018: talking about corruption, communism, guns,” she said. “And it works for him.”

©2022 Bloomberg L.P.

Bolsonaro Launches Reelection Bid Complicated by Weak Economy - BNN

Read More

How blue economy can help rewrite India’s growth story post pandemic - Firstpost

With bright possibilities in India, the blue economy should get a much needed framework for unlocking the potential for inclusive economic growth

Almost echoing the similar tine, the Centre for the Blue Economy says, “It is now a widely used term around the world with three related but distinct meanings — the overall contribution of the oceans to economies, the need to address the environmental and ecological sustainability of the oceans, and the ocean economy as a growth opportunity for both developed and developing countries.” The definitions clearly exemplify the writing on the wall and that is acknowledging and practising the ‘sustainability’ in letter and spirit rather merely as keepsake words.

While the blue economy comprises a range of economic sectors and related policies that together determine whether the use of ocean resources is sustainable, a major challenge it confronts in understanding and managing the many aspects of oceanic sustainability, ranging from sustainable fisheries to ecosystem health to preventing pollution.

Second, as put forward by a finding of the United Nations (UN), “the blue economy challenges us to realise that the sustainable management of ocean resources will require collaboration across borders and sectors through a variety of partnerships, and on a scale that has not been previously achieved. This is a tall order, particularly for Small Island Developing States (SIDS) and Least Developed Countries (LDCs) who face significant limitations.”

The UN notes that the blue economy will aid in achieving the UN Sustainable Development Goals (SDGs), of which one goal, 14, is “Life Below Water”. It seeks to conserve and sustainably use the oceans, seas and marine resources for sustainable development.

As per Action Group on Sustainable Blue Economy, the worldwide ocean economy is valued at around $1.5 trillion per year, making it the seventh largest economy in the world. It is set to double by 2030 to $3 trillion. The total value of ocean assets (natural capital) has been estimated at $24 trillion.

Remarkably, Action Group on Sustainable Blue Economy encourages collaborative efforts among the countries to exchange successful strategies, information, knowledge and best practices; facilitating the deployment of new technologies and innovations to create and drive environmentally-compatible industries; developing the economic empowerment and resilience of communities living around oceans, seas, lakes and rivers; and building economic instruments to leverage environmental protection, such as blue carbon, blue bonds and coastal resilience insurance.

A sort of global consensus on the blue economy is aimed for and this is something to be duly taken into the consideration for making a long-term action plan for substantiating the ongoing dialogues and practices in this domain.

In the South Asian or global context at large, India is among the most formidable players in the blue economy ecosystem whose action and achievements on the sustainability front are keenly observed, discussed and often emulated as well. With a rich water resources base and marine environment to explore the actual potential, India is just waiting for its moments to broaden the ambit by linking the blue economy framework to the economic growth and environmental sustainability besides serving the national security interests.

As finding a sustainable development paradigm is the need of the hour, the blue economy should be seen as a subset of India’s national economy that is making a headway albeit with the challenges of an uncertain global geo-political and economic order. With bright possibilities in India, the blue economy should get a much needed framework for unlocking the potential for inclusive economic growth.

To ascertain India’s edge with strong fundamentals that are supportive to the blue economy, knowing a few figures is utmost important. First and foremost, with about 7,500 kilometers of coastline, its maritime position is extremely significant.

Out of India’s twenty-nine states, nine states are coastal with 1,382 islands. Reportedly, there are 199 ports including some of the largest in the world that handle enormous amounts of cargo.

Spreading in over 2 million square kilometres, India’s Exclusive Economic Zone is rich with crucial resources like crude oil and natural gas. Added to the fact, India has a promising coastal economy that creates livelihood for over four million people from the local communities, especially those that rely on commercial fishing.

As an emerging concept, the blue economy merits to be not presented only as a business model that rests on precisely exploiting the maritime and marine resources like commercial shipping, fishing and mineral development. What is critically important is to emphasise on the holistic vision for the blue economy with an unwavering focus on sustainable economic growth.

In a clearer reference, the blue economy can be seen as an extension of the green economy, giving due to the responsibility in commercialising the ocean resources and finally serving the greater common goods by keeping the harmony in development. As the reckoning is, the blue economy creates economic opportunities but equally vital is highlighting its another facet in preserving the ‘blue resources’ — for mitigating the vicious impacts of chronic poverty and climate change.

Recently, the Ministry of Earth Sciences (MoES), government of India, has rolled out the Draft Blue Economy policy for India in the public domain inviting suggestions and inputs from various stakeholders including industry, NGOs, academia, and citizens. The draft blue economy policy document outlines the vision and strategy that can be adopted to utilise the abundant oceanic resources available in the country.

The policy document has been recently disseminated for public consultation on several outreach platforms by MoES and it is time to discuss the ways to enhance contribution of the blue economy to India’s GDP, improve lives of coastal communities, preserve marine biodiversity, and maintain the national security of marine areas and resources. The MoES prepared the draft blue economy policy framework in line with the Government of India’s vision and highlights the blue economy as one of the ten core dimensions for national growth.

India’s vast maritime interests make its tryst with the blue economy uniquely decisive, especially so for economic growth. India’s draft blue economy policy should be debated widely for giving it the required traction to finally be an enabler of a crucial framework that ensures GDP growth as well as welfare of people.

The draft policy recognises the blue economy as one of the ten core dimensions for national growth. Noticeably, the draft document focuses on seven thematic areas: National Accounting Framework for the Blue Economy and Ocean Governance; Coastal Marine Spatial Planning and Tourism; Marine Fisheries, Aquaculture & Fish Processing; Manufacturing, Emerging Industries, Trade, Technology, Services and Skill Development; Logistics, Infrastructure and Shipping including Transshipment; Coastal and Deep-sea Mining & Offshore Energy; Security, Strategic Dimensions & International Engagement. It is wishful that the blue economy policy gains the ground and is implemented progressively for positive changes.

UN member states, including India, adopted 17 SDGs, also known as the Global Goals, in 2015 as a universal call to take action to end poverty, protect the planet, and ensure that all people enjoy peace and prosperity by 2030. Several countries have undertaken initiatives to harness their blue economy. For instance, Australia, Brazil, United Kingdom, United States, Russia, and Norway have developed dedicated national ocean policies with measurable outcomes and budgetary provisions. Canada and Australia have enacted legislation and established hierarchical institutions at federal and state levels to ensure progress and monitoring of their blue economy targets. With a draft blue economy policy framework of its own, India is now all set to harness the vast potential of its ocean resources.

In the post-pandemic times, when the industrial revival depends on a consistent demand push to keep the market fundamentals in order, the newer opportunities including blue economy offer the green shoots for sure.

Notwithstanding the unprecedented hardship created by Covid-19 and operational disruptions, the Indian economy has promising prospects beyond short to medium fluctuations. The policies and action combining together can harness a fledgling sector that has potential to give a fresh momentum to the India Growth Story.

India, the world’s largest democracy and one of the fastest growing economies, is waiting for the next success story and that possibly may come from the territory of the blue economy. The opening of the new opportunities will revitalise the economic reforms in India as well, lately the realisation should get further firmed up in favour of exploring the actual economic potential India has. Moreover, a cleaner future will also be helpful in bringing the Environmental, Social and Governance (ESG) equation into action where India’s response to the sustainable development needs is closely looked at globally.

One stellar show with the blue economy will position India as a hope for the world which otherwise should be in the collective search of finding an alternative development paradigm. Time will tell more about it.

The author is a policy professional, columnist and writer with a special focus on South Asia. Views expressed are personal.

Read all the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

How blue economy can help rewrite India’s growth story post pandemic - Firstpost

Read More

The Week in Business: Attempts to Prop Up the Russian Economy - The New York Times

What’s Up? (March 20-26)

Responding to Western Sanctions

President Vladimir V. Putin of Russia said last week that he would require “unfriendly countries” to pay for Russian gas in rubles. The move was intended to force countries like the United States and Britain to prop up Russia’s currency, which crashed after sanctions targeting Russia’s central bank effectively froze hundreds of billions of dollars of assets. People, in turn, rushed to exchange their rubles for dollars or euros. Officials in Europe and experts in the United States have already rejected the idea of paying in rubles. In another attempt to mitigate economic ruin, the Russian stock market reopened for limited trading on Thursday after a monthlong shutdown. The MOEX index rose 4.4 percent, but this upward trend was probably because of government measures aimed at avoiding a sell-off.

Dealing With Accelerating Inflation

The Federal Reserve chair, Jerome H. Powell, foreshadowed the central bank’s more aggressive approach to inflation, speaking urgently last week about the Fed’s willingness to take additional measures to ease demand and curb record inflation. His comments followed the Fed’s decision to increase its key interest rate by a quarter of a percentage point, the first of several increases the Fed is now projecting for 2022. “If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so,” Mr. Powell said last Monday. In Britain, where inflation is at a three-decade high, officials announced measures on Wednesday to help people cope with the rising prices, including plans to cut taxes on gasoline and diesel and release more funds to support low-income households.

Biden Eases Trump-Era Tariffs

The Biden administration made two moves to roll back tariffs imposed by President Donald J. Trump that sought to limit trade with Britain and China. On Tuesday, the administration announced an end to Trump-era tariffs on British steel and aluminum. In return, Britain agreed to lift tariffs on a variety of American products including whiskey and blue jeans. The agreement removed some of the remaining trans-Atlantic trade tensions, which bubbled up under Mr. Trump. The next day, the Office of the United States Trade Representative said it would allow some Chinese products to bypass tariffs imposed during a trade war between Mr. Trump and Beijing.

What’s Next? (March 27-April 2)

A New Climate Disclosure Rule

The Securities and Exchange Commission has opened a comment period for a far-reaching rule that would require public companies to report their impact on the environment to shareholders and the federal government. The public can respond for 30 days after the proposed rule is published in the Federal Register or until May 20, whichever comes first. The rule is intended to inform shareholders about the risks that climate change may pose to a company’s bottom line, including whether consumers may lose interest in products or services that contribute to global warming. Advocates for the measure say it will hold companies accountable for how they affect the climate and give investors more leverage to nudge businesses toward more environmentally friendly practices. But the proposed rule is already facing opposition from some business trade groups and the prospect of potential court challenges.

Union Efforts at Starbucks and Amazon

Union drives continue to sweep Starbucks locations across the country, with employees in Seattle, the franchise’s hometown, and Mesa, Ariz., voting last week to unionize. The stores are the seventh and eighth locations to vote for unions. Since December, more than 100 Starbucks stores have filed for union elections. Amazon has been trying to fend off unions in two of its own elections: Employees in Staten Island were still casting their ballots, and voting ended on Friday in Bessemer, Ala. A union victory in either location would be a first for Amazon’s operations in the United States. There is special attention on Bessemer, where the union lost an election last year and Amazon was hit with complaints from the National Labor Relations Board for its activities during the union efforts. This time, Amazon has relied largely on mandatory meetings intended to discourage workers from supporting the union.

A Pivotal Jobs Report

Last month’s jobs report showed a strong gain, with U.S. employers adding 678,000 jobs in February. The March report is also expected to be strong — though how strong will depend on the elasticity of demand, which has to do with whether factors like changing prices affect consumer behavior. The March report from the Department of Labor will not have registered any effects of the Fed’s rate increase, which was announced midway through the month. But the central bank’s moves will be a big caveat going forward as a potential recession looms large.

What Else?

Germany released plans to drastically cut its dependence on Russian energy. Uber and New York City’s taxis formed a partnership. The European Union approved sweeping legislation to regulate the biggest tech companies. And the billionaire MacKenzie Scott has donated $12 billion to 1,257 groups since 2020.

The Week in Business: Attempts to Prop Up the Russian Economy - The New York Times

Read More

Pimco says the risks have increased for an ‘anti-Goldilocks economy’ — where growth is too cold and inflation is far too hot - Yahoo Canada Finance

-

The Ukraine war's impact on supply chains and trade could result in a global "anti-Goldilocks" economy, Pimco said.

-

Higher energy prices could help lead to "stagflation", where inflation is too hot and growth is too cold.

-

Even once the war ends, sanctions will likely persist and make supply-chain and trade flow issues worse, they said.

The Ukraine conflict's impact on supply of key goods could easily result in a global "anti-Goldilocks" economy, where inflation runs too hot and growth is too cold, according to bond giant Pimco.

Russia's monthlong war on Ukraine and the intense Western sanctions imposed in response have disrupted supply chains and trade flows, its strategists said.

"The global economy and policymakers are confronted with a stagflationary supply shock that is negative for growth and will tend to push up inflation further," the Pimco team said in a note this week.

Concerns about supply have driven prices of commodities and energy to soar, and intensified an already uncertain economic and financial market outlook, weighed down by the coronavirus crisis.

Pandemic pressures meant inflation was running at historic highs even before the Russia-Ukraine conflict. The US Consumer Price Index, a closely watched measure of inflation, surged to 7.9% in February — a 40-year high.

Pimco noted four factors that could lead to stagflation, a combination of stagnant growth and high inflation in the same period.

These are higher food and energy prices, disrupted supply chains and trade flow, less spending and so less funding in the economy, and lower consumer and business confidence.

"In combination, these could easily result in what one participant at our forum called an 'anti-Goldilocks economy': an economy that will be both too hot in terms of inflation and too cold in terms of growth," its team said.

The strategists — global economic advisor Joachim Fels, and CIO for fixed income Andrew Balls — noted that while Pimco has revised its forecasts lower, it tentatively expects inflation to peak in coming months, then moderate gradually.

Pimco also forecasts growth of 3% for 2022, sustained by a return to normal and by people spending savings after the pandemic.

"However, there are obvious and significant downside risks to this growth baseline and upside risks to the inflation outlook, especially if the war or the sanctions escalate further," they said.

The Ukraine crisis has led to further disruptions just as some of the bottlenecks related to COVID-19 restrictions had started to ease, according to Pimco.

"While Russia only accounts for 1.5% of global trade, it has a much larger footprint in a range of energy and non-energy commodities," its team said. Meanwhile, Ukraine is a key supplier of grain, auto parts, and chip requirements such as neon.

"Given the complexity of global supply chains, seemingly minor shortages in certain raw materials and components can have an outsized impact on output and prices," they said.

Russia's invasion of Ukraine has been the biggest factor boosting inflation in the past few weeks. Initial fears of an attack hit crude oil and natural gas prices, and it has since driven up prices for wheat, nickel, and fertilizer.

Even once the war ends, sanctions will likely stay in place for a long time, according to Pimco. That will make supply-chain issues worse, and hinder the movement of trade and capital.

The firm suggested investors look to commodities as a way to lessen the risks from increases in inflation, because their prices may well rise due to buyers shunning Russian exports. US Treasury Inflation-Protected Securities (TIPS) are another option, they said.

Read the original article on Business Insider

Pimco says the risks have increased for an ‘anti-Goldilocks economy’ — where growth is too cold and inflation is far too hot - Yahoo Canada Finance

Read More

Saturday, March 26, 2022

China Economy Faces Worst Slowdown Since Pandemic, Nomura Says - Bloomberg

[unable to retrieve full-text content]

China Economy Faces Worst Slowdown Since Pandemic, Nomura Says BloombergChina Economy Faces Worst Slowdown Since Pandemic, Nomura Says - Bloomberg

Read More

Friday, March 25, 2022

Perspective | Russia is threatening a move that will haunt its economy for decades - The Washington Post

Sanctions can hurt an economy, but they can be revoked. Reputation, on the other hand, is not so easily repaired. Vladimir Putin has spent years working to distinguish modern Russia from its czarist and Soviet predecessors, and he is well aware of the costs associated with proposing nationalization as a wartime policy. His willingness to jettison what could have been one of his most important legacies to pursue a war in Ukraine suggests that the last few months represent a marked turn in Putin’s goals and his vision of Russia’s place in the world.

In the late 19th and early 20th centuries, the czarist regime established a favorable reputation with foreign lenders. The czar’s firm control over the economy, which included the power to revoke corporate charters at any time, made direct investment in the Russian economy risky. But the Romanov Dynasty’s 300-year reign and control over roughly one-sixth of the Earth’s land made the regime appear to be a reliable debtor. Lured by high interest rates and often encouraged by glowing articles written by journalists secretly bribed by the Russian government, foreign investors lent a staggering amount of money to the czarist government in its last decades in power.

Foreign investors’ confidence in Russia’s economic stability remained high even as the czar’s regime grew frail. At the outbreak of World War I, 1.6 million French citizens held czarist-backed securities worth 4.5 percent of France’s national wealth. During the war, American and British firms invested more in the czarist government to ensure that their ally could maintain an eastern front in the war. In 1916, even as large American firms, such as International Harvester and Singer Manufacturing, found themselves subject to strict state controls on repatriating their Russian profits, New York City Bank floated $75 million in dollar-backed Russian treasury bonds on American markets.

The czar’s fall from power in March 1917 and the subsequent rise of Vladimir Lenin and the Bolshevik Party the following November, therefore, came as quite a shock to those with a financial stake in the country.

In January 1918 — in a move that staggered global markets and would haunt foreign investment in Russia for decades to come — the Bolsheviks put their communist ideology into practice by nationalizing all foreign-owned property and repudiating all foreign debt accumulated by their predecessors. When the Bolsheviks emerged victorious from the Russian Civil War in 1921, they solidified themselves not only as the government of the former Russian Empire, but as a pariah in the global economy.

Yet even as they renounced foreign debts and pursued a commitment to end global capitalism, Bolshevik policymakers expended a great deal of effort trying to attract foreign capital. They developed a foreign concession committee to court Western firms such as BP and Shell to develop the oil fields at Baku, signed a deal with Armand Hammer to build a pencil factory in Moscow and awarded future U.S. ambassador to the U.S.S.R. W. Averill Harriman a concession to mine manganese in Georgia.

Despite a good-faith effort to abide by the contracts they offered, the Soviet government in the 1920s remained too weak to enforce them, and the relatively few projects that came to fruition were either canceled or taken over by the state by the end of the decade. In light of the Soviet repudiation of 1918, many foreign observers ignored the fact that the Soviet government actually reimbursed many concession holders for the capital they had invested plus interest, and instead presented these concessions as one more communist trick to steal foreign property.

In the 1930s, the Soviet regime turned its search for capital inward, but it never fully withdrew from global markets. Soviet leaders, for example, negotiated contracts to purchase technology from foreign firms, including Ford, in the 1930s. But the U.S.S.R.’s emergence as one of two Cold War “superpowers” after World War II meant that it was no longer reliant on Western investment for economic development.

Still, the U.S.S.R. continued to trade with foreign firms during the Cold War. In 1972, the Soviets struck a deal to bring Pepsi to the U.S.S.R., which they first purchased with Stolichnaya vodka and later Soviet ships.

Yet even after decades of economic growth and a near-perfect track record in fulfilling financial obligations to foreign trade partners, the specter of the 1918 nationalization decree continued to haunt the U.S.S.R. by making foreign firms wary of such engagements.

In the mid-1980s, when Mikhail Gorbachev turned to British and French financiers for loans to stabilize a Soviet economy that was falling alongside the price of oil, both countries mandated repayment of czarist debt as a prerequisite to offering loans. Soviet negotiators eventually relented, although they ultimately settled at a discount, increasing the costs of Russia’s post-Soviet transition to a market economy.

When the Soviet Union dissolved in 1991, the Russian Federation assumed most foreign debt accumulated by the U.S.S.R. This debt, along with Boris Yeltsin’s rule by fiat, helped to make the 1990s a decade of economic and political instability for Russia.

On Aug. 17, 1998, the government declared a moratorium on payments to foreign lenders as part of its response to the ruble crisis, confirming investors’ doubts about Russia’s economic stability. Within a month, Russia’s already low BB credit rating from S&P plunged to an abysmal rating of CCC-. By Jan. 27, 1999, the country was in selective default, where it remained on Dec. 31, when Yeltsin announced that he was resigning as president to be replaced by his prime minister, a relatively unknown former KGB agent named Vladimir Putin.

Putin inherited a Russian economy in free fall. Although it continued to collapse during Putin’s first year in office, rising oil prices allowed Russia to resume debt payments and buoyed Putin’s leadership as he restructured the country’s legal system and recentralized state power at the federal level.

Then, like now, Putin’s lack of concern over human rights was obvious. Yet during his first eight years in office, what seemed most remarkable to many at home and abroad was the success of his economic agenda. As Time magazine put it when naming him 2007 Person of the Year, Putin had “performed an extraordinary feat of imposing stability on a nation that has rarely known it.” And just like his czarist predecessors, Putin found that the image of stability was a valuable asset in attracting foreign investment.

In 2008, when Putin completed his second term as president, foreign direct investment inflows in Russia totaled $74.8 billion, almost 30 times higher than during his first full year in office, and the country’s S&P credit rating had risen to BBB+. Had he ended his tenure in Russian politics then, Putin probably would have been remembered for saving Russia’s economy and setting it on the road to firm integration into the international economy — no small feat.

Instead, Putin’s brutal war against Ukraine is now bringing Russia to the verge of financial ruin once again. Having spent his first years in office distancing Russia from its legacy of economic disrepute, he has reawakened this reputation with startling force. And unlike his first years in office, Putin can no longer make a convincing case that the country’s leadership represents a break with this troubled past. Putin’s destabilization of Russia’s place in the world suggests that he is now pursuing a very different set of goals. So long as Putin and his party remain in power, they will serve as a reminder of Russia’s long history of economic instability, stifling the prosperity of Russia’s people and threatening that of their neighbors.

Perspective | Russia is threatening a move that will haunt its economy for decades - The Washington Post

Read More

Thursday, March 24, 2022

Four weeks of war scar Russia's economy - Financial Post

Author of the article:

Article content

LONDON — Russia’s invasion of Ukraine on Feb. 24 sparked sweeping sanctions that ripped the country out of the global financial fabric and sent its economy reeling.

A month on, Russia’s currency has lost a large part of its value and its bonds and stocks have been ejected from indexes. Its people are experiencing economic pain that is likely to last for years to come.

Below are five charts showing how the past month has changed Russia’s economy and its global standing:

ECONOMIC PAIN

Advertisement 2

Article content

In 2020, Russia was the world’s 11th-largest economy, according to the World Bank. But by the end of this year, it may rank no higher than No. 15, based on the end-February rouble exchange rate, according to Jim O’Neill, the former Goldman Sachs economist who coined the BRIC acronym to describe the four big emerging economies Brazil, Russia, India and China.

Recession looks inevitable. Economists polled by the central bank predicted an 8% contraction this year and for inflation to reach 20%.

Forecasts from economists outside Russia are even gloomier. The Institute of International Finance predicts a 15% contraction in 2022, followed by a 3% contraction in 2023.

“Altogether, our projections mean that current developments are set to wipe out the economic gains of roughly fifteen years,” the IIF said in a note.

Advertisement 3

Article content

INFLATION BUSTING TURNS TO DUST

Since taking office in 2013, central bank governor Elvira Nabiullina’s biggest triumph was curbing inflation from 17% in 2015 to just above 2% in early-2018. As price pressures rose in the post-pandemic months, she defied industrialists by raising interest rates eight months straight.

Nabiullina also resisted calls in 2014-2015 for capital controls to stem outflows following the annexation of Crimea.

But those achievements have been torn to shreds in less than a month.

Annual price growth has accelerated to 14.5% and should surpass 20%, five times the target. Households’ inflation expectations for the year ahead are above 18%, an 11-year high.

While panic-buying accounts for some of this, rouble weakness may keep price pressures elevated.

Advertisement 4

Article content

With Russia’s reserves warchest frozen overseas, Nabiullina was forced to more than double interest rates on Feb. 28 and introduce capital controls. The central bank now expects inflation back at target only in 2024.

INDEX ELIMINATION

Sanctions are forcing index providers to eject Russia from benchmarks used by investors to funnel billions of dollars into emerging markets.

JPMorgan and MSCI are among those that have announced they are removing Russia from their bond and stock indexes respectively.

Russia’s standing in these indexes had already taken a hit following the first set of Western sanctions in 2014 and then in 2018, following the poisoning of a former Russian spy in Britain and investigations into alleged Russian meddling in the 2016 U.S. elections.

Advertisement 5

Article content

On March 31, Russia’s weighting will be dialed to zero by nearly all major index providers.

RATINGS RUPTURE

When Russian troops stormed into Ukraine, their country had a coveted “investment grade” credit rating with the three major agencies S&P Global, Moody’s and Fitch.

That allowed it to borrow relatively cheaply and a sovereign debt default appeared a distant prospect.

In the past four weeks, Russia has suffered the largest cuts ever made to a sovereign credit score. It is now at the bottom of the ratings ladder, flagging an imminent risk of default.

ROUBLE TROUBLE

A month ago, the rouble’s one-year average exchange rate sat at 74 per dollar. Trading on different platforms showed the ample liquidity and tight bid/ask spreads expected for a major emerging market currency.

All that has changed. With the central bank bereft of a large portion of it hard currency reserves, the rouble plunged to record lows of more than 120 per dollar locally. In offshore trade it fell as low as 160 to the greenback.

As liquidity dried up and bid/ask spreads widened, pricing the rouble has become haphazard. The exchange rate is yet to find a balance on- and offshore.

(Reporting by Karin Strohecker, Sujata Rao, Rodrigo Campos and Marc Jones; Editing by Sam Holmes)

Share this article in your social network

Advertisement

Four weeks of war scar Russia's economy - Financial Post

Read More

Fed report says U.S. economy solid but notes disruption from Minnesota immigration crackdown - The Globe and Mail

[unable to retrieve full-text content] Fed report says U.S. economy solid but notes disruption from Minnesota immigration crackdown The ...

-

We blew it. That is the queasy feeling I have as I watch borrowing costs surge, housing starts fall, and politicians rush to subsidize fos...

-

[unable to retrieve full-text content] The economy on the brink, Taliban rely on former technocrats The Seattle Times The economy on th...

-

[unable to retrieve full-text content] Is Housing the Next Shoe to Drop for the Economy? Homebuilder Confidence Plunges in July U.S. New...